Crypto Custody: Should Institutions Build or Buy Their Custodial Solutions?

Why Crypto Custody Matters for Institutions

Crypto custody involves securing digital assets, ensuring regulatory compliance, and enabling efficient transactions while mitigating risks like hacks, fraud, and mismanagement. Unlike traditional finance, where custodians such as banks handle asset storage, crypto custody may require new models incorporating private key management, multi-signature setups, hardware security modules (HSMs), and multi-party computation (MPC) for cryptographic security.

Institutions entering the digital asset space must establish highly secure infrastructure that protects against private key compromises, unauthorized access, and regulatory breaches. Institutional-grade custody solutions often integrate hardware security modules (HSMs) for key storage, role-based access controls (RBAC), and real-time anomaly detection systems. Additionally, ensuring regulatory compliance under frameworks such as MiCA, Basel III, and SEC guidelines is essential for risk mitigation.

With the rise of institutional involvement in crypto, firms need to determine whether they should invest in developing in-house custody solutions or rely on established providers like this one.

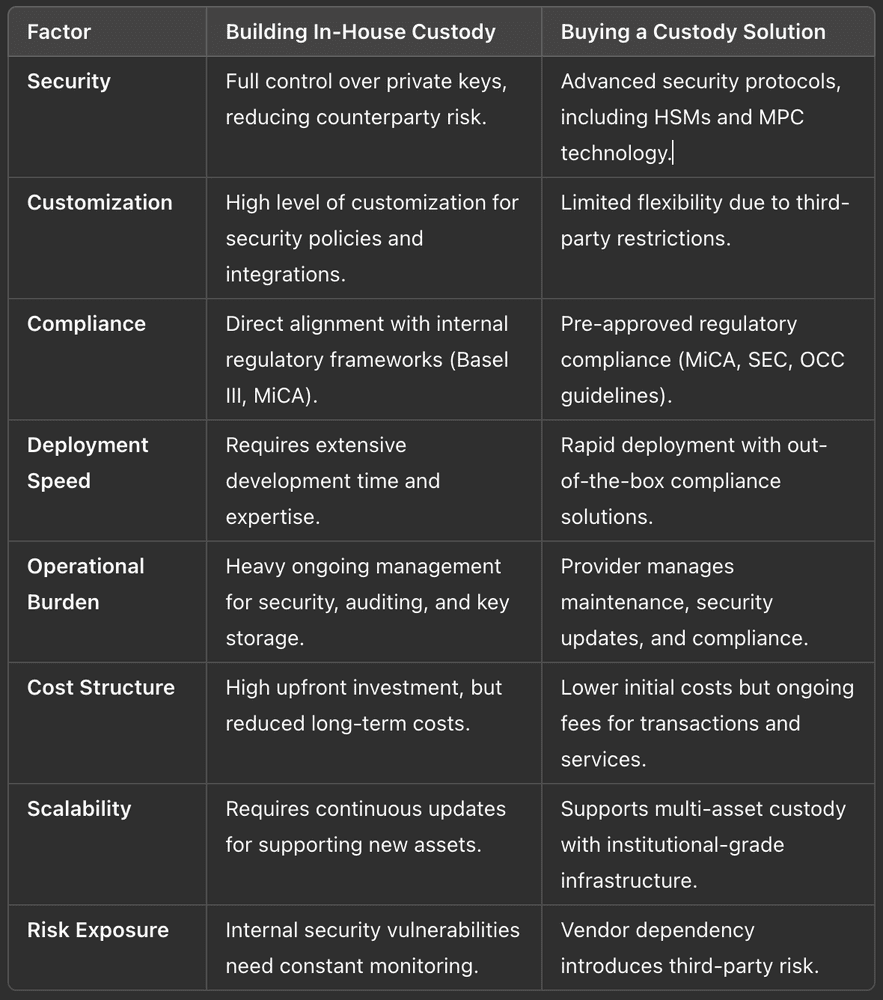

Build vs Buy: Key Considerations

To help institutions decide whether to build or buy a crypto custody solution, the following table summarizes the advantages and challenges of each approach:

Why Institutions Should Prioritize Buying Custody:

✅ Regulatory Compliance Made Easy –

Established providers are already licensed under MiCA, SEC, OCC, and FATF guidelines, eliminating the need for complex legal navigation.

✅ Advanced Security & Insurance –

Providers invest in cutting-edge HSMs, MPC wallets, and cybersecurity monitoring to protect assets beyond what most institutions can implement internally.

✅ Faster Deployment & Reduced Complexity –

Building an in-house solution can take years, while third-party custody offers instant, secure, and fully compliant solutions.

✅ Lower Total Cost of Ownership (TCO) –

Instead of managing expensive infrastructure and compliance teams, institutions can outsource custody with predictable pricing models.

✅ Scalability & Future-Proofing –

As new assets and blockchain networks emerge, buying a custody solution ensures seamless multi-asset and tokenized security support without needing continuous in-house upgrades.

While some financial institutions may consider developing their own custody infrastructure, the reality is that few have the technical expertise, security infrastructure, or regulatory resources to compete with established providers. Internal custody solutions are prime targets for cyberattacks, social engineering, and internal fraud. On top of that, building a secure custody solution requires millions in R&D and ongoing security audits.

It's always about money...

To put the decision into perspective, let’s break down the estimated costs of building an in-house custody solution versus using a third-party provider.

Cost Breakdown for In-House Custody

- Infrastructure & Security Development: $10M - $20M (HSMs, MPC, private key management, security audits)

- Compliance & Licensing: $2M - $5M (AML/KYC frameworks, regulatory approval, continuous audits)

- Ongoing Maintenance: $3M - $7M annually (security updates, risk assessments, compliance checks)

- Insurance & Risk Management: $1M - $3M annually (policy coverage for loss/theft prevention)

Total 3-Year Cost: $25M - $50M+

Cost Breakdown for Third-Party Custody

- Setup Fees: $100K - $500K (one-time integration cost)

- Custody Fees: 0.1% - 0.5% of assets under custody (AUC) (varies by provider and asset volume)

- Ongoing Compliance & Security: Handled by the custodian at no additional operational cost

Total 3-Year Cost (for $1B AUC): $3M - $7M

For most institutions, the cost savings of outsourcing custody are substantial. Building an internal custody solution can cost 5-10x more than partnering with a regulated provider. Moreover, third-party custodians handle compliance, security updates, and risk management, significantly reducing the operational burden and regulatory exposure on institutions.

I believe institutions benefit most from leveraging proven, secure infrastructure when considering custody operations. Building in-house is often resource-heavy and challenging, while relying on specialized technology ensures robust security, regulatory compliance, and the flexibility to scale as the market evolves.

Nik Gavrilov, Head of Commercial at Scalable Solutions

Regulatory frameworks can shift, making in-house solutions outdated or non-compliant. The best strategy for institutions? Leverage a regulated, secure, and scalable provider as a third-party custodian to ensure secure and compliant digital asset custody. Providers invest in cutting-edge HSMs, MPC wallets, and cybersecurity monitoring to protect assets beyond what most institutions can implement internally.

It's worth trying. Contact us - Scalable offers battle-tested solution and time-proven risk management tools to keep your funds safe.