Unlock the future of finance with Scalable digital wallet

Create best-in-class financial products with Scalable software. We deliver tailored solutions to meet your unique business needs and drive sustainable growth

Request demoOur partners

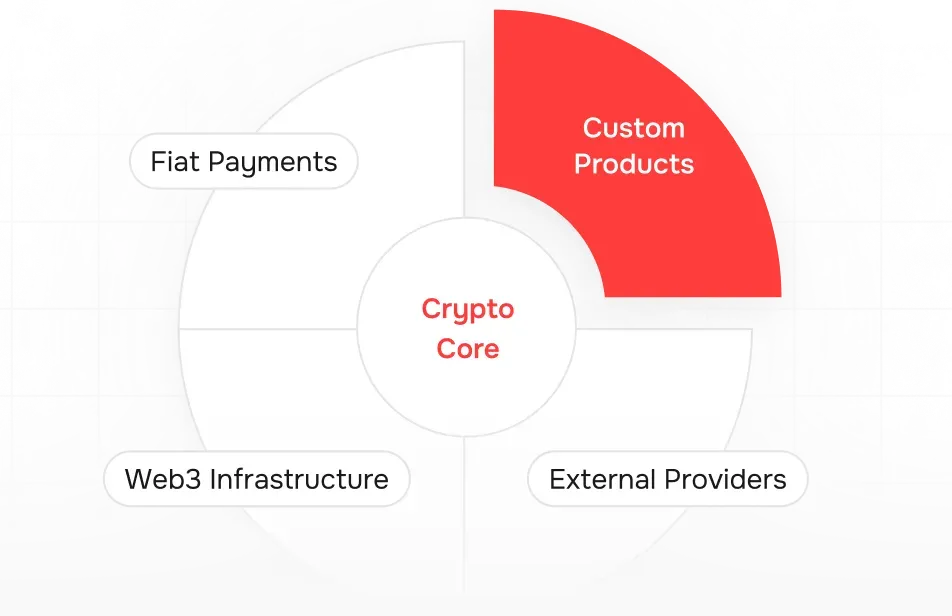

Combine the stability of traditional finance with the agility of blockchain

Manage digital assets. Mitigate risks. Deliver value to your customers

Crypto core

Modular infrastructure that enables banks and technology companies to build, launch, and scale crypto products

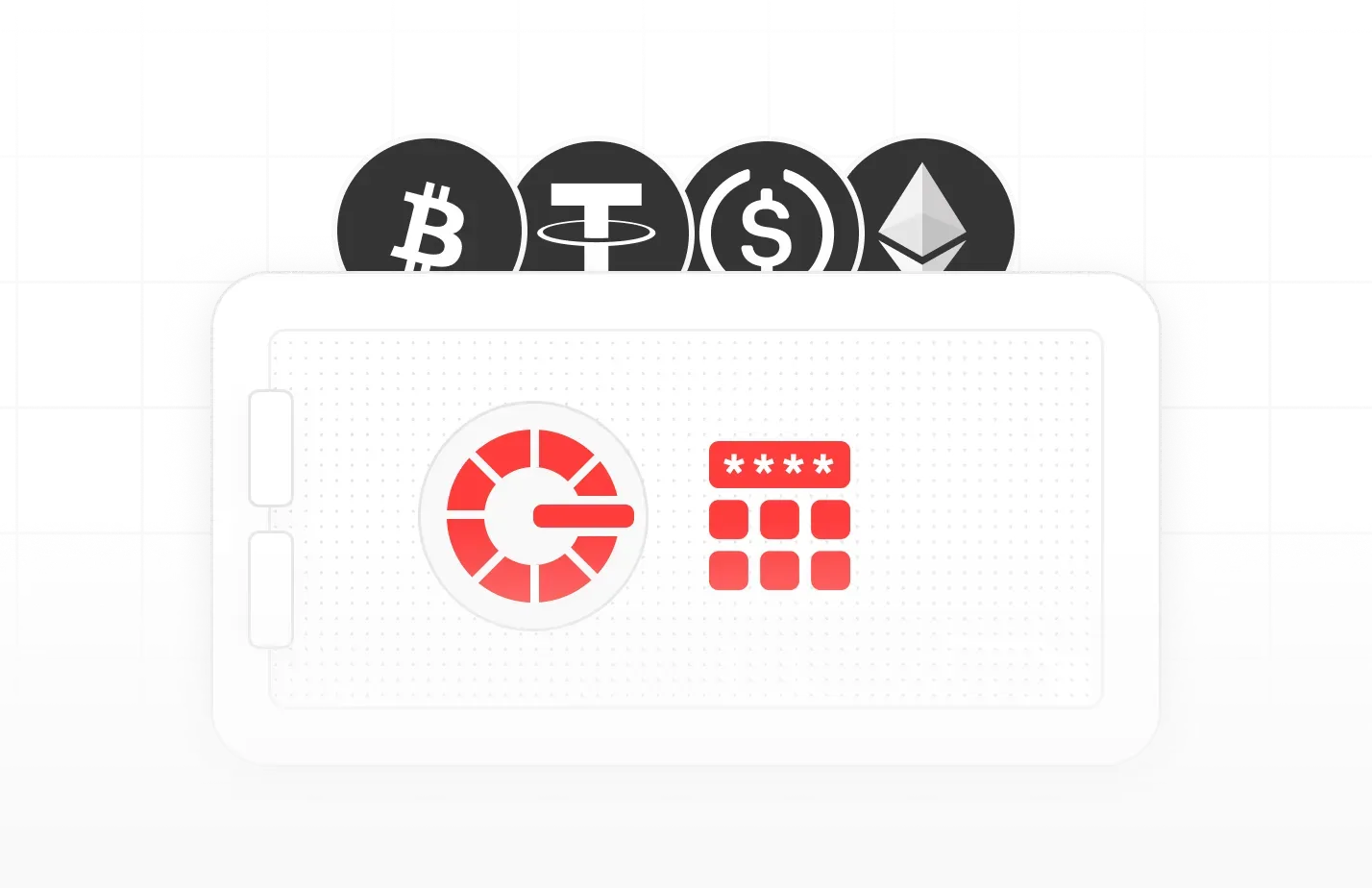

Custody Solution

Digital asset treasury solution that enables banks to provide custodial services to business and retail customers

Pro Exchange

World-class trading platform for all types of traders

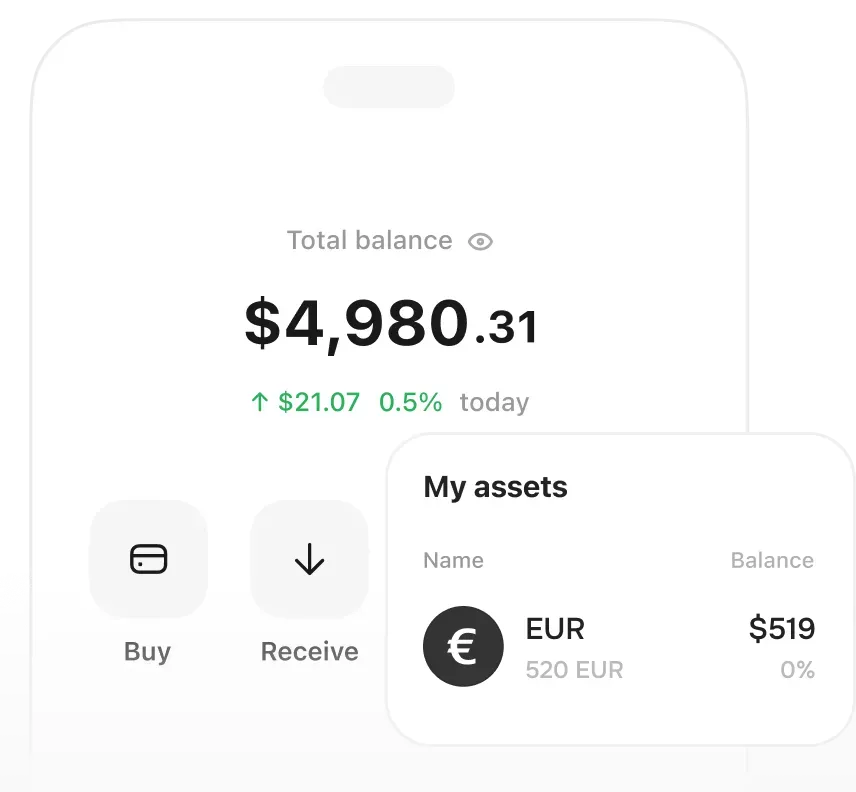

Digital Wallet

Secure, intuitive wallet for retail users, built with core banking functionality

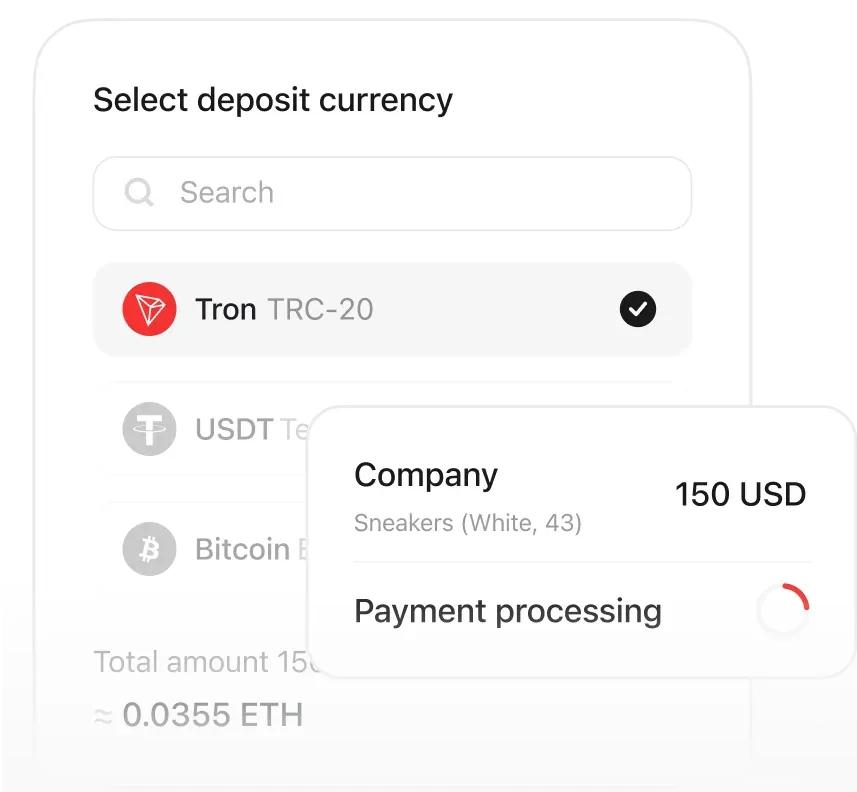

Payment Gateway

Payment processing solution that enables merchants to accept payments in crypto

Scalable helps with banking infrastructureweb3 infrastructuredigital asset custodysmart contract audit•digital asset securityasset tokenizationdigital product launch

The fastest way to market. With the lowest risk for you.

12

years of experience in financial technology

0

security breaches over 12 years

99.99%

uptime ensures uninterrupted operations

24/7

assistance to ensure your success

-1762327731182.png)

Looking to provide your clients with best-in-class digital asset products? There you have it

From day one to full implementation, our team of experts with 12 years of web3 technology experience will guide you to client success and revenue growth

Request demo