Digital Wallet Security: How Banks Can Ensure Safe and Compliant Transactions

The Growing Importance of Digital Wallet Security in Banking

A multi-layered security approach is essential, combining end-to-end encryption (E2EE), adaptive authentication, and AI-driven fraud detection. Financial institutions must proactively address these risks to maintain trust and ensure compliance.

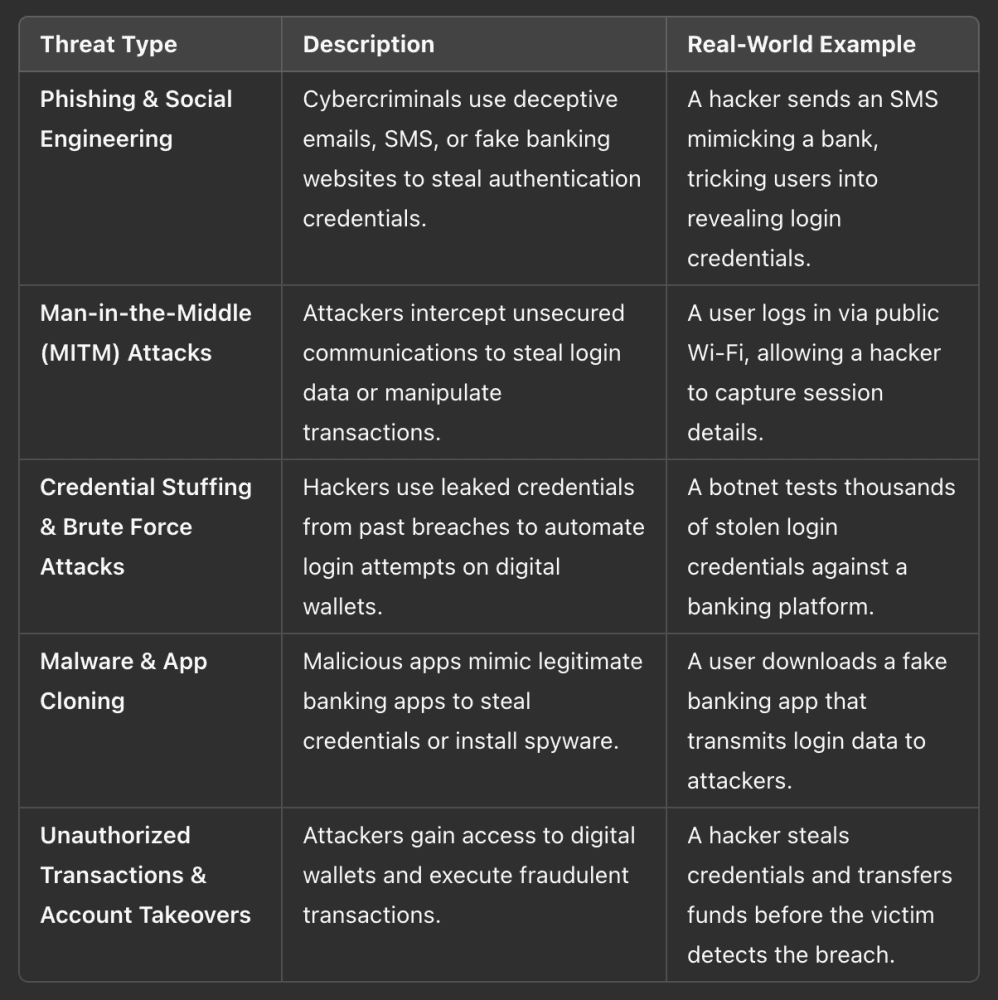

Key Security Threats in Digital Wallets and Mitigation Strategies

Digital wallets face multiple security threats that can compromise customer data and financial assets. The table below outlines key threats, their descriptions, and real-world examples demonstrating how they occur.

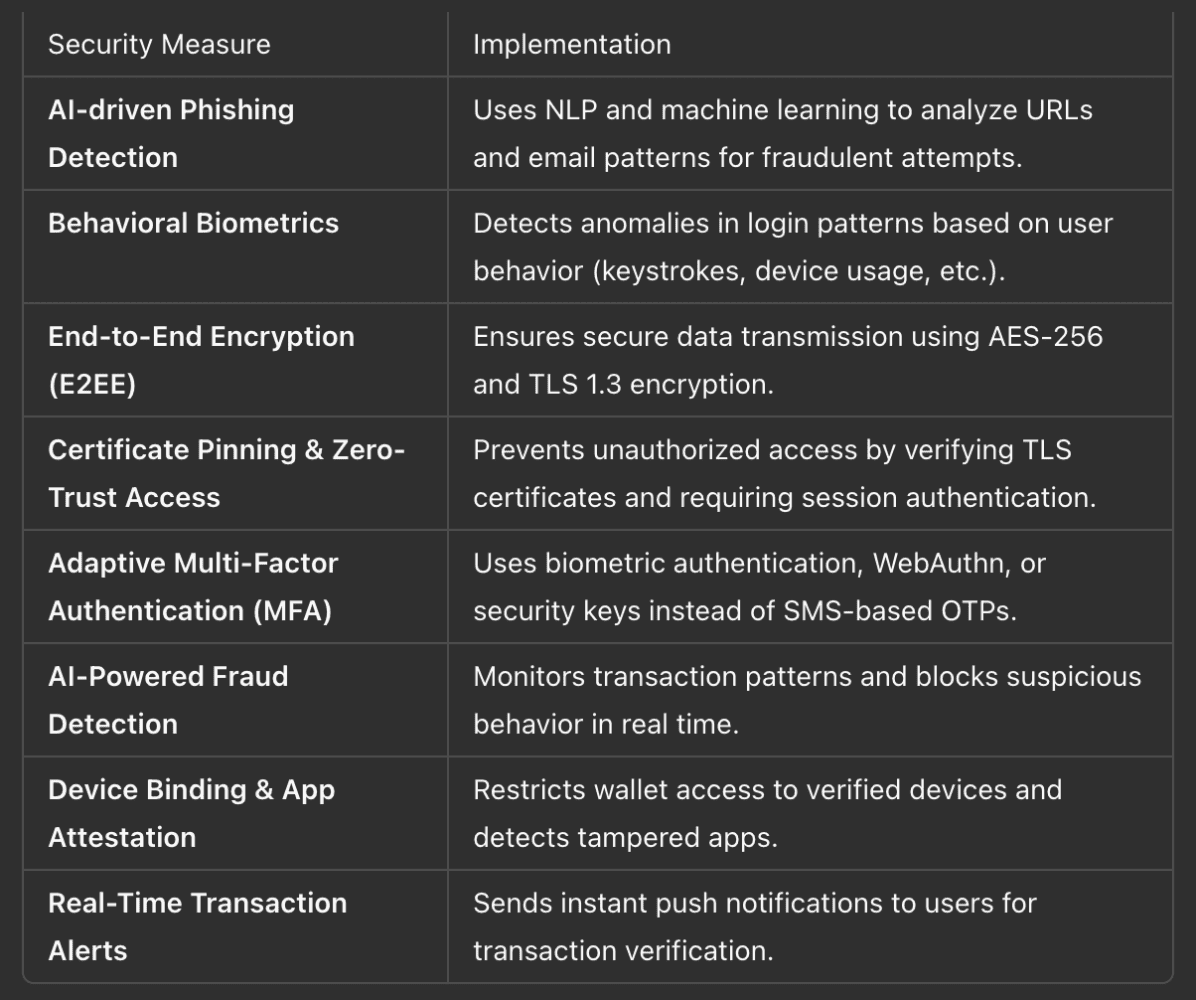

Prevention Strategies for Digital Wallet Security

To combat these threats, banks must implement strong security measures. The table below highlights effective prevention strategies and their implementations.

Advanced Security Measures for Digital Wallets

To ensure a resilient digital wallet ecosystem, banks must integrate cutting-edge security mechanisms:

End-to-End Encryption and Secure Key Management

Data encryption ensures sensitive information remains inaccessible to unauthorized entities. Hardware Security Modules (HSMs) provide secure key storage, reducing the risk of cryptographic key compromise.

Multi-Factor Authentication (MFA) Beyond OTPs

Traditional SMS-based OTPs are vulnerable to SIM swap attacks. Banks should implement:

- Biometric authentication (e.g., fingerprint, facial recognition)

- FIDO2 security keys for phishing-resistant authentication

- Passkeys and cryptographic challenge-response mechanisms

AI-Driven Fraud Detection and Risk Scoring

Machine learning models trained on transaction data can detect fraud patterns and automate threat mitigation.

- Federated learning ensures privacy-preserving AI model training across distributed banking infrastructure.

- Graph-based fraud detection uncovers hidden relationships between fraudulent transactions.

Regulatory Compliance and Data Protection

In Europe, digital wallets must comply with stringent financial regulations, including:

- PSD2 (Revised Payment Services Directive) – Mandates strong customer authentication (SCA) and enhanced fraud prevention.

- GDPR (General Data Protection Regulation) – Ensures secure data handling and user privacy protection.

- EBA Guidelines – Outlines risk management practices for financial institutions.

Scalable Solutions’ Digital Wallet: Product, Perfectly Tailored to Your Needs

Scalable Solutions' enterprise-grade digital wallet is engineered for secure, regulatory-compliant banking transactions.

Scalable Solutions' digital wallet is designed to provide secure and compliant digital asset management. Supporting over 150 blockchains, it enables seamless buying, selling, and conversion between cryptocurrencies and fiat. Security features include two-factor authentication, biometric login, and identity verification to protect user accounts.

The wallet also offers instant asset exchange, staking rewards, and integration with SEPA payment solutions for European clients. Its multi-platform accessibility ensures a consistent experience across web and mobile devices. Additionally, businesses benefit from robust back-office tools, CRM integrations, and real-time transaction monitoring to enhance security and user management.

At Scalable Solutions, we’ve seen first-hand how rapidly the digital wallet landscape is evolving. Security threats are becoming increasingly sophisticated, and regulatory requirements continue to tighten. This is exactly why we built our digital wallet solution—to empower banks with the most secure and compliant infrastructure, without sacrificing user experience. We believe that combining encryption, adaptive authentication, and fraud detection is no longer optional—it’s the new standard. Banks that embrace this approach will not only protect their customers but also unlock new growth opportunities in digital finance.

Nik Gavrilov, Head of Commercial at Scalable Solutions

Final Thoughts

As digital transactions continue to rise, security in digital wallets must remain a top priority for banks. Implementing encryption, multi-factor authentication, and AI-driven fraud prevention is crucial for safeguarding customer data and ensuring compliance with European regulations.

Scalable Solutions' Digital Wallet offers state-of-the-art security, seamless compliance, and frictionless user experiences—empowering banks to provide secure and innovative financial services.

👉 Discover how Scalable Solutions’ Digital Wallet can enhance your bank’s security and compliance today. Learn More