Nigeria has become one of the African countries with the highest digital asset adoption rates when measured by P2P volume transactions, adjusted for PPP per capita and internet-using population. According to the 2021 Global Crypto Adoption Index, Nigeria ranks 6th at a global level, second only to Kenya in the African continent [1]. Below we further explore factors that contribute to digital asset adoption in Nigeria.

Nigeria adopts digital assets

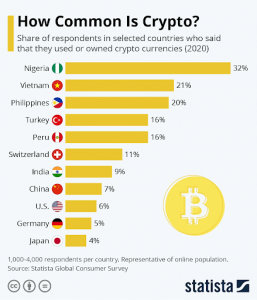

Digital asset adoption in Nigeria has been steadily increasing for the past half-decade. According to the Global Consumer Survey carried out by Statista, Nigeria is the leading country (per capita) for Bitcoin and cryptocurrency adoption in the world. The 2020 global survey estimates that approximately 300 million people have owned or used digital assets at some point, with Nigerians achieving an impressive response – 32% of surveyed Nigerians reported to have used or owned digital assets at some point [2].

“How Common is Crypto?” Statista, 2020

Naturally, country-specific factors fuel digital asset adoption throughout the world. The case of Nigeria is no different. Currency controls and pervasive inflation light the spark of the remarkable rise of cryptocurrencies in Nigeria.

The value of the Nigerian naira has plummeted almost 30% against the dollar in the past five years. Additionally, the Nigerian currency has been suffering from variable inflation rates, increasing from a 10 year low of 8% to a current 17%, according to the National Bureau of Statistics of Nigeria [3].

Digital asset adoption as insurance

Nigerians have also been subject to political repression, sowing an uncertainty that inadvertently propitiated the scene for digital assets to arrive. This repression was not only physical in nature, but financial, as well. Thousands of citizens marched last October against police brutality and the Sars police unit, resulting in hundreds suffering tangible afflictions. During these protests, several bank accounts belonging to groups that raised funds to free protesters and supply first aid were temporarily suspended. This scenario provided yet another strong argument in favour of digital assets,which are now also considered as a key insurance against hostile interventions [4].

Adapting the Regulator Speech

Despite adoption advancements, it wasn’t until relatively recently that the regulator started to show its official position regarding cryptocurrencies. In 2021, central authorities and regulators in Nigeria have shared their stance on cryptocurrency usage, though not in a consistent manner.

After initially warning users on the dangers of investing and trading digital assets, the Central Bank of Nigeria (CBN) ordered banks to close accounts of all cryptocurrency users. Following a worldwide trend of regulatory institutions repelling the use of digital assets, the CBN submitted a letter in February 2021 signed by the Director of Banking Supervision, Bello Hassan. With it, it reminded regulated banking institutions that dealing in cryptocurrencies or facilitating payments for cryptocurrency exchanges was “prohibited.” Banking institutions -DMBs, NBFIs, and OFIs – were therefore directed to “identify persons and/or entities” transacting with cryptocurrency or operating crypto exchanges on their platforms and immediately close their accounts. Finally, it clearly stated that any breaches would face severe regulatory sanctions [5][6].

This state did not deter Nigerian citizens from getting hold of cryptocurrencies. In fact, Bitcoin demand in this region increased after the public ban, reaching highs of over USD 86,000 – nearly a ~ 70% premium over average market prices [7][8].

The official speech rapidly changed as the regulator faced both public unease and observed how the same actions that were designed to disincentivize digital asset use resulted in the exact opposite – an increment in usage and transactions [9]. Less than a month after the letter was submitted, the CBN issued a statement of clarification, where bank officials said the directive should not be mistaken for an outright ban. Instead, the alleged initial communication was only meant to prohibit transactions of cryptocurrencies in the banking sector [10].

Down the road

Less than a year since its mostly debated announcement against digital currencies, the Central Bank of Nigeria announced that it will launch the pilot scheme of its digital currency by October 1, 2021. Apparently, the CBN has been carrying out research on CBDC’s since 2017, and might conduct a proof of concept before the end of this year [11].

With the current pressures piling up in favour of digital assets, there is no time like now to take the opportunity and discover more about the industry.

Learn more about the benefits of blockchain solutions and how to build a digital asset exchange by exploring our blog and subscribing to not miss any news.

Our range of clients include the international digital asset exchange, TradeFada. Together, we explored the rise of cryptocurrency in Africa in a webinar, which you can view here.

References

[1] Chainalysis (2021). The Chainalysis 2021 Geography of Cryptocurrency Report. Chainalysis. Available at https://blog.chainalysis.com/reports/2021-global-crypto-adoption-index.

[2] Buchholz, Katharina, and Felix Richter. “Infographic: How Common Is Crypto?” Statista Infographics, 17 Mar. 2021, https://www.statista.com/chart/18345/crypto-currency-adoption/.

[3] https://tradingeconomics.com/nigeria/inflation-cpi.

[4] Akinwotu, Emmanuel. “Out of Control and Rising: Why Bitcoin Has Nigeria’s Government in a Panic.” The Guardian, Guardian News and Media, 31 July 2021, https://www.theguardian.com/technology/2021/jul/31/out-of-control-and-rising-why-bitcoin-has-nigerias-government-in-a-panic.

[5] https://www.cbn.gov.ng/Out/2021/CCD/Letter%20on%20Crypto.pdf.

[6] Akhtar, Tanzeel. “Nigeria’s Central BANK ORDERS Banks to Close Accounts of All Crypto Users .” CoinDesk, 5 Feb. 2021, https://www.coindesk.com/policy/2021/02/05/nigerias-central-bank-orders-banks-to-close-accounts-of-all-crypto-users/.

[7] Pechman, Marcel. “Why Is Bitcoin $86K in Nigeria ? Here’s Why the BTC Premium Is Huge in Some Countries.” Cointelegraph, 26 Feb. 2021, https://cointelegraph.com/news/why-is-bitcoin-86k-in-nigeria-here-s-why-the-btc-premium-is-huge-in-some-countries.

[8] Adesina, Olumide. “Nigerians Increasingly Using Bitcoin since CBN’s CRYPTO BAN.” Nairametrics, 21 Apr. 2021, nairametrics.com/2021/04/21/nigerians-increasingly-using-bitcoin-since-cbns-crypto-ban/

[9] Avan-Nomayo, Osato. “Bitcoin Adoption in Nigeria Soars as Central Bank Blocks Remittances in Naira.” Cointelegraph, Cointelegraph, 18 Dec. 2020, https://cointelegraph.com/news/bitcoin-adoption-in-nigeria-soars-as-central-bank-blocks-remittances-in-naira.

[10] Sinclair, Sebastian. “Nigeria’s Central Bank: We Didn’t Ban Crypto Trading .” CoinDesk , 22 Mar. 2021, https://www.coindesk.com/markets/2021/03/22/nigerias-central-bank-we-didnt-ban-crypto-trading/.

[11] Essien, Hillary. “CBN’s Digital Currency Cbdc Set for October 1.” Peoples Gazette, 23 July 2021, https://gazettengr.com/cbns-digital-currency-cbdc-set-for-october-1/.