Understanding the forces that drive digital asset adoption in heterogeneous regions throughout the world can be a complex endeavour. While the process involves high initial fixed costs and variable (constantly updating) ones, it acts as an authentication level needed before setting out to undertake any new venture in the digital asset world.

Following an overview and subsequent detailed analysis on some of the Latin American countries with the highest potential for digital asset adoption -such as Brazil, Mexico and Colombia – we turn our attention to digital asset adoption in Africa.

Digital asset adoption landscape in Africa

The African continent provides a curious case for analyzing a number of phenomena. As the largest continent with almost 30,000,000 square kilometers (second only to Asia) and a population of approximately 1.3 billion people living in 54 countries, it naturally raises questions about the place it should be occupying at a global scale.

What makes this region interesting for digital assets from a business perspective?

The answer to this particular question – and any others that may be derived from it – lies in its realized development in relation with its potential. More specifically, Africa represents an array of untapped markets, from commodities to finance, that presents time-sensitive opportunities to those that pay close attention.

Let us limit the analysis to our interest in blockchain technology. Blockchain has the potential to fill the gaps that are plaguing African communities, most of them based on financial inclusion; this includes personal credit availability, infrastructure funding, currency stability, and more. According to the International Monetary Fund, internet penetration in sub-Saharan Africa has grown tenfold since the early 2000s, compared with a mere threefold increase in the rest of the world [1].

Still, Sub-Saharan Africa is reported to have the second highest population of unbanked adults in the world, at about 350 million people, or 17% of the global total. Citizens need new, better and more efficient ways of sending and receiving funds, as well as transacting or maintaining a stable reserve currency.

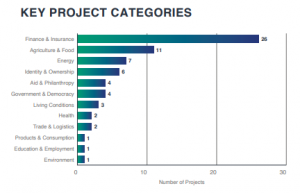

This is easily evidenced in the category distribution of main blockchain projects being developed in Africa estimated by PositiveBlockchain.io

Source: Blockchain projects in Africa by sector, according to PositiveBlockchain.io [2]

A large market opportunity is therefore present for blockchain to step in and become the main underlying financial infrastructure throughout the region.

As per this report by Smart Africa, there are a number of use cases that appear most feasible or outright needed throughout the African continent. Some of these use cases include:

- Digital payment infrastructures, including central bank digital currencies,

- Public spending and governance,

- Peer-to-peer energy trading,

- Digital claims to land ownership,

- Digital claims to education credentials,

- Tracing agricultural goods along supply chains and

- Trade facilitation.

Digital asset adoption in Africa

In a region plagued by a lack of access to financial instruments, high transaction fees [3], unemployment, inflation and more, it is but natural to understand the power that a technology such as blockchain can have. By combining cheaper and easier money transfers with access to stable currencies, alternative systems can easily compete and take market share away from fiat currencies. KamPay, a continent-long borderless DeFi solution is a clear example of the potential of blockchain in this region – with over 50 million potential users, it elevates main African digital asset uses such as commercial transactions. KamPay is also developing a suite of possible products to incentivize further adoption, such as their 50k farmer pilot program in Zimbabwe that will gain access into blockchain and provide micro lending [4].

A report by Binance showcases a surge in the number of African users on its platform. It saw an increase of 2228.21% in P2P users on the platform and 386.93% in P2P volumes across Africa [5].

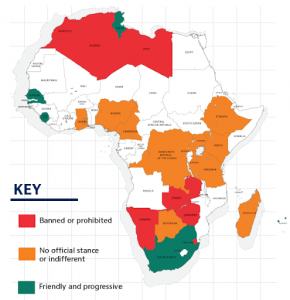

Despite the range of possibilities, the advancement of blockchain in the continent is naturally related to its regulatory landscape. While some specific cases explicitly banned or prohibited digital assets, others have yet to have an official stance.

Source: Geographical overview of country-level stance on digital asset adoption (2019) [6]

Cardano to take part in African special projects

To further understand the necessity of an inclusive technology-based system, you can analyze Caradano’s involvement in the region. A conversation between Charles Hoskinson and James B. discussed the role IOHK and Cardano will have on Africa’s special projects, including digital identity and blockchain-based schooling information. Furthermore, having a verifiable ID means that “users can get a passport or driving licence, register property and access vital financial services like banking and loans.”

It seems that one of Cardano’s goals is to deliver economic identity to those currently left behind by current systems – a world’s estimate of 2.2bn unbanked [7].

Main African countries adopting digital assets

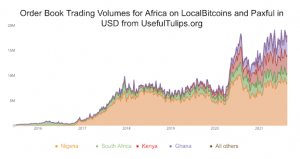

According to UsefulTips, four main African currencies have been taking the spotlight in USD denominated weekly volume transactions. These are the Nigerian Naira, South African Rand, Kenyan Shilling and Ghanaian Franc [8].

This assessment is in line with the 2021 Global Crypto Adoption Index, where several African countries appear in the top 20: Kenya (5), Nigeria (6), Togo (9), South Africa (16) and Tanzania (19). Some of these, among other emerging countries including Vietnam and Venezuela, rank high on their index largely because they have huge transaction volumes on peer-to-peer (P2P) platforms when adjusted for PPP per capita and internet-using population.

Nigeria

Notwithstanding its place in world rankings on digital asset adoption, Nigerian authorities do not share its citizen enthusiasm. The Central Bank of Nigeria (CBN) recently directed banks to stop offering services to cryptocurrency providers.

Last February, the CBN issued a circular prohibiting banks and financial institutions from facilitating payments for cryptocurrency exchanges. This followed a trend of governments worldwide pushing back on the use of cryptocurrencies, with United States Federal Reserve Chairman, Jerome Powell [9].

Kenya

So, what makes Kenya the right place for blockchain technology?

Firstly, Kenya is already an innovation hub in Africa. Connectivity, infrastructure, high literacy rate, and other high-achieving status on distinct categories evidence that Kenya is well-developed and a natural place to start. Moreover, Kenya has already benefited from the adoption of M-PESA – an electronic mobile money service that allows you to store, send and receive money on your mobile phone, which was key to solving the problem of remittance in several African countries. After M-PESA, the demand for other technology solutions in Kenya started to rise.

Conclusion

Stay tuned as we develop upon some of the most interesting cases in the African digital asset market, reviewing both adoption and specific regulatory landscapes. We will further take a look at digital asset adoption in Nigeria, Kenya and South Africa.

References

[1] Baker McKenzie (2019). Blockchain and Cryptocurrency in Africa. Stolp J., Perumall A., Selfe E. Available at https://www.bakermckenzie.com/-/media/files/insight/publications/2019/02/report_blockchainandcryptocurrencyreg_feb2019.pdf

[2] Smart Africa Secretariat (2020). BLOCKCHAIN IN AFRICA: OPPORTUNITIES AND CHALLENGES FOR THE NEXT DECADE. How African countries can take advantage of distributed ledger technologies as they are maturing. Available at: https://www.giz.de/expertise/downloads/Blockchain%20in%20Africa.pdf

[3] Based on a report from the World Bank, remittances worth less than $200 to sub-Saharan countries cost an average of about 9% compared to a global average of 6.8%

[4] Marcus, Dov. “With Crypto Adoption on the Rise across Africa, the Need for a Leading Digital Currency Grows Stronger.” KamPay, 23 Aug. 2021, www.kampay.io/post/with-crypto-adoption-on-the-rise-across-africa-the-need-for-a-leading-digital-currency-grows-stronger

[5] Nwokoma, Chimgozirim. “Despite Clampdowns on Cryptocurrency Usage, African P2P Users on Binance Grow by over 2000%.” Techpoint Africa, 16 May 2021, techpoint.africa/2021/05/17/binance-users-grow/

[6] Devermont, Judd, and Marielle Harris. “Digital Africa: Leveling up through Governance and Trade.” Digital Africa: Leveling Up through Governance and Trade | Center for Strategic and International Studies, 8 Sept. 2021, www.csis.org/analysis/digital-africa-leveling-through-governance-and-trade

[7] “Africa’s Huge Potential Could Be the Key to Mass Adoption for Crypto.” CityAM, 29 Apr. 2021, www.cityam.com/africas-huge-potential-could-be-the-key-to-mass-adoption-for-crypto/

[8] https://www.usefultulips.org/combined_Sub%20Saharan%20Africa_Page.html

[9] Adesina, Olumide. “Nigerians Increasingly Using Bitcoin since CBN’s CRYPTO BAN.” Nairametrics, 21 Apr. 2021, nairametrics.com/2021/04/21/nigerians-increasingly-using-bitcoin-since-cbns-crypto-ban/

Sources

Chainalysis (2021). The Chainalysis 2021 Geography of Cryptocurrency Report. Chainalysis. Available at https://blog.chainalysis.com/reports/2021-global-crypto-adoption-index.

Chainalysis (2021). The Chainalysis 2021 Global DeFi Adoption Index. Chainalysis. Available at https://blog.chainalysis.com/reports/2021-global-defi-adoption-index.

Bilotta, Nicola, and Fabrizio Botti. The (Near) Future of Central Bank Digital Currencies: Risks and Opportunities for the Global Economy and Society. Peter Lang International Academic Publishers, 2021.

Kingsley, Alo. “Exploring the Landscape of Crypto Regulations in Sub-Saharan Africa.” Cointelegraph, Cointelegraph, 19 Oct. 2020, cointelegraph.com/news/exploring-the-landscape-of-crypto-regulations-in-sub-saharan-africa.