With today’s rapidly growing cryptocurrency space and its mass adoption, it is almost impossible to stay away from cryptocurrencies, even for traditional investors and traders. Among a variety of cryptocurrency exchanges, the choice of the right one can be complex and time-consuming. Today there are several independent cryptocurrency data aggregators that track thousands of crypto assets on hundreds of crypto exchanges. They offer sophisticated ranking of exchanges based on their scoring system, which makes it easy for investors to decide between many alternatives. But how can an exchange increase their position in the ranking? In this article we will concentrate on scoring algorithms, provided by the largest and well-trusted crypto market data aggregators, CoinGecko and CoinMarketCap, with close attention to metrics that are included in it.

1. CoinGecko

CoinGecko is an independent cryptocurrency data aggregator with over 13,000+ different crypto assets tracked across 600 exchanges worldwide. Exchange rating is available here.

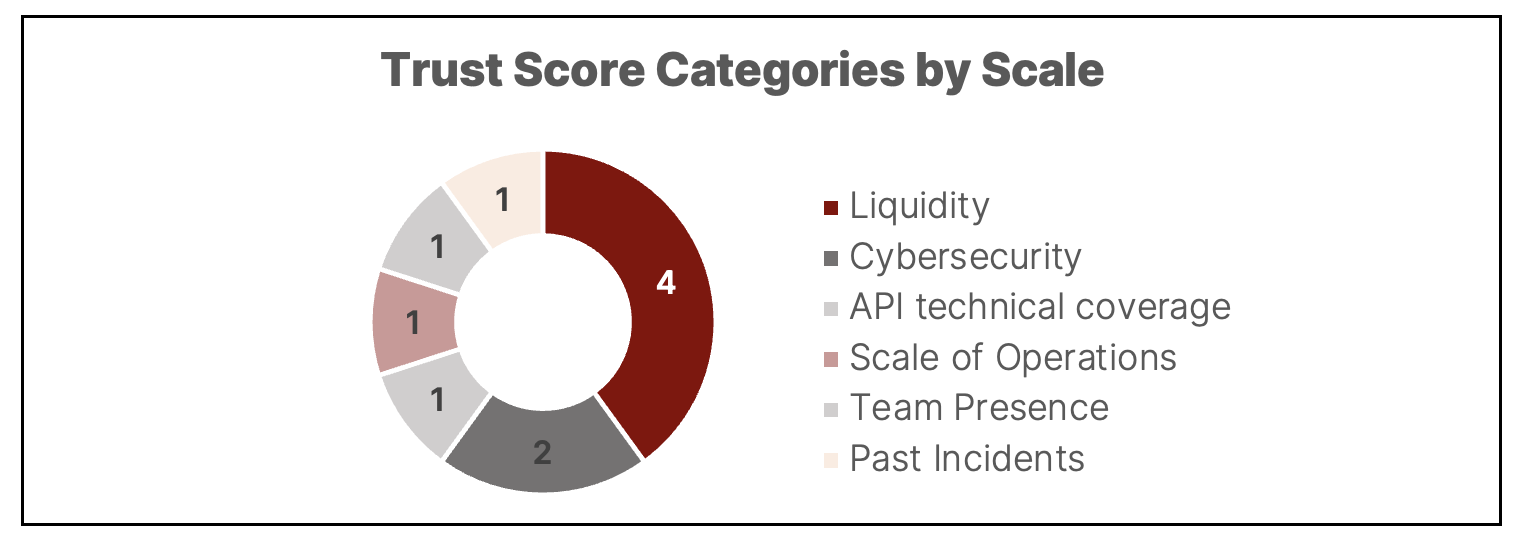

Trust Score on CoinGecko based on six categories (on a scale of 0 – 10):

We will direct special attention to each of the listed metrics and explicate it below.

We will direct special attention to each of the listed metrics and explicate it below.

1.1 Liquidity

The measure estimates reported volume, order book depth and order book spread, trading activity, and web traffic quality.

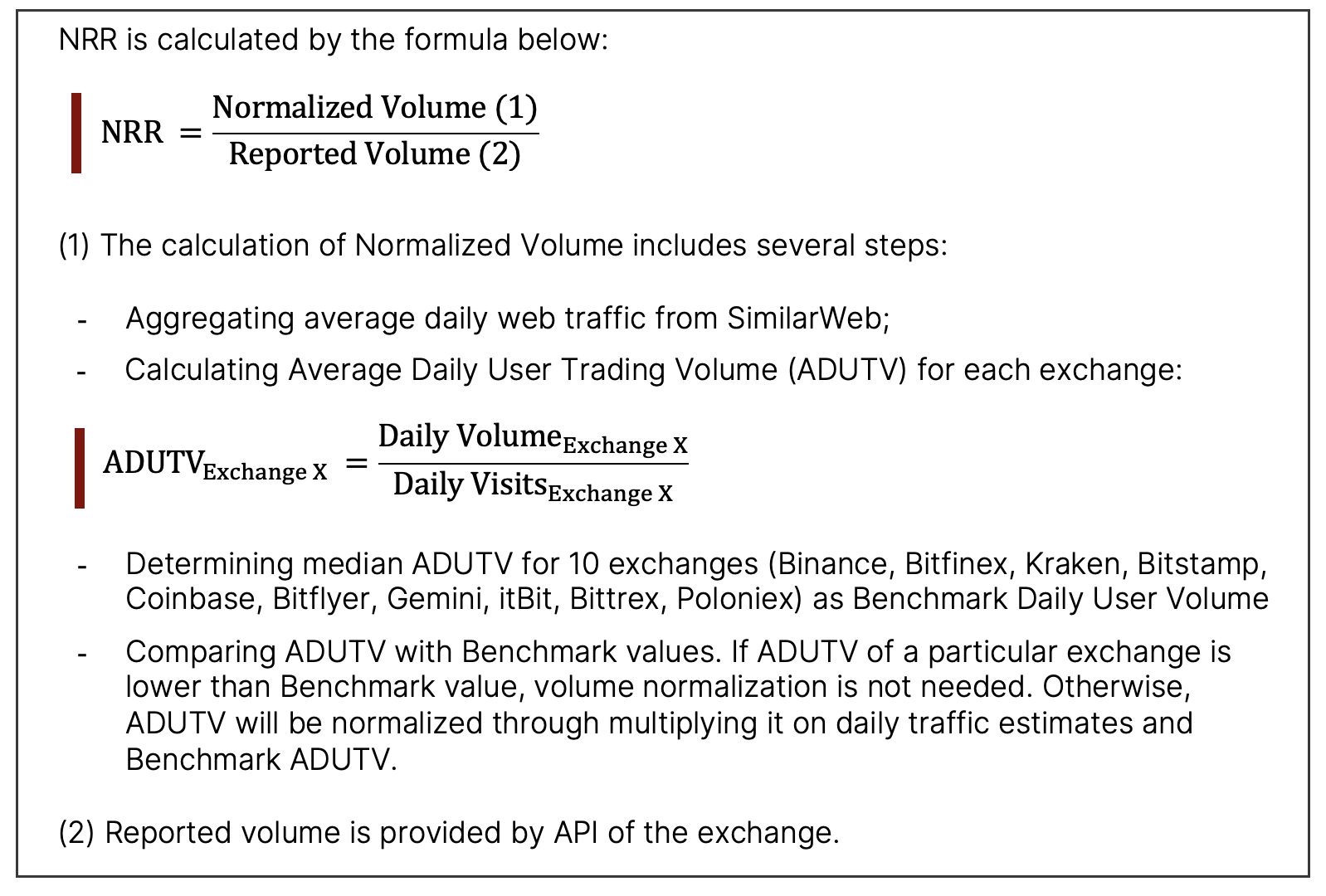

- Normalized-Reported Volume Ratio (NRR).

- Average Bid-Ask Spread (collected by API) across all trading pairs traded within the last hour. The lower average bid/ask spread, the more liquid an exchange.

- Active Trading Pair Ratio or ATR (collected by API). It measures trading activity and shows actively traded pairs in the last hour against actively traded pairs in the last 24 hours, where higher ATR will indicate more liquidity on the exchange.

- Trading Pair Trust Score (collected by API). A high score of trading pairs with a Green sign in front of it indicates more liquid exchange.

1.2 Scale of Operations

This measure relies on an exchange’s trading volume, order book depth, order book spread and activity relative to the benchmark.

- Normalized Volume Percentile. Exchanges are ranked with regards to benchmark based on normalized trading volume, obtained in section 1.1

- Normalized Depth Percentile. The points for this criterion are given based on an exchange’s order book depth relative to all other exchanges, which are normalized using the NRR, obtained in section 1.1

1.3 API Technical Coverage

This criterion evaluates an exchange’s API availability and coverage of the following data:

- Tickers (latest price and 24 hours rolling volume for all traded pairs)

- Historical Trades (historical trade data for any pair)

- Order Book

- Candlestick/OHLC

- Web Socket API (live trades and order book data)

- API Trading

- Public Documentation

As stated by CoinGecko Team, a well-performing and transparent exchange that has the necessary technical competencies, will disclose all trading data with acceptable limits through API.

1.4 Cybersecurity

Cybersecurity metric estimates protection level of a crypto exchange against external threats towards:

- Product & infrastructure, namely servers, front-end and web services. It checks availability of programs such as Server Security, DNS SEC, Firewalls, Spam Protection and others.

- Users accounts. It evaluates the existence of 2-factor authentication (2FA), Password Policies, Captcha, Phishing protection and other.

- Hack cases & bug bounty programmes. Hacken, a cybersecurity firm partnered with CoinGecko, analyzes hack cases and the availability of bug bounty programmes for vulnerability disclosures.

1.5 Team Presence

The factor accounts for disclosed team members, at least top management, on an exchange’s website.

1.6 Past Incidents

This measure records negative past incidents, connected with regulatory troubles, hack attacks, withdrawal issues, user account disputes and other.

The CoinGecko team mentioned that it will constantly revise, improve and upgrade Trust Score by incorporating more metrics to make it more robust. The following dimensions were highlighted:

- Trade history analysis

- API quality analysis

- Hot & Cold wallet analysis

- Social Media analysis

- Exchange support turnover time

- User Reviews

- Licensing & Regulations

2. CoinMarketCap

CoinMarketCap is one of the largest data aggregators with over 18,000+ different crypto assets tracked across more than 500 exchanges worldwide. Exchange rating is available here.

The methodology of Exchange Ranking prepared by CoinMarketCap is less complex and detailed compared to the Trust Score provided by CoinGecko.

The aggregator scores exchanges from 0.0 to 10.0 based on traffic, liquidity, trading volumes, and legitimacy of trading volumes reported, with weights attributed to each factor. The weights are undisclosed.

The interpretation of scores are as follows:

- Above 6.0 — Good

- 4.0 to 6.0 — Average

- Below 4.0 — Poor

- N/A — Insufficient data points for a score.

2.1 Web Traffic Factor

Web traffic factor is a relative measure, which scales from 0 to 1,000, where the exchange with the highest web traffic receives 1,000 points, while the others are scored relative to the top exchange. The score is based on the indicators collected from various web traffic solutions (SimilarWeb, Alexa, Ahrefs) and updated on a monthly basis.

The weights of web traffic indicator are presented below:

- Pageviews (20%)

- Unique visitor count (15%)

- Bounce rate (10%)

- Time-on-site (5%)

- Relative ranking (25%) — gathered through Alexa’s relative ranking

- Keyword searches (25%) — tracked through the search engine ranking of exchanges for a select pool of keywords (e.g. “cryptocurrency exchange,” “bitcoin exchange,” “cryptocurrency trading,” etc.)

2.2 Liquidity Score

Liquidity factor measures average of top 25 trading pairs listed on an exchange, which are received through API. Stablecoin pairs are noy included.

Conclusion

We have considered the components of Exchange Score composed by two largest and highly trusted crypto market data aggregators — CoinGecko and CoinMarketCap. According to their methodology, exchanges with high reported trading volume don’t necessarily equate to high liquidity and trust. Therefore, more comprehensive measures were included in the rating algorithms, such as liquidity, trading activity, scale, technical expertise, cybersecurity and other. Knowing the criteria, cryptocurrency exchanges could not only improve their positions in their rating, but also to provide a better and safer service for their clients.

Read more:

Cryptocurrency Exchange Hacks: how to secure user funds from theft

Crypto Industry Regulatory Risks. 2022 Rating by Country

References:

- “Exchange Ranking”. CoinMarketCap, Access Date: April 18, 2022

- Jin, S. “Trust Score Algorithm Update: Incorporating Hacken’s CyberSecurity Score”. CoinGecko, July 01, 2020

- Jin, S. “Trust Score Algorithm Update: Incorporating Team Presence & Incidents”. CoinGecko, November 13, 2020

- Jin, S. “Trust Score Explained”. CoinGecko, March 05, 2020

- Jin, S. “Trust Score 2.0: CoinGecko Updates Trust Score to Improve Exchange Transparency”. CoinGecko, September 10, 2019

- Ong, B. “CoinGecko Introduces “Trust Score” to Combat Fake Exchange Volume Data”. CoinGecko, May 13, 2019