Nascent blockchain technology and its main derivative -cryptocurrencies- are stealing the spotlight. Explosive returns and growing total value locked (TVL) are broadcasting the advent of a new financial ecosystem, highlighted by decentralization as well as trustless environment, minimal fees, lightning speed, and most importantly, a (better) alternative to the current traditional financial services.

Despite being young, blockchain is not new. Though originally limited to the attention of savvy developers and open-minded seed investors, it has grown to be baptized as the “fourth industrial revolution,” and is building recognition worldwide, fast. Traditional finance players are constantly keeping an eye on new developments in the digital assets space, timing the seconds to jump in and harness everything the technology has to offer. Institutions are steadily becoming the new whales of the industry.

So, what has changed?

Historically, price volatility of digital assets (though it has been constantly decreasing for the past years), lack of fundamentals to gauge appropriate value, security concerns, private key management concerns, system complexity, lack of tax/regulatory treatment, irreversible transactions, and a lack of institutional grade service were some of the main issues that made institutional capital abstain from entering. Now, these problems are starting to resolve and institutions are placing one foot inside the door, ready to take the extra step. We are at an inflection point regarding mass adoption.

Ever since the digital assets ATH in 2017 and its subsequent downfall, the space has been constantly growing and consolidating.

Since 2017, financial institutions have been getting more interested in securing a place within the blockchain ecosystem. In 2017, Harvard, Stanford, and MIT endowment funds have paved the way for reluctant institutions that needed a pull from pioneers of the industry [1]. Recently, over 20 companies filed the 13F form (it tracks positions, greater than US$ 100M, possibly changed to US$3.5B), declaring they have made sizable investments in Grayscale Bitcoin Trust (BTC). Grayscale Investments has been one of the first to offer traditional finance products with digital assets as the underlying, and is seeing its trust grow at a rate of US$ ~60M a week [2]. The space is starting to fill with whales, but this sea has plenty of room for everyone.

According to Deloitte’s 2020 Global Blockchain Survey, 55% of organizations responded that blockchain will be critical and is one of the top 5 strategic priorities, relative to 53% and 43% in 2019 and 2018, respectively. Similarly, Fidelity Digital Asset’ Institutional Investors Digital Asset Survey showed that almost 60% of all investors surveyed have a neutral or positive perception toward digital assets, and 36% are currently investing in them. Every category in these surveys has improved its outlook on blockchain, showcasing a predestined institutional growth. And even though sentiment is not a sufficient condition for adoption, it is necessary for establishing confidence and further involvement.

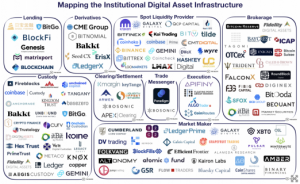

A July research report from The Block mapped over 110 institutional digital asset infrastructures by services provided, and found out that from the US$ 2.1B in investments allocated to institution-serving firms, US$ 1.2B went solely to institutions, focused mainly on derivatives, custody, and lending services [3].

(The Block, 2020)

Digital appeal of digital assets

The main appeal and growing interest on digital assets is based on:

- Low correlation between digital assets and traditional assets. Most renowned cryptocurrency Bitcoin has had a daily average correlation (Rolling 30D) of 0.1 with US small/mid/large cap equities, global bonds, international stocks and emerging markets in the period of January 2015 to September 2020 [4]. A correlation lower than 1 provides diversification benefits as demonstrated by Nobel prize-winning economist Harry Markowitz in his groundbreaking work on modern portfolio theory, over half a century ago. [5]

- Adoption and usage of underlying networks. As network usage grows and gains mass adoption, the path for institutions gets clearer for entering the space and taking advantage of it.

- Decentralization. No government intervention is a characteristic that many investors find appealing. Not fueling the power struggle between national economies and being subject to its laws, regulations, and intervention, can be an enticing sweetener for participants.

- Higher returns: In a situation where current developed economies have zero or even negative nominal and real interest rates, providing investors with asset classes that have higher risk-adjusted returns is a growing challenge for traditional institutions. As the most representative case example, Bitcoin has grown +320% since its twelve month low in March [6].

- Launch of institutional grade infrastructure. Without institutional grade infrastructure, traditional finance still keeps a competitive advantage on both scalability, security, custody, and settlement/clearance processes, maintaining a reluctant stand on the space [7][8].

- The growth in talent and service providers focused on the space. Everyday, prominent traditional actors are entering the digital asset market, raising the bar. Recently, USDC issuer Center, for instance, hired former State Street and JPMorgan Chase executive David Puth as its new CEO [9].

Dynamics going forward

It is evident that the current dynamics will change as blockchain reaches higher levels of adoption, especially when accounting for institutional investors. We believe that as the new ecosystem unveils, new challenges as well as new opportunities will rise. For one, retail investors (the majority in the first period of digital asset ATH) will have more prepared counterparts to trade with. This is a common fact when any market expands. Liquidity will flood exchanges, provoking a higher valuation, consolidating, and reducing volatility. More and more interesting and user-centered projects will be funded, and the ecosystem will grow exponentially.

At the moment of writing, S&P Dow Jones Indices reported to launch cryptocurrency indexes in 2021. Many customizable indexes will be born, creating new benchmarks for what will probably be the fastest growing year for cryptocurrencies [10]. In our next article, we further explore the impact blockchain and cryptocurrencies are having on recent investments and adoption.

SCALABLE

Regardless of whether you are a retail trader, high net worth individual, investment fund or any financial institution, with SCALABLE you can find a partner that can help you navigate every stream of this exciting wave of adoption. Innovative technology and security is at the heart of what we do, and thanks to our wide array of regulatory partners, we can help institutions along each step the way. Get in touch with us here.

References

[1] Victor, Jon. “Harvard, Stanford, MIT Endowments Invest in Crypto Funds.” The Information, The Information, 10 Oct. 2018, www.theinformation.com/articles/harvard-stanford-mit-endowments-invest-in-crypto-funds.

[2] Castillo, Michael del. “20 Institutional Bitcoin Investors Revealed, But Soon The List May Vanish.” Forbes, Forbes Magazine, 7 Aug. 2020, www.forbes.com/sites/michaeldelcastillo/2020/08/06/valuable-sec-data-on-20-institutional-bitcoin-investors-could-soon-disappear/?sh=7db31fbd1de2.

[3] Dantoni, John. “Mapping the Institutional Digital Asset Infrastructure Space.” The Block Research, The Block, 12 May 2020, www.cryptofinance.ch/wp-content/uploads/2020/07/Mapping-the-Institutional-Digital-Asset-Infrastructure-space-The-Block-Part-1.pdf.

[4] Morningstar Portfolio Visualizer > Asset Class Correlations;

Correlation is a statistical metric that showcases how close two variables are linked. A value of 1 is a ‘perfect’ relationship, -1 is a perfect inverse relationship, and 0 means no relationship. Note: correlation within digital assets are much higher than with traditional assets (equities, bonds, REIT, etc), and in times of economic crisis, assets tend to have higher positive correlations between classes (i.e they all can lose value together).

[5] Markowitz, H. (1952). Portfolio Selection. The Journal of Finance, 7(1), 77-91. doi:10.2307/2975974

[6] Gola, Yashu. “Bitcoin Beats Stocks, Gold, Bonds in Risk-Adjusted Returns: Research.” Bitcoinist.com, 12 Nov. 2020, bitcoinist.com/bitcoin-beats-stocks-gold-bonds-in-risk-adjusted-returns-research/;

We shouldn’t leave unmentioned that even though digital currencies provide outstanding risk-adjusted returns, these are only of significance when the assets have deep liquidity. Nowadays, sizable investments from institutional actors can cause major price shifts, affecting future returns and volatility.

[7] “$20 Billion in Crypto Under Custody: Coinbase Sees ‘Explosion of Capital’ From Institutional Investors.” Bitcoin News, 23 Nov. 2020, news.bitcoin.com/coinbase-20-billion-cryptocurrency-custody-institutional-investors/.

[8] “Crypto Hedge Fund ARK36 Partners with Coinify for Institutional Services.” Hedgeweek, 24 Nov. 2020, www.hedgeweek.com/2020/11/24/292625/crypto-hedge-fund-ark36-partners-coinify-institutional-services.

[9] Bourgi, Sam. “USDC Issuer Centre Lands Wall Street Veteran David Puth as CEO.” Cointelegraph, Cointelegraph, 1 Dec. 2020, cointelegraph.com/news/usdc-issuer-centre-lands-wall-street-veteran-david-puth-as-ceo.

[10] Irrera, Anna. “S&P Dow Jones Indices to Launch Cryptocurrency Indexes in 2021.” Reuters, Thomson Reuters, 3 Dec. 2020, www.reuters.com/article/cryptocurrencies-sp/sp-dow-jones-indices-to-launch-cryptocurrency-indexes-in-2021-idUSL1N2IJ0TG.

Sources

Chandler, Simon. “Institutional Investors Could Help Push Bitcoin to New Heights.” CryptoVantage, CryptoVantage, 14 Oct. 2020, www.cryptovantage.com/news/institutional-investors-dominate-crypto-market-heres-why-thats-bullish-for-bitcoin/.

“Are Institutional Investors Moving into Cryptocurrencies? – ET BFSI.” ETBFSI.com, 26 Oct. 2019, bfsi.economictimes.indiatimes.com/news/blockchain/are-institutional-investors-moving-into-cryptocurrencies/71770031.

“Guggenheim Opens Door to Bitcoin Exposure for $5 Billion Macro Fund via Grayscale’s GBTC.” CryptoZ News, Medium, 30 Nov. 2020, cryptozblog.medium.com/guggenheim-opens-door-to-bitcoin-exposure-for-5-billion-macro-fund-via-grayscales-gbtc-c30328a88c38.

Watkins, Jonathan. “The Institutional Crypto Backers: How Endowments Are Allocating to Cryptocurrency Investments.” GlobalCustodian, GlobalCustodian, The Trade Crypto, BitGo, Apr. 2019, www.globalcustodian.com/wp-content/uploads/2019/04/The-institutional-crypto-backers-How-endowments-are-allocating-to-cryptocurrency-investments.pdf.