March, 2022

Key Takeaways:

- Spot market volumes on cryptocurrency exchanges demonstrated slight recovery in March since November 2021 longstanding recession

- BTC trading volumes on the derivative market went up, while trading volume of ETH decreased

- Aggregated open interest of BTC and ETH futures along with its prices showed an upward trend during March

- Futures market recorded one large liquidation of more than $500m when the BTC price increased

- By the result of March, Bitcoin price went up by 8.9%, while Ethereum price climbed by 15.9%

- Market capitalization as of March 31, 2022 achieved $2.25 trillion, which is 25% higher compared to the capitalization at the end of February

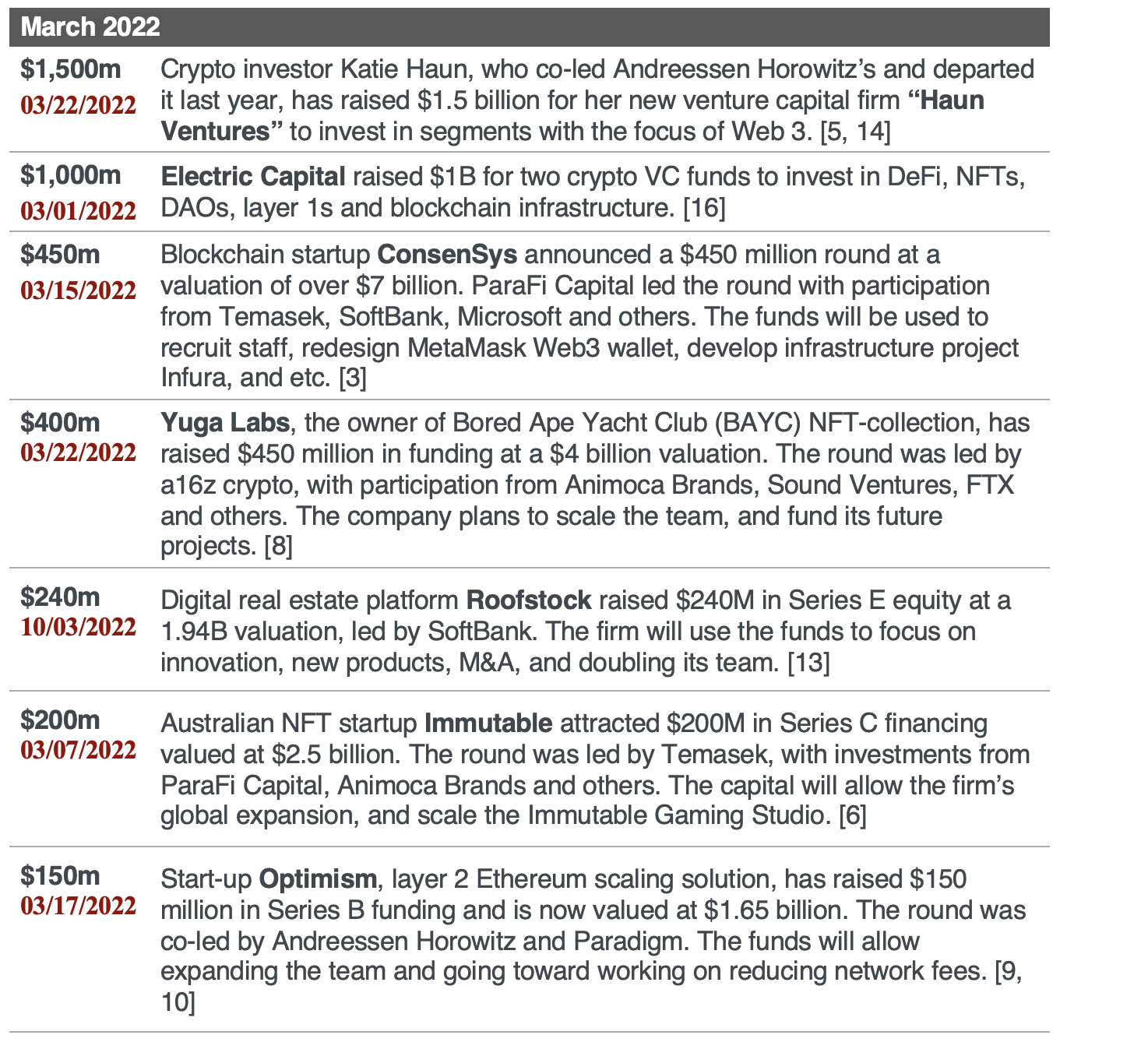

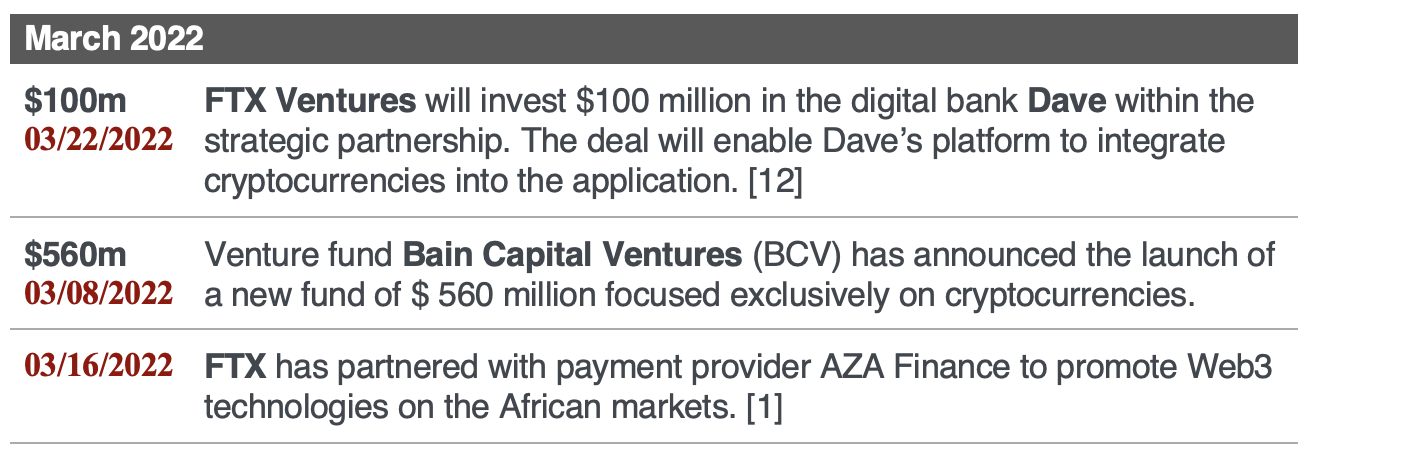

- Haun Ventures, Electric Capital, ConsenSys and Yuga Labs raised more than $400m in venture funding rounds in March

Spot Market

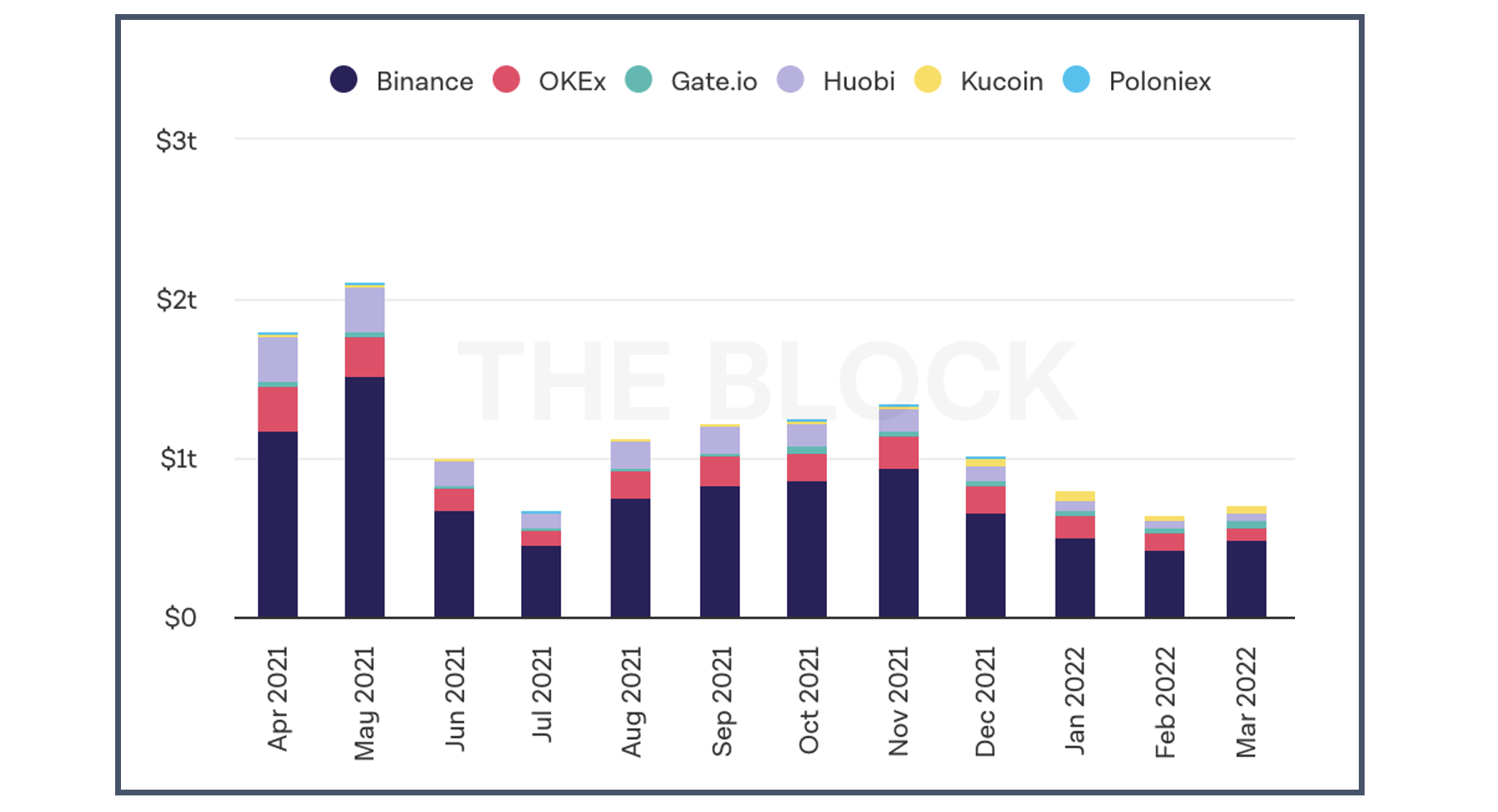

Trading volume on six leading spot cryptocurrency exchanges in March went up to $700.7b, which is 8% higher in contrast with the February results [15]

- Crypto only trading volume on the largest crypto exchange Binance climbed in March by 16% to $490.3b, which was the highest March upturn in absolute terms. However, this level doesn’t exceed trading volume of the previous year except July 2021.

- Gate.io demonstrated 44% upside in terms of trading volume, which reached $45.2b in March. This number corresponds to the results of May and October 2021, when the crypto market experienced its peak values.

- Huobi’s share among crypto exchanges has shrunk significantly since Chinese investors’ capitulation. In March we saw a slight upturn in trading volume by 2% to $46.5b, which is 287% lower than the average volume of the previous year.

- Despite no change in terms of trading volume on KuCoin in March versus February, the exchange demonstrated high trading volume for the last 4 months, which is around 500% higher than the average values of January-November 2021.

- At the same time, crypto-only exchange volume on OKX (formerly OKEx) plunged by 26% to $75.9b versus previous month. This is the lowest value since December 2020.

- Poloniex trading volume fell dramatically since November 2021 from $5.7b to $1.8b, which is the lowest value in comparison with the previous year.

Graph 1. Crypto-only Exchange Volume [15]

Note: Spot market share of cryptocurrency exchanges with primarily only crypto supportFutures Market

Futures Market

1) Futures Volume

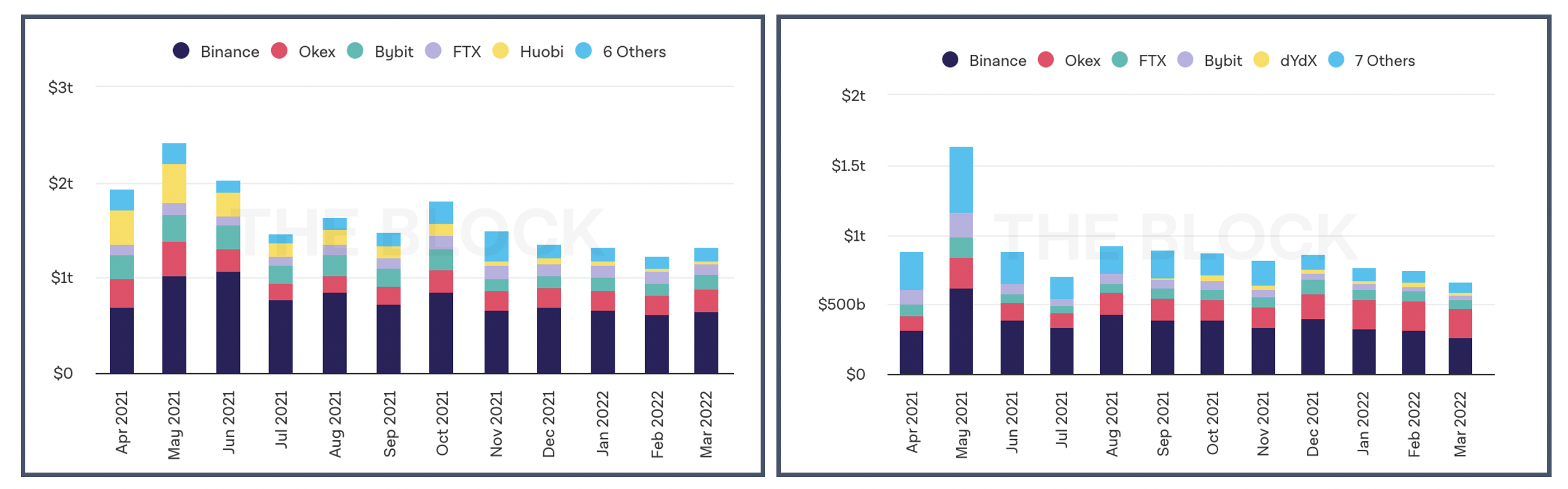

- Total trading volume of bitcoin futures on leading cryptocurrency exchanges grew in March by 7%, which is in line with trading volume on the spot market and BTC price change

- However, this cannot be said about the futures contract on Ethereum, which trading fell by 12% in March versus the February results and continued its downward trend since December 2021.

Graph 2. Volume of Bitcoin Futures [15] Graph 3. Volume of Ethereum Futures [15]

Glassnode analytics proclaim that BTC derivatives market in February and March 2022 has historically low implied volatility and futures premium, and such a market situation has historically forerun the periods of high volatility, and usually with an upside trend [7].

2) Aggregated Open Interest

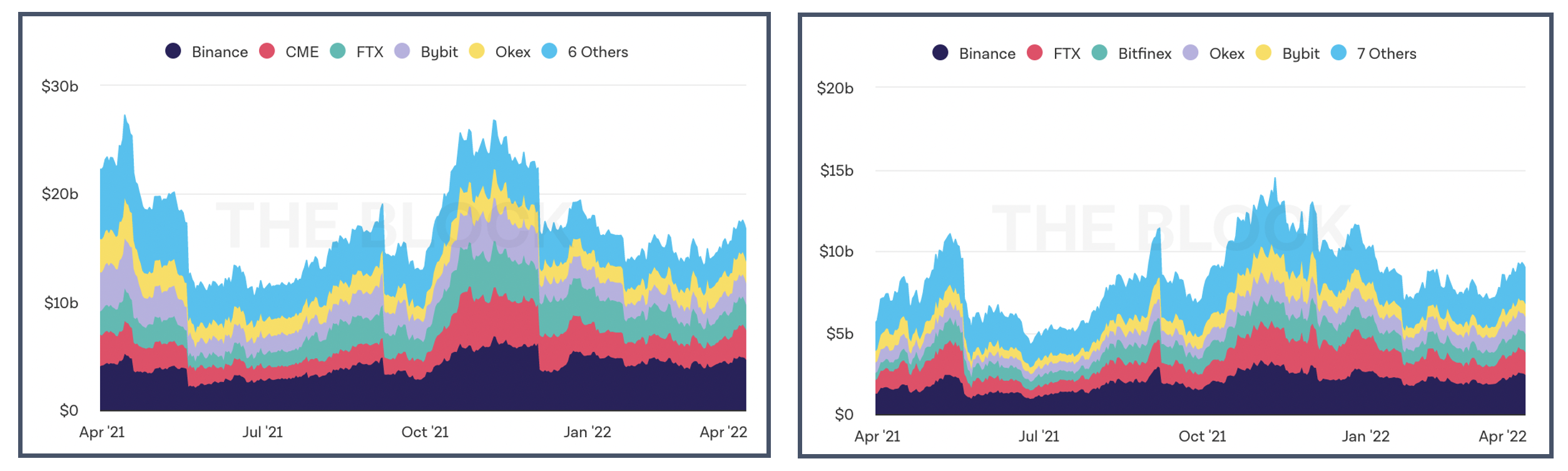

Aggregated open interest (OI) of BTC and ETH along with its prices had an upward trend in March, and at the end of the month it reached its highest values of $17.55b and $9.27b for BTC and ETH correspondingly.

Graph 4. Open Interest on BTC Futures [15] Graph 5. Open Interest on ETH Futures [15]

At the end of March, OI of futures contracts on BTC reached 1.94% of the Bitcoin market cap; while historically, leverage ratios of more than 2.0% of the market cap led to sharp de-leveraging [7].

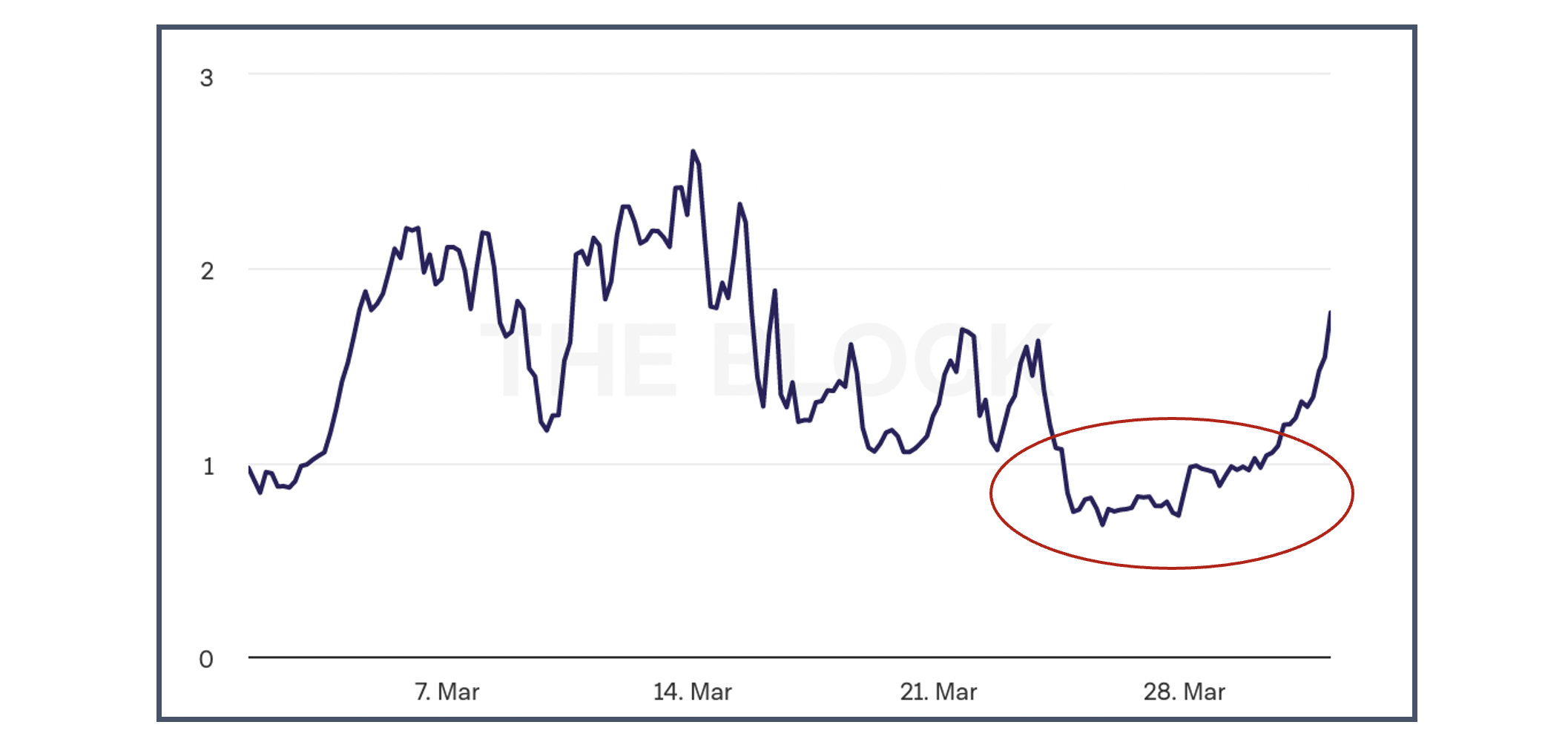

3) Long/ Short ratio

BTC Long/ Short ratio on Binance shows that domination of BTC long positions over short positions during March discontinued at the end of the month, where the minimum BTC Long/Short ratio achieved 0.68.

Graph 6. BTC Long/Short Ratio on Binance [15]

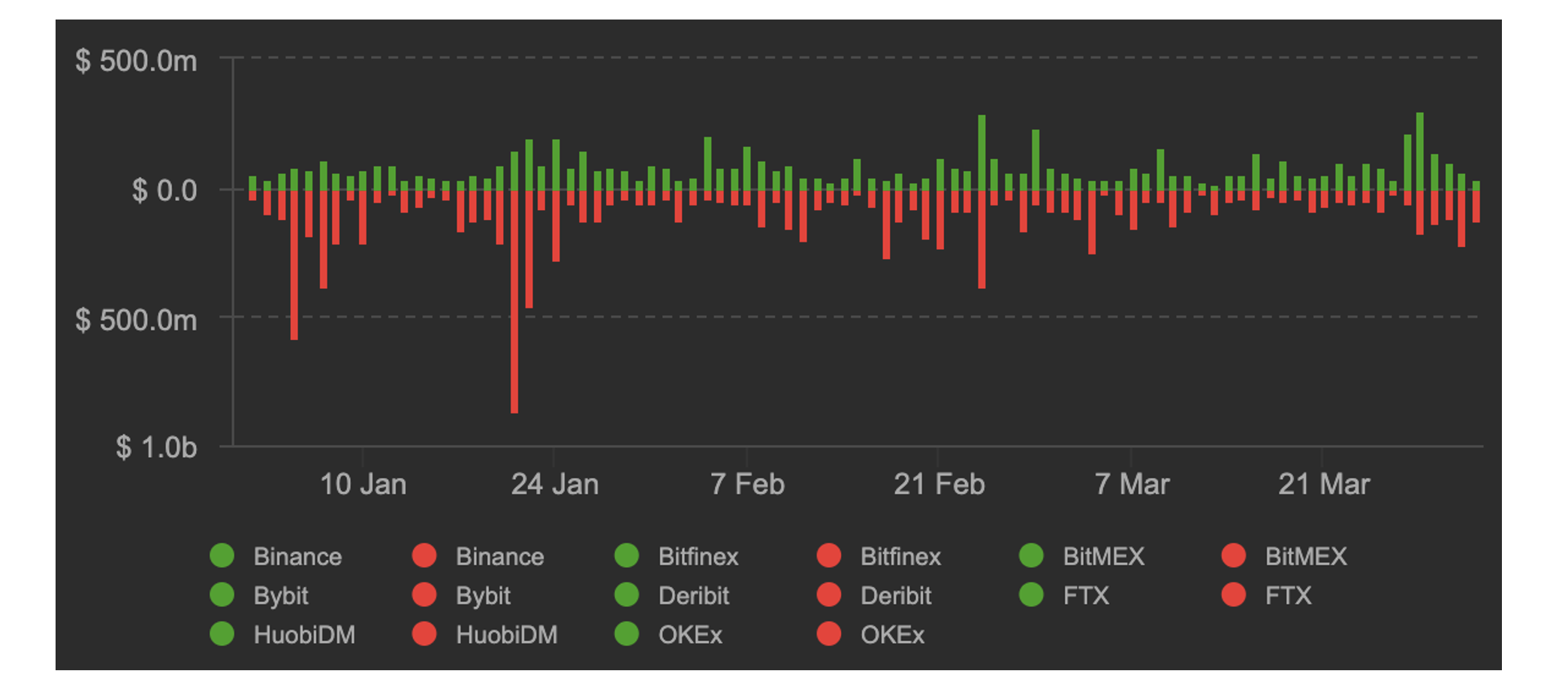

4) Liquidations

The liquidation level in March wasn’t considerable versus the first two months of the year. However, the highest liquidation of almost $500m was recorded on March 28, when BTC price went up by 5%.

Graph 7. Liquidations [4]

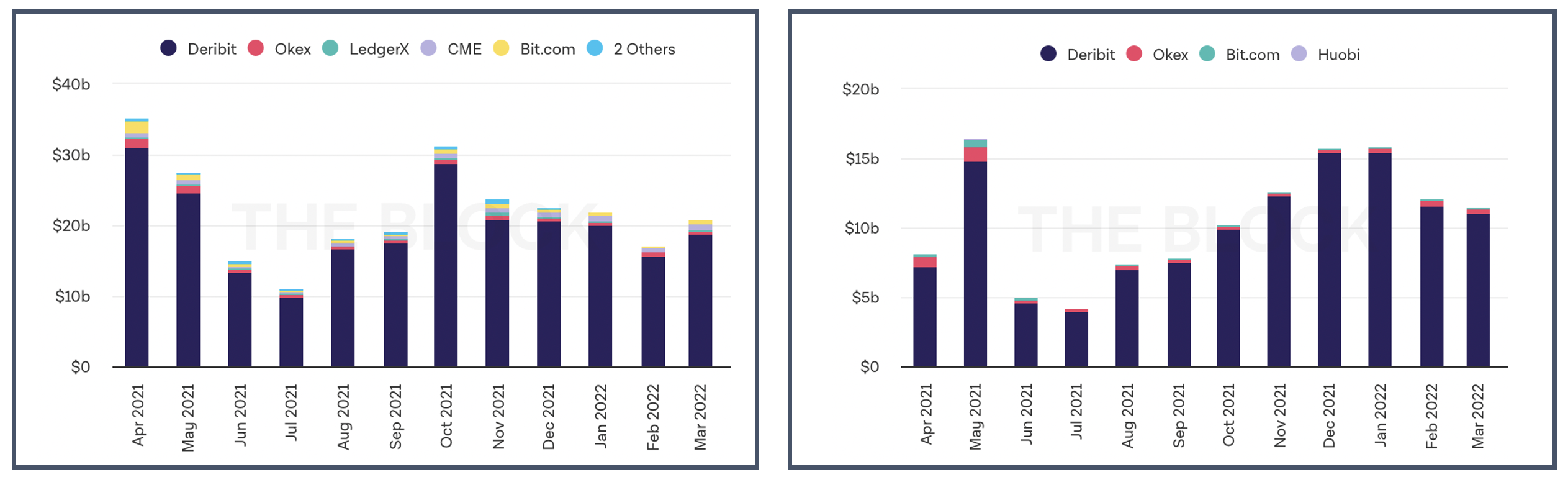

Options Market

The options market in March has demonstrated the same tendency as the futures market.

- The volume of BTC options grew by 21% and reached $20.8b.

- The volume of ETH options decreased by 5% and achieved $11.4.

Overall, we can observe growing interest in the options market.

Graph 8. Volume of BTC options [15] Graph 9. Volume of ETH options [15]

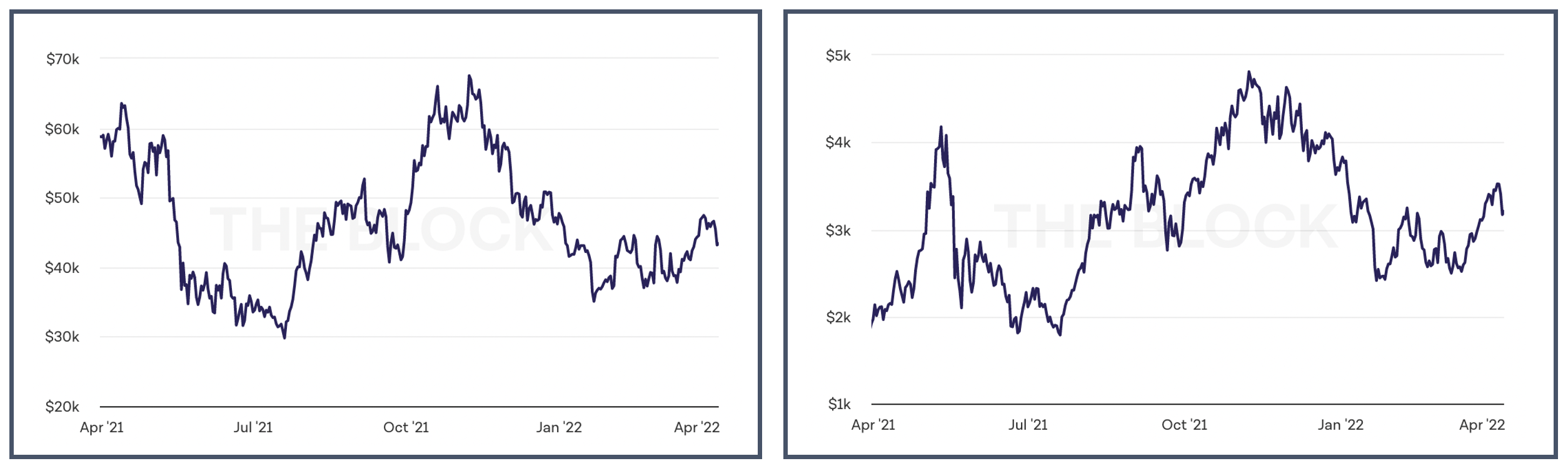

Dynamics of Leading Assets

1) Prices

- By the result of March, bitcoin price went up by 8.9%, and came up with January price level of $47.8k

- The price of the second largest cryptocurrency Ethereum climbed by 15.9% and reached $3,384.

- By the results of the first quarter, the price of the first cryptocurrency went up by 1.6%, and Ethereum fell by 8.2%.

Graph 10. BTC price [15] Graph 11. ETH price [15]

Glassnode analysts note that in Q1 2022 BTC was traded in a narrow price range, and they suggest that the market could expect higher volatility on the short-term horizon [7].

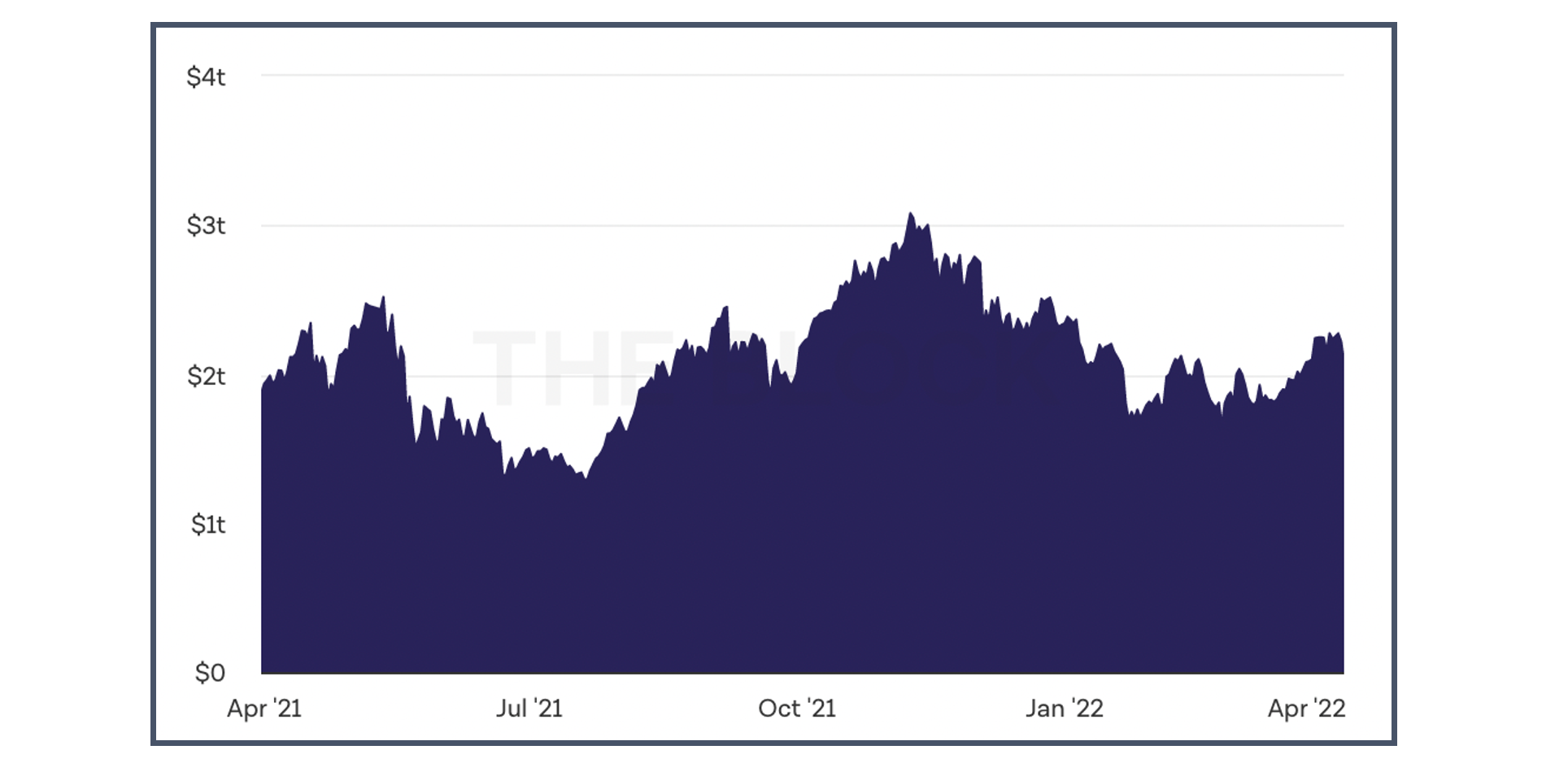

2) Market Capitalization

The total capitalization of the cryptocurrency market as of March 31, 2022 was $2.25 trillion, which is 25% higher compared to the capitalization of the end of February.

Graph 13. Total Market Capitalization [15]

Large Venture Rounds

In March 2022, several blockchain companies attracted funding of less than $150m, which are Polychain ($125m), Сryptos Capital ($110m), Mina Protocol ($92m), Hex Trust ($88m), Lunar ($70m), Blockmetrix ($43m), NFT-marketplace Magic Eden ($27m), Gauntlet ($23.8m) and Lava Labs ($10m).

M&A Deals

Other Events

Read more:

Cryptocurrency Exchange Hacks: how to secure user funds from theft

Crypto Industry Regulatory Risks. 2022 Rating by Country

References:

- Avan-Nomayo, O. “FTX partners with African payments company AZA Finance to boost web3 adoption”. The Block Crypto, 16 March, 2022

- Betz, B. “FTX Acquires Good Luck Games Amid Gaming Push”. Coindesk, March 22, 2022

- “ConsenSys Raises $450M Series D Funding as Leading Self-Custodial Wallet MetaMask Reaches Over 30 Million MAUs”. ConsenSys, March 15, 2022

- “Futures Markets Global Charts”. Coinalyze, March 15, 2022.

- Haun, K. “Introducing Haun Ventures”. Mirror.xyz, March 22, 2022

- Hernandez, O. “Immutable raises $200M to invest in blockchain gaming, bringing valuation to $2.5B”. Cointelegraph, March 7, 2022

- “High Volatility Is On the Horizon”. Glassnode, 21 March, 2022

- Kastrenakes, J. “Bored Ape Yacht Club creator raises $450 million to build an NFT metaverse”. The verge, March 22, 2022

- Metinko, C. “The Week’s 10 Biggest Funding Rounds: Blockchain Leads The Way As ConsenSys And Optimism Have Big Raises; Transportation Platform FLASH Parks Large Round”. Crunchbase, March 18, 2022

- Mitchelhill, T. “Optimism saves users $1B in fees, raises $150M in Series B”. Cointelegraph, March 18, 2022

- Nelson, J. “Former Polychain Capital Partner Launches $125M Crypto Fund That Will Become DAO”. Decrypt, March 23, 2022

- Nelson. J. “FTX Ventures Invests $100 Million in Money App Dave”. Decrypt, 22 March, 2022

- “Roofstock raises $240M at $1.9B valuation to expand access to real estate investing”. PR Newswire, March 10, 2022

- Rooney, K. “Crypto investor Katie Haun raises $1.5 billion, the largest debut fund ever by a female VC”. CNBC, March 22, 2022

- The Block Crypto, 16 March, 2021

- Thurman, A. “Electric Capital Raises $1B for 2 New Crypto VC Funds”. CoinDesk, March 1, 2022