As a white-label digital asset exchange provider, we are constantly analyzing the landscape for technological innovation, adoption, and regulatory changes. We continue to share an overview of this information with our community, and assist them in making more informed decisions. This path has taken us to far-out regions and special case countries. Some of them included Latin America – Brazil, Mexico, Colombia – and Africa – Nigeria, Kenya, and South Africa. We will now take a look at the state of digital asset adoption in the Middle East.

The relationship between adoption and regulation

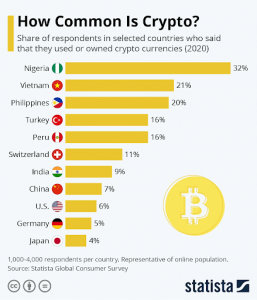

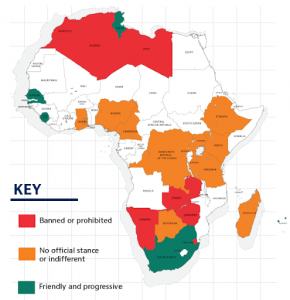

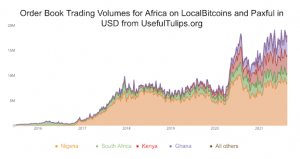

It appears natural to intuitively link digital asset adoption with any given regulatory landscape. Yet one must not fall into the correlation trap. The evidence does not support this implicit relationship – at least not as much as one would think. For example, take Nigeria and Venezuela – countries where adoption rates have been skyrocketing despite the hostile regulatory landscape.

Yet there is a distinction between correlation and causation. Causation – as opposed to correlation – can trace a distinct cause-and-effect relationship between two variables. While an uncertain regulatory landscape does not necessarily mean low adoption rates, a friendly regulatory landscape invites innovation and therefore has a stronger relationship with high adoption rates. Switzerland, one of the most prominent blockchain hubs, has demonstrated this multiple times.

What does this mean? Finding cases where the regulatory landscape is slowly positioning itself as open can be a strong proxy of digital adoption in the coming years. We’ll see that the disposition of some Middle Eastern countries makes them a suitable and potentially profitable option for those seeking the next region on the brink of blockchain disruption.

Reasons for the shift and steps towards adoption

The case for the adoption of digital assets in the Middle East stems from a similar tree to that of Latin America. Fundamental economic situations – such as hyperinflation – and macro consumption trends have forced Latin American countries to adopt digital currencies. In the Middle East, the drive was born out of a necessity to shift away from oil-like economic revenue sources to cleaner ones – the “green revolution” has led to increased diversification within the Middle East towards investments in alternative sectors like tourism, technology, and finance. Nowadays, ME countries leverage blockchain to reach their sustainability agendas. Thus, the Middle East has established itself as a global hub for innovation in financial technology.

Specific accomplishments toward the goal of responsible adoption encountered a joint CBDC project called Project Aber, where half a dozen commercial banks participated. Furthermore, central banks from Saudi Arabia and UAE have been collaborating on blockchain and its involvement in the financial sector. Project tests were a success, showing as a result that CBDCs would be technically viable for cross-border payments – an improvement over current centralized systems in costs and processing speed [1].

Cryptocurrency adoption trends

Appetite for digital assets has been growing in this region as well. In 2020, the total value of digital payment transactions more than doubled when compared to its previous year – achieving a vast $US 18.5 Bn [2].

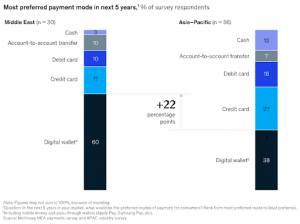

According to a McKinsey survey carried out in 2020, even though the region’s population can be categorized as ‘digitally savvy’ – smartphone penetration reaches ~90% in leading markets – the region has remained heavily dependent on cash. Underdeveloped digital payment infrastructure results in underbanked consumers and a cultural bias towards cash (65% of retail transactions) [3]. New developments and digital payment awareness have demonstrated that 58% of ME consumers expressed a ‘strong preference for digital payment methods,’ suggesting that a cultural shift may be underway.

Source: Most preferred payment mode in 5 years. McKinsey (2020) [3].

A special Crypto Center project launched and managed by the DMCC – Dubai-based world’s No.1 Free Zone – to promote blockchain technology has become the home to hundreds of organizations, with +900 awaiting licence approval. Over 400 crypto businesses already operate in the UAE, with many more expected. Ahmed bin Sulayem, executive chairman and chief of the DMCC, is optimistic that the UAE will have +1000 crypto businesses running by the end of 2022 [4].

Regulation in the Middle East

The need for a regulated marketplace has become the focus of attention for both digital asset adopters and those reluctant to include them in their daily lives. While both positions can passionately argue about their stance, one thing is clear. Digital asset users need a safe space to utilize the technology. Also, countries need a way to control extreme situations. An example of this is the recent incident that included a falsely-claimed official cryptocurrency of Dubai, Dubacoin, which surged in price by over 1,000% in under 24 hours. It subsequently decreased almost as spectacularly – leaving investors empty-handed.

The regulatory stance on digital assets across the world has been as heterogeneous as the coin offering itself. While some government agencies have had a rigid attitude towards cryptocurrencies, others have seen the potential that could be harnessed by embracing them, and are acting accordingly. Several Middle East and North Africa (MENA) countries have chosen this route [2].

In 2018, the Abu Dhabi Market regulatory authority (FSRA) introduced a framework for operating digital asset businesses. This has made Abu Dhabi an appealing jurisdiction for blockchain-based financial services firms [2].

Later, the ME SEC-equivalent authority (SCA), in partnership with the Dubai World Trade Center Authority, signed an agreement to support trading and other financially-related activities within its free zone. While digital assets are not licensed by the Central Bank – the UAE dirham is the only legal tender recognised by the central bank – the agreement established a framework for the DWTCA to regulate and issue necessary the licences for financial activities related to crypto assets, and the SCA would oversee and monitor operating entities [5].

Scalable Solutions

At Scalable, we can help you make the journey of building an exchange seamless. Also, we are there to advise you on the regulatory implications to keep in mind. Get in touch by booking a demo today.

References

[1] Team, Editorial. “Middle Eastern Central Bank Digital Currencies and the World.” Finextra Research, 3 May 2021, https://www.finextra.com/blogposting/20249/middle-eastern-central-bank-digital-currencies-and-the-world.

[2] Hensel, John. The UAE’s Growing Appetite for Crypto and Blockchain. The National, 21 Sept. 2021, https://www.thenationalnews.com/opinion/comment/2021/09/12/the-uaes-growing-appetite-for-crypto-and-blockchain/.

[3] Chan, Jon, et al. “The Future of Payments in the Middle East.” McKinsey & Company, 26 Aug. 2021, https://www.mckinsey.com/industries/financial-services/our-insights/the-future-of-payments-in-the-middle-east.

[4] Cabral, Alvin R. Dubai Expects to Have More than 1,000 Cryptocurrency Businesses by 2022. The National, 19 Oct. 2021, https://www.thenationalnews.com/business/cryptocurrencies/2021/10/18/dubai-expects-to-have-more-than-1000-cryptocurrency-businesses-by-2022/.

[5] Mansoor, Zainab. “UAE Stock Market Regulator, Dubai World Trade Centre Authority Agree to Support Crypto Assets Trading.” Gulf Business, 23 Sept. 2021, https://gulfbusiness.com/uae-stock-market-regulator-dubai-world-trade-centre-authority-agree-to-support-crypto-assets-trading/