Cryptocurrency derivative trading has gained popularity, and its size has expanded dramatically since 2020. According to CryptoCompare, volumes in crypto derivatives grew by 10 times since June 2020, and as of May 2022, it achieved $3.19 trillion. In Scalable white label platform we offer perpetual futures contracts for exchanges and brokers to provide our clients with a larger set of advanced trading options for their users.

An insurance fund serves a crucial role in derivatives trading both in cryptocurrency and traditional exchanges. Insurance funds act as a defensive mechanism and ensure that it covers unexpected contract losses from leveraged trading when they exceed the initial margin. At the same time, an insurance fund guarantees that profitable traders receive their profits.

To understand the need for insurance funds, we will primarily refer to the definition of leveraged trading, considering the instances when leveraged positions are exposed to liquidation. Then move directly to an explanation of insurance funds, their source of financing, cases when insurance funds pay off to traders, and the advantages and disadvantages of such funds.

Leveraged Trading and Liquidations

Leverage trading, also known as margin trading, is a type of trading mechanism allowing users to trade with more money than they have. It is a key point that makes leverage trading attractive and enables customers to generate more profit from relatively small changes in an asset’s price. However, leverage can equally increase both profits and losses of a trader.

To start trading and keep the margin position open, a user should place initial money, which is called collateral. Through leverage, traders can increase their purchasing power which might be several times higher than the deposited collateral. Below we will consider it in an example.

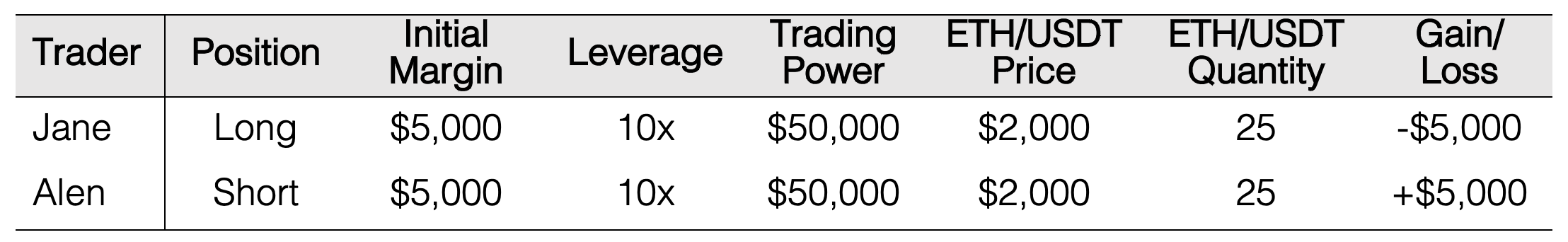

Example: Jane deposits $5,000 to her account and intends to take 10x leverage. As a result, she can enhance her trading power to $50,000 and start trading short or long.

Jane strongly believes in a price increase for Ethereum, and she aims for high leverage. Therefore she opens a long position on ETH/USDT perpetual futures contract because futures allow trading with higher leverage. She estimates that Ethereum price will go up by 10%, and she will earn as much as $5,000. Without leverage, Jane’s profit would be 10 times less and achieve only $500.

Unfortunately for Jane, the price of Ethereum starts to deteriorate, and when it goes down by 10%, Jane’s position gets automatically liquidated, and she loses her initial margin of $5,000.

Liquidation prevented Jane from losing more money than she deposited. However, in volatile markets, prices are exposed to slippage, therefore a leveraged position can fall into a price gap, which can lead to an instant loss of equity that is greater than the initial margin. As a result, traders lose their positions and may not have enough capital to pay out profits to other market participants.

On an order book-based exchange, there is usually a counterparty to Jane’s trade. Suppose that Alen plays short on the same instrument with an equal deposit amount.

When the price of Ethereum goes down by 10% to $1,800, Alen will make a profit of ($2,000 – $1,800) * 25 or $5,000 in his short position, when Jane loses the exact amount, and her long position is liquidated. If the price of Ethereum went up, the result would be the right opposite – Alen loses $5,000 and Jane makes a profit.

- In the case of Ethereum price deterioration, $1,800 is a bankruptcy price for Jane, or in other words, it is a price when losses from price change are equal to collateral.

- In a spot market, Jane would lose her initial margin if the Ethereum price drops to $0. However, with 10x leverage, a 10% price change, or in our case $1,800, is enough for a leveraged position to become worthless.

- In the leveraged market, an exchange should instantly liquidate Jane’s position to guarantee that she won’t lose more than her collateral.

In a volatile cryptocurrency market, there is price slippage that leads to situations where positions could be closed below bankruptcy price. It means that Jane can end up in a situation where she will owe more money than her initial margin, and besides that, Alen will receive less profit.

Once again, the bankruptcy price is the price at which position losses are exactly the same as the initial margin.

Cryptocurrency platforms intend to prevent the situations described above by closing losing positions above bankruptcy price – at a liquidation price.

The price at which a position is closed is called the closing price. It is close to the liquidation price in a liquid market and the bankruptcy price in an illiquid market.

The relationship between bankruptcy, closing, and liquidation prices is illustrated below.

Liquidation of long position Liquidation of short position

(Jane’s scenario) (Alen’s scenario)

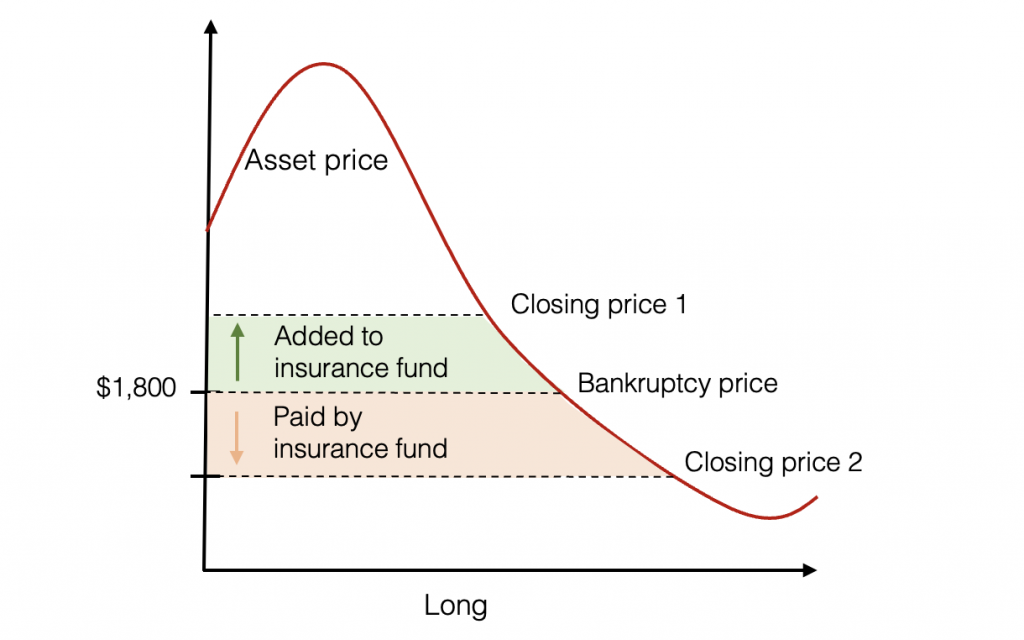

In Jane’s scenario, when the Ethereum price starts to decrease, the closing price will lie between liquidation ($1,850) and bankruptcy price ($1,800), depending on the liquidity of the market. Upon liquidation, Jane loses her margin and remaining capital. The equity between closing and bankruptcy transfers to the insurance fund.

Now we go back to the situation when Jane’s position is closed below the bankruptcy price. Let’s say, at $1,790.

Jane now owes ($2,000 – $1,790) * 25 or $5,250, but she deposited only $5,000. What should Jane do? The collateral Jane deposited is the maximum she can lose. At that moment, an insurance fund comes out and compensates Jane for the excessive part of her loss. In the next paragraph, we will concentrate on the insurance fund and its source of financing.

Insurance Fund and Its Source of Financing

An insurance fund is an exchange treasury that guarantees earnings for profitable traders and compensation for excess losses brought by bankrupt traders. In our example, the insurance fund will take over all losses incurred by Jane when the Ethereum price is lower than $1,800 and pay off to Alen for his profit in a successful short position.

As we have already mentioned, in a liquid market with a sufficient amount of buyers and sellers and low slippage, Jane’s position will be closed somewhere in between liquidation and bankruptcy price, so the insurance fund will grow up by the difference between the closing price and bankruptcy price. In the opposite situation, when a position is closed below bankruptcy price, the insurance fund has to pay the difference between closing and bankruptcy price to a trader, who lost more money that was his initial margin.

Advantages and Disadvantages

The advantage of having an insurance fund is that insurance funds are intended to prevent cases of auto-deleverage liquidations (ADLs). ADL is a disruptive method used by cryptocurrency exchanges when traders’ losing positions are covered through forced liquidation of opposite trader positions, which is profitable. That method is extremely punishing for traders who manage risk carefully.

Insurance funds are financed through a spread between closing and bankruptcy prices, where the closing price is incentivized by an exchange. Therefore, some insurance funds can grow uncontrollably by generating larger inflows into the insurance fund, where the funding mechanism does not seem to be transparent. Despite insurance funds needing to have a sufficient amount of capital to protect traders’ profit and loss, excessive insurance funds can be a symptom of an aggressive liquidation mechanism.

Conclusion

The insurance fund is a key part of any cryptocurrency exchange that proposes leveraged trading. Crypto platforms launch insurance funds to protect traders from significant losses, to ensure profitable traders receive their earnings, and to avoid occurrences of auto-deleverage liquidations (ADLs), which can be disruptive for a successful trader.

Insurance funds are financed by liquidated positions, namely by the spread between closing and bankruptcy price if a position’s liquidation price rises higher than its bankruptcy price. Conversely, if the liquidation price falls lower than the bankruptcy price, the insurance fund covers the loss.

A sufficient amount of money in the fund could indicate safety; excessive insurance, however, could be non-transparent and grow uncontrollably.