Crypto Payment Gateway for SMB Banks

Modern SMBs expect crypto payment options. Enable your business clients to accept crypto under your bank's brand with a turnkey andwhite-label gateway

Request demoFaster onboarding

New fee revenue

Higher product stickiness

Key benefits for your bank

New revenue stream

Transaction and service fees from crypto acceptance

Client acquisition & retention

Attract tech-savvy SMEs and marketplaces

Bank-branded experience

Your UI, your support, your risk policies

Faster onboarding

Digital KYC flows and role-based access for merchant teams

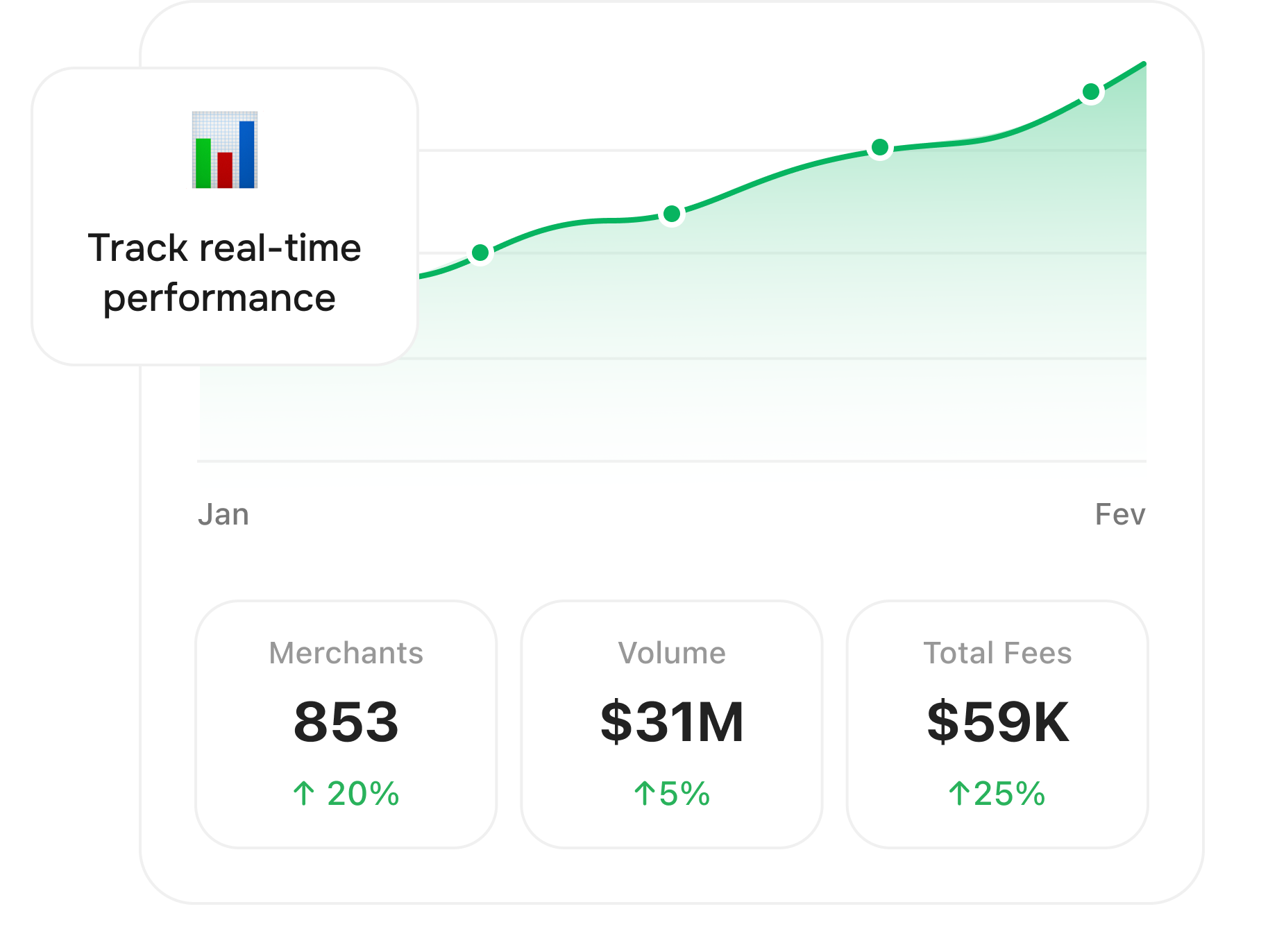

Actionable data

Payment and payout analytics for cross-sell and risk detection

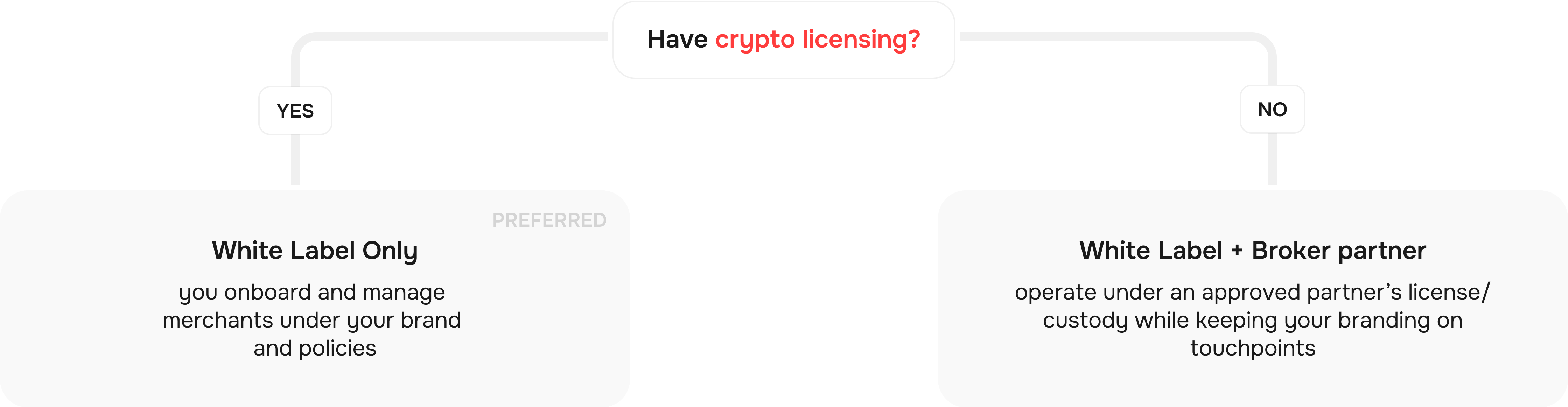

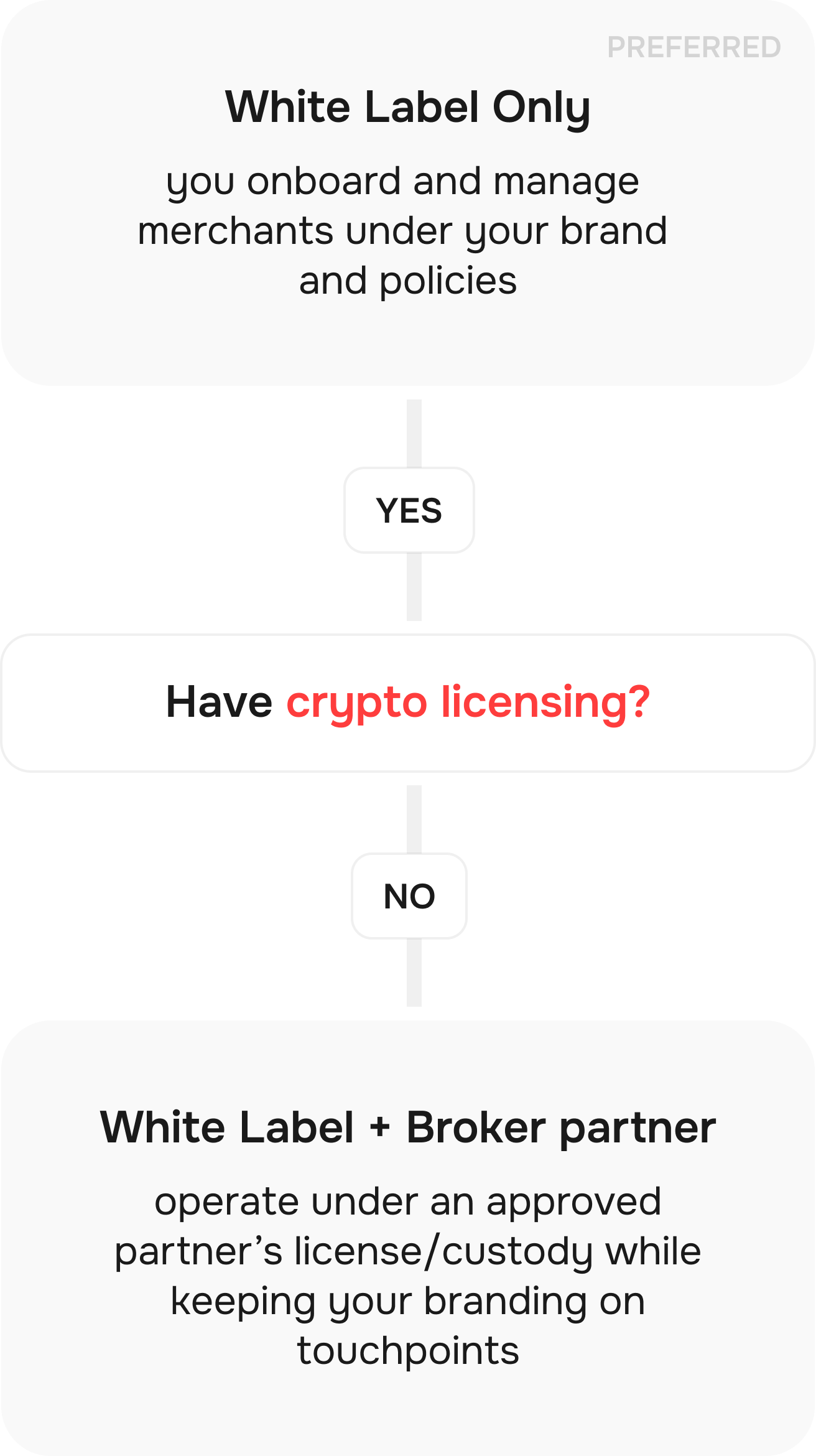

Launch options

Run under your brand or via an approved broker partner

How it works

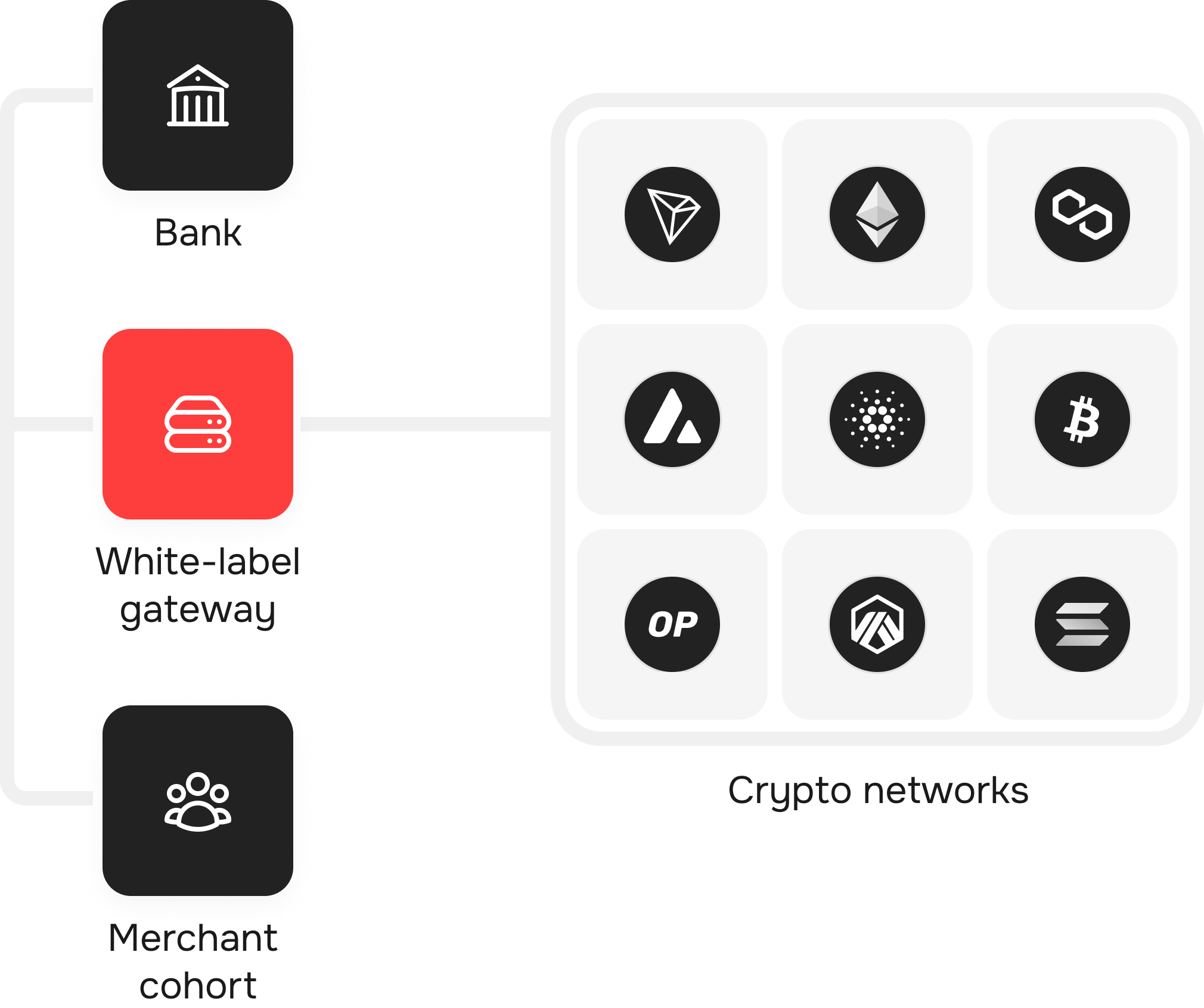

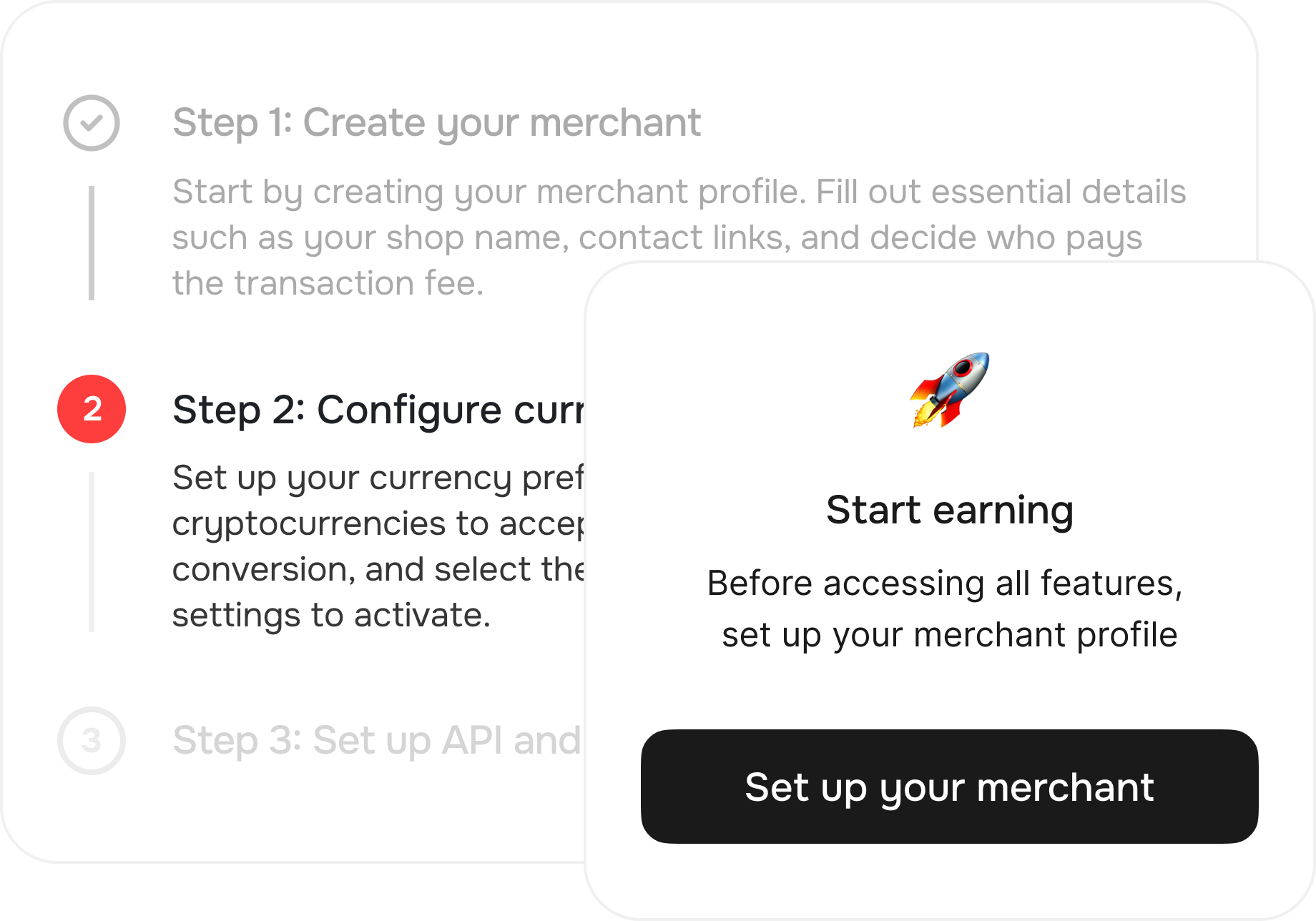

Set up custody and compliance

Then choose a KYT/AML provider from our partner network to automatically screen every transaction and ensure compliance from day one.

Customize and brand your gateway

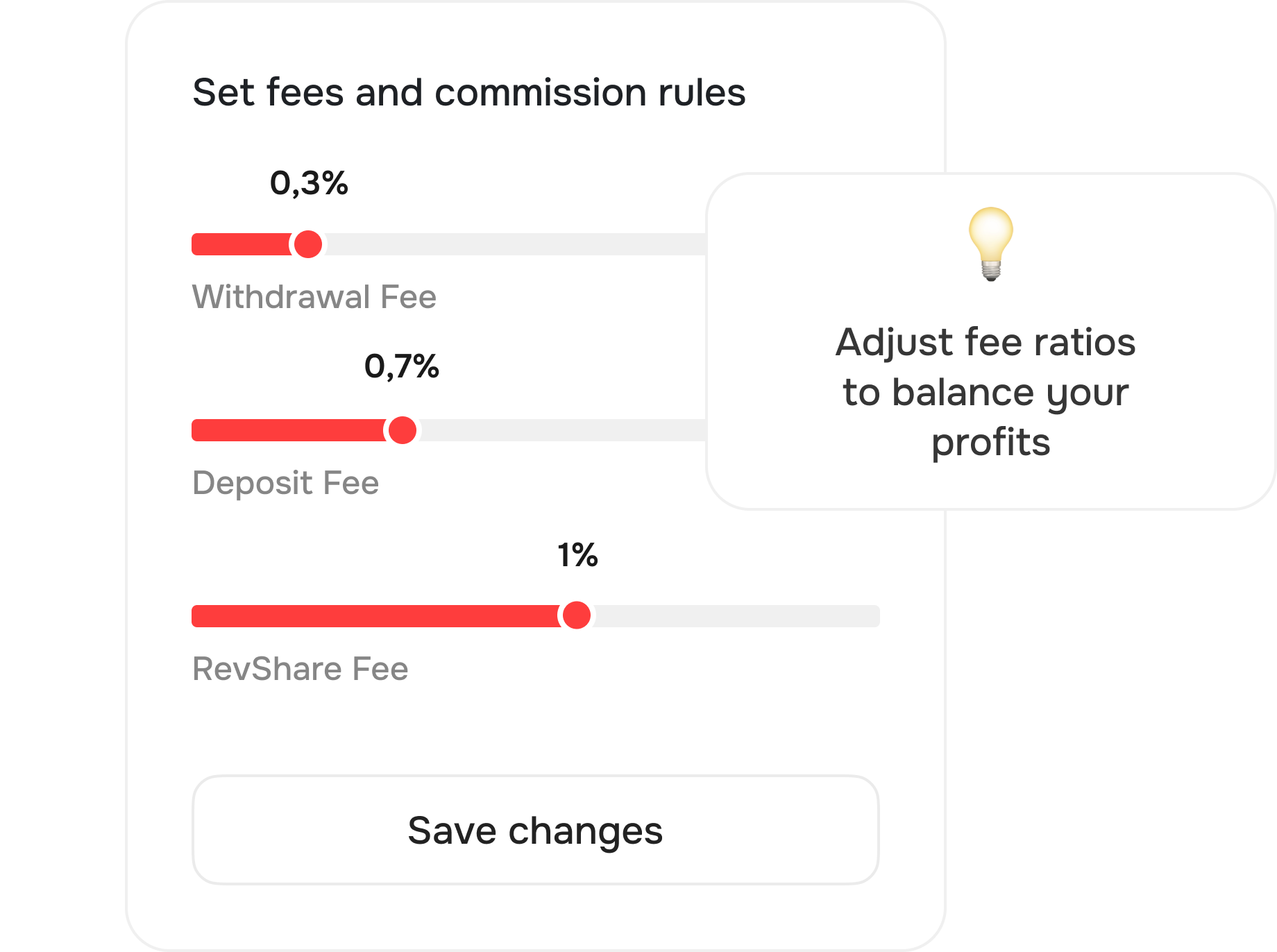

Define your pricing model

You can combine fixed and percentage fees, per-merchant pricing tiers, to balance profitability with competitive pricing.

Onboard merchants

Go live

You get transparent monitoring, operational visibility, and a new revenue stream from every processed transaction.

Start accepting crypto payments under your bank’s brand

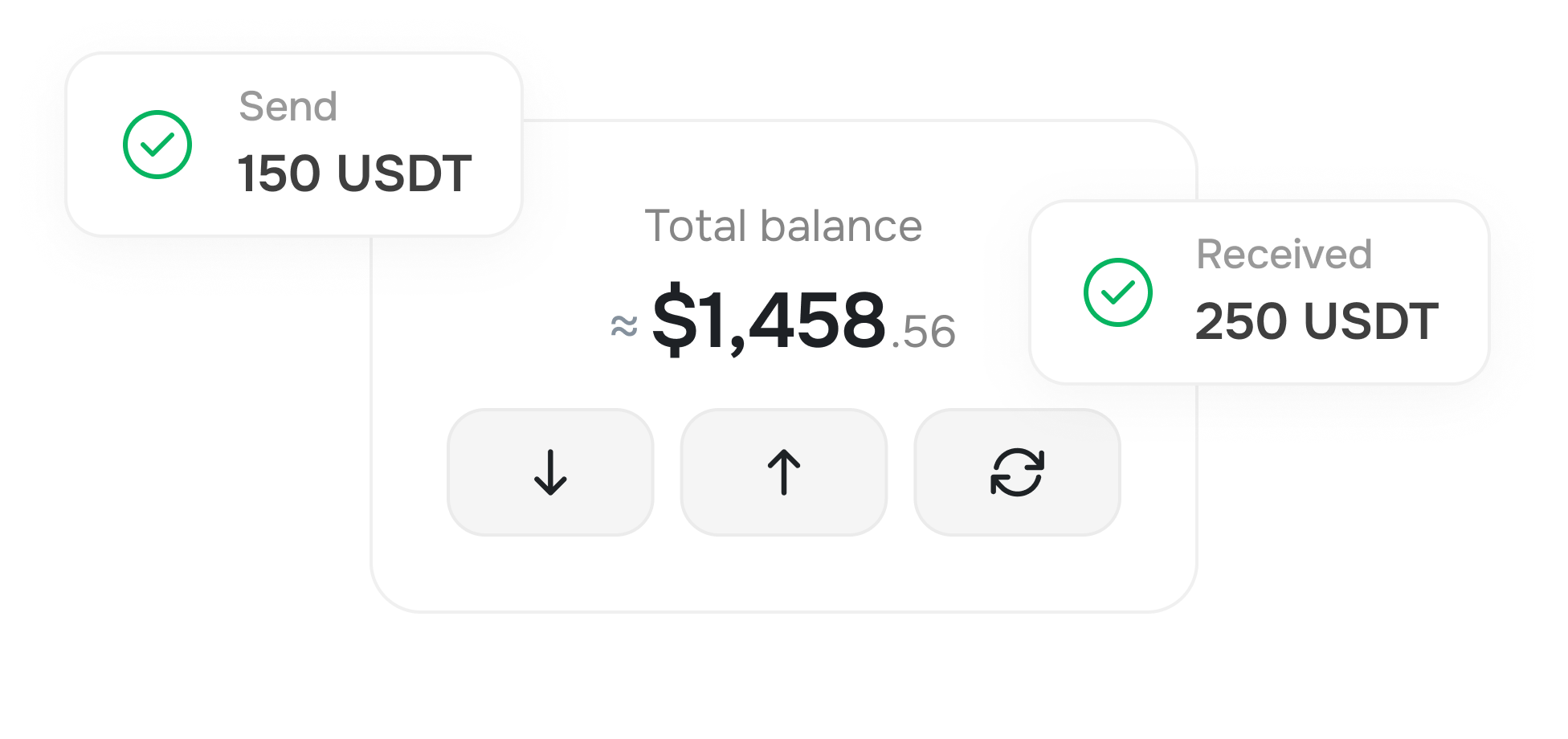

Request demoAdvanced Treasury & Merchant Features

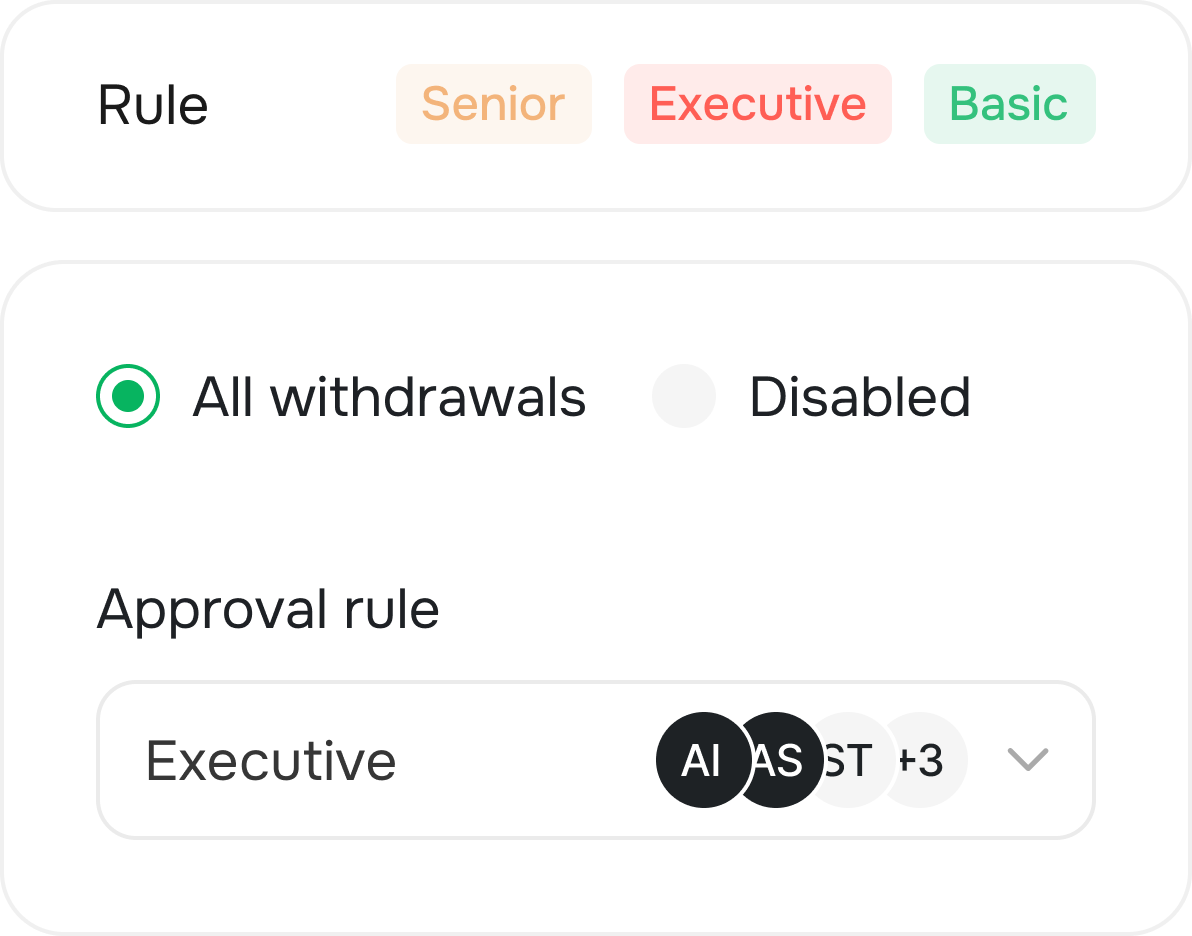

Multi-level withdrawal approvals

Policy-based, multi-sig-like workflows with customizable roles and quorum

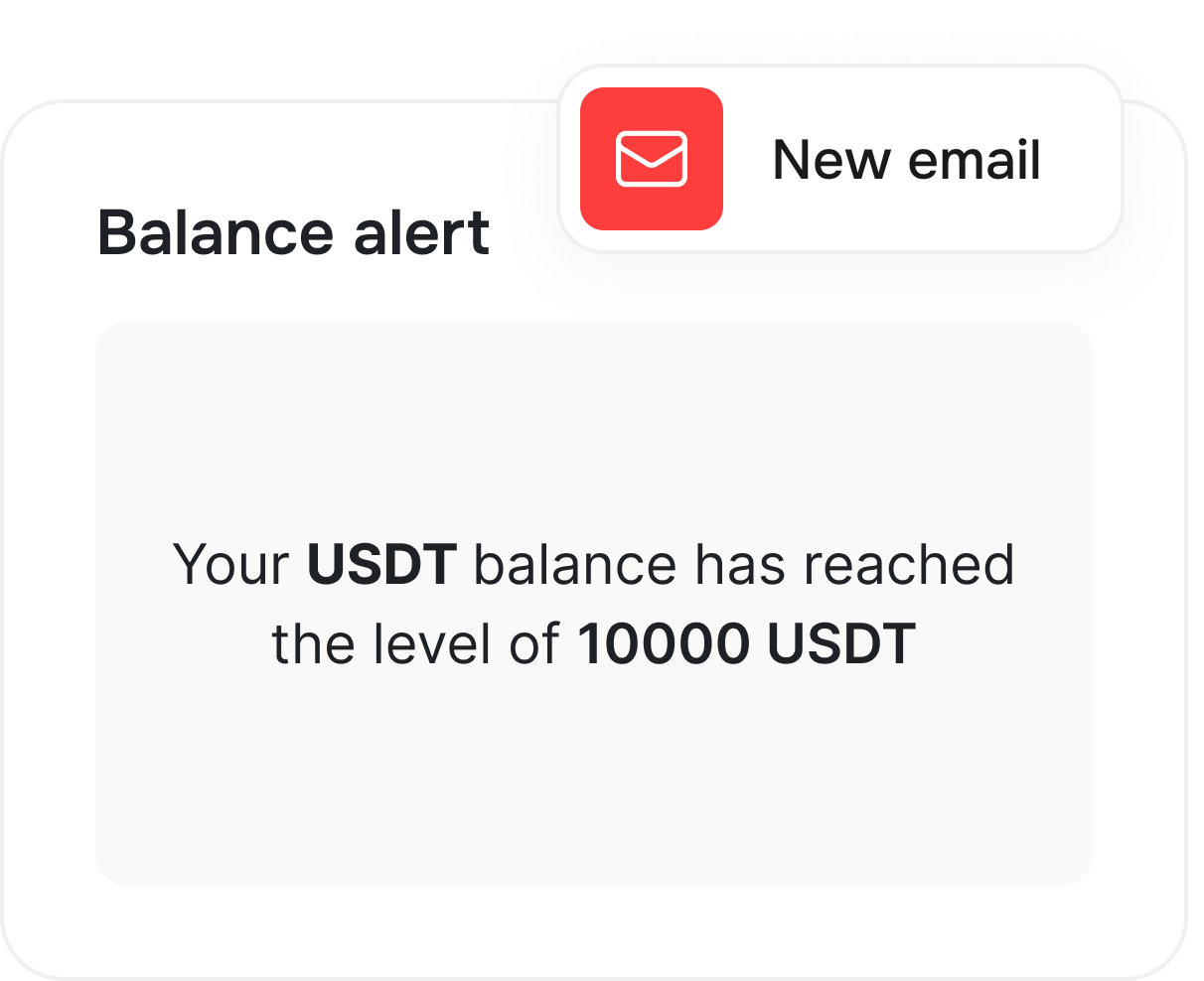

Automated balance warnings

Per-wallet thresholds; email + webhooks to prevent failed payouts

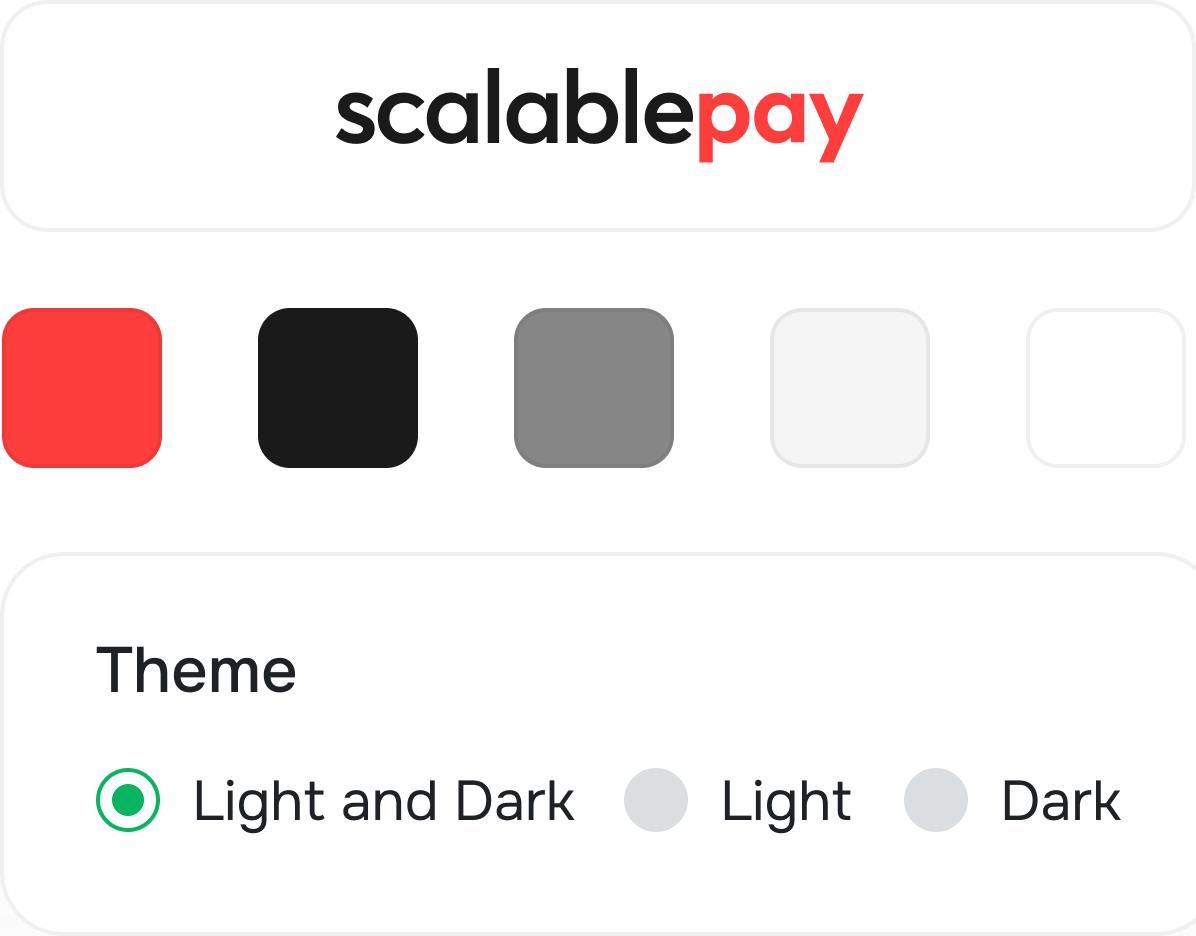

Customizable checkout & branding

Logos, colors, allowed coins, and payment instructions per merchant

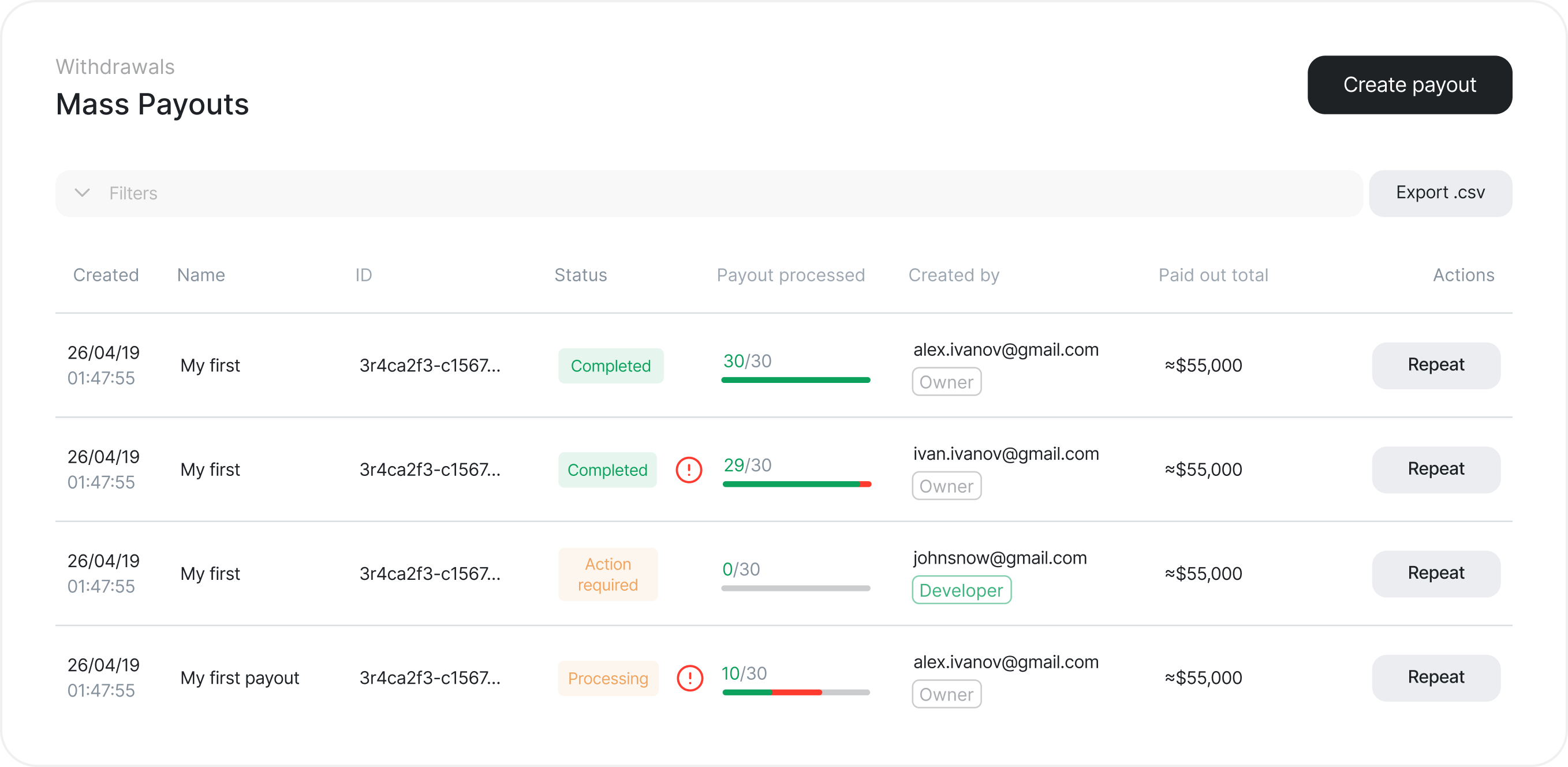

Mass payouts

Upload list or API; batch disbursements to employees, affiliates, suppliers

As well as

Direct crypto top-ups

Merchants fund operational balances instantly on-chain

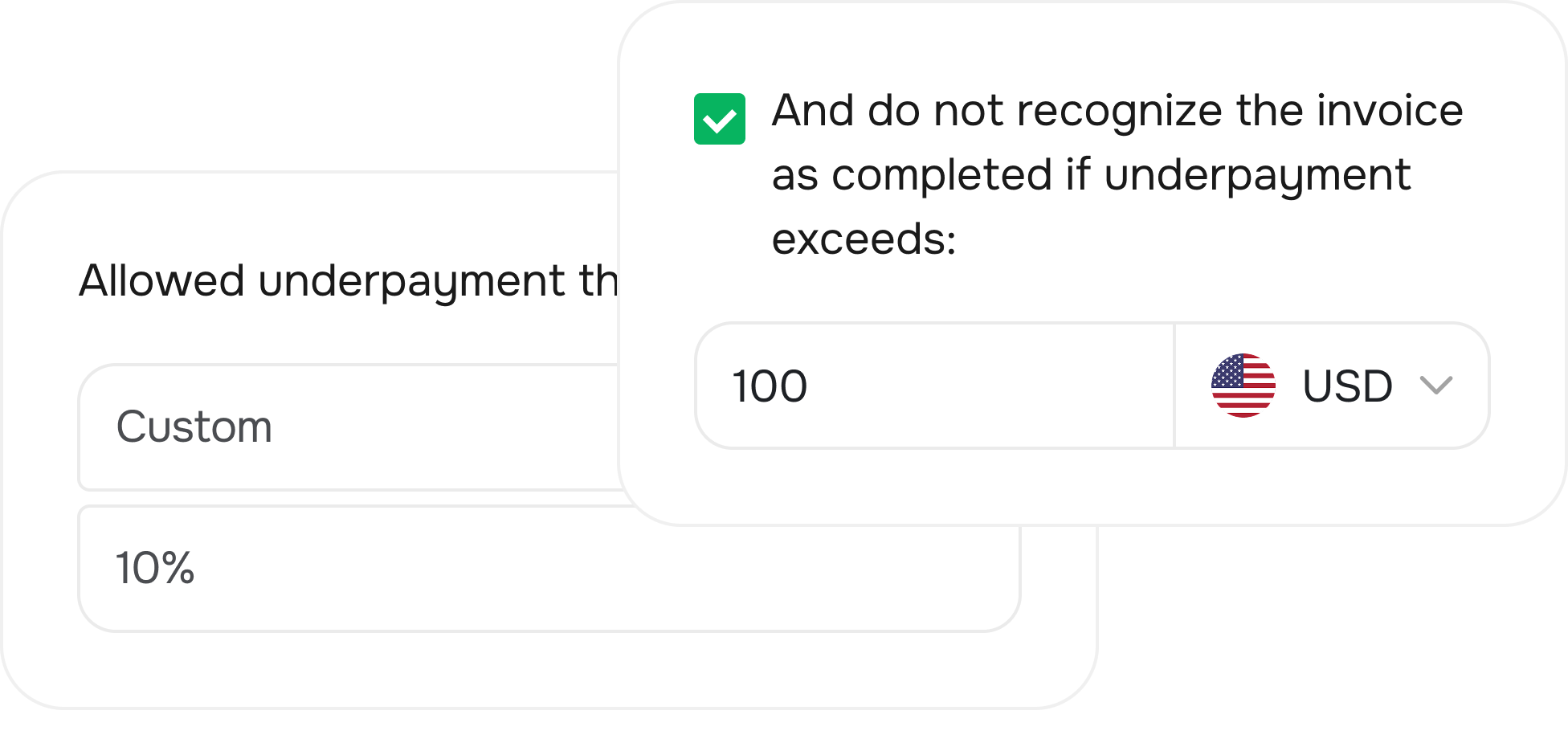

Over/Underpayment handling

Merchant-side tools to resolve discrepancies without support tickets

Security & Compliance

Two-Factor Authentication

All admin and merchant accounts require 2FA to ensure secure access for actions and logins

KYT & AML Screening

All transactions — both incoming and outgoing — are automatically screened using configurable KYT risk scoring and AML checks

High Availability

The platform delivers 99.99% uptime, ensuring continuous, reliable payment processing even during peak usage

Custody-Level Security

Combines MPC (Multi-Party Computation) and HSM (Hardware Security Modules) for advanced key protection and zero-trust architecture

Withdrawal Controls

Outgoing transfers are protected via withdrawal whitelisting and multi-signature approval workflows, preventing unauthorized transfers

Role-Based Access Control

Only authorized users can perform sensitive actions, reducing risk and ensuring compliance

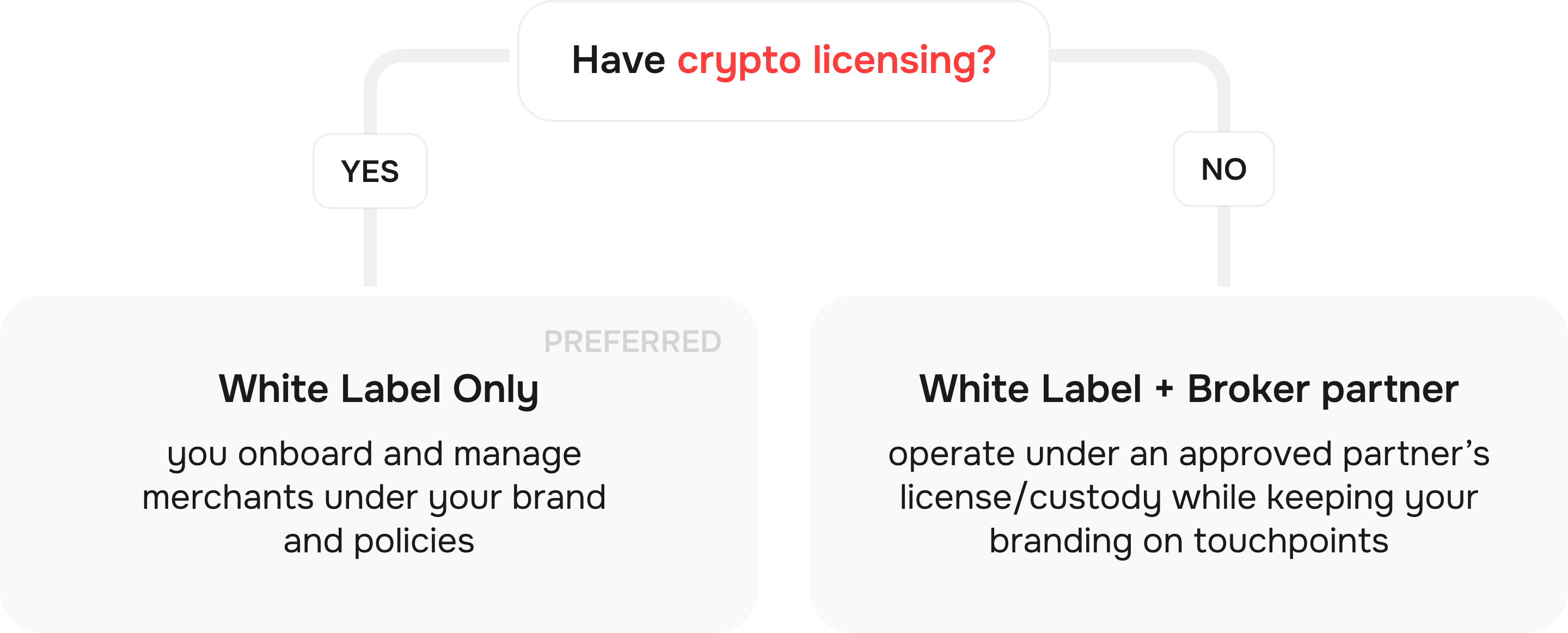

Integration models

12+

years of experience in financial technology

0

security breaches over 12 years

24/7

assistance to ensure your success

99.99%

uptime ensures uninterrupted operations

Launch and scale your bank-branded crypto payment solution

Empower your business clients to accept digital assets with a turnkey, white-label solution

Request demoReady to work with us?

Our experts are here to help