Regulatory Compliance for Custody Solutions: What Bank Executives Should Know

Introduction

Regulatory compliance for digital asset custody is essential for banks entering the digital finance market. As digital assets become more popular, regulations are getting tougher, and failing to comply can lead to big financial and reputational risks.

Global regulators, including the SEC, MiCA, and FATF, set clear rules on anti-money laundering (AML), know your customer (KYC), data protection, and securities laws. Bank executives need to understand these changing regulations to avoid problems and turn compliance into a competitive edge.

This article covers the main compliance requirements, technical challenges, and best practices to help financial institutions set up strong custody solutions while staying compliant and driving business growth.

Understanding Custody Solutions in Finance

Custody solutions help banks and financial institutions securely store and manage digital assets. These solutions come in three main types:

- Custodial Solutions: The provider holds and manages digital assets on behalf of the client, offering convenience but with less control for the client.

- Non-Custodial Solutions: Clients maintain control of their assets, with the provider offering tools for secure management, ideal for users who prioritize ownership and security.

- Hybrid Models: Combine elements of both custodial and non-custodial solutions, providing flexibility based on user needs.

Custody solutions are crucial for safekeeping, transaction management, and ensuring regulatory compliance. They involve key players like banks, fintech companies, regulatory bodies, and technology providers, all of whom must collaborate to meet compliance standards.

Key Regulatory Bodies Governing Digital Asset Custody

United States: Key regulators include the SEC, CFTC, FINRA, and OCC.

Europe: The MiCA framework, along with the EU-wide regulators ESMA, EBA and BaFin (Germany), and the FCA (UK).

Asia-Pacific: Authorities such as MAS in Singapore, FSA in Japan, and ASIC in Australia.

Global Organizations: International bodies like FATF, BIS, IOSCO, and the IMF provide overarching guidelines that influence national regulations, particularly around anti-money laundering and compliance practices.

Banks must first identify potential risks, including operational errors, cybersecurity threats, and possible regulatory breaches. Regular audits, both internal and external, are necessary to validate compliance with regulatory requirements and pinpoint areas for improvement. Utilizing risk assessment frameworks like COSO and ISO 31000 helps banks systematically evaluate and manage risks.

Legal Frameworks and Compliance Requirements

If a digital asset is considered a security under SEC regulations, banks must follow specific custody rules, including asset segregation and reporting requirements.

Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations are also fundamental. These require banks to verify customer identities and monitor transactions to prevent financial crimes. Strict adherence to AML and KYC protocols not only helps avoid legal issues but also supports overall financial integrity.

Custody-specific regulations such as the SEC’s Rule 206(4)-2, known as the Custody Rule, mandate that custodians maintain customer assets separately from their own and undergo regular audits to ensure transparency and security.

Data protection laws like the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the U.S. set strict standards on how banks must handle and store customer data securely. These regulations emphasize data privacy and mandate strong data management practices within custody solutions.

Ensuring compliance with the Financial Action Task Force (FATF) Travel Rule requires financial institutions to share specific information about customers when transferring digital assets between entities, enhancing transparency and reducing the risk of illicit activities.

The Basel III and IV frameworks, primarily focused on risk management and capital requirements for financial institutions, also impact digital asset custody by setting standards for how banks must manage liquidity and operational risks associated with digital assets.

Finally, banks must navigate complex tax reporting requirements under the Common Reporting Standard (CRS) and the Foreign Account Tax Compliance Act (FATCA). These regulations require financial institutions to report account information accurately to tax authorities, ensuring compliance with international tax laws and avoiding penalties.

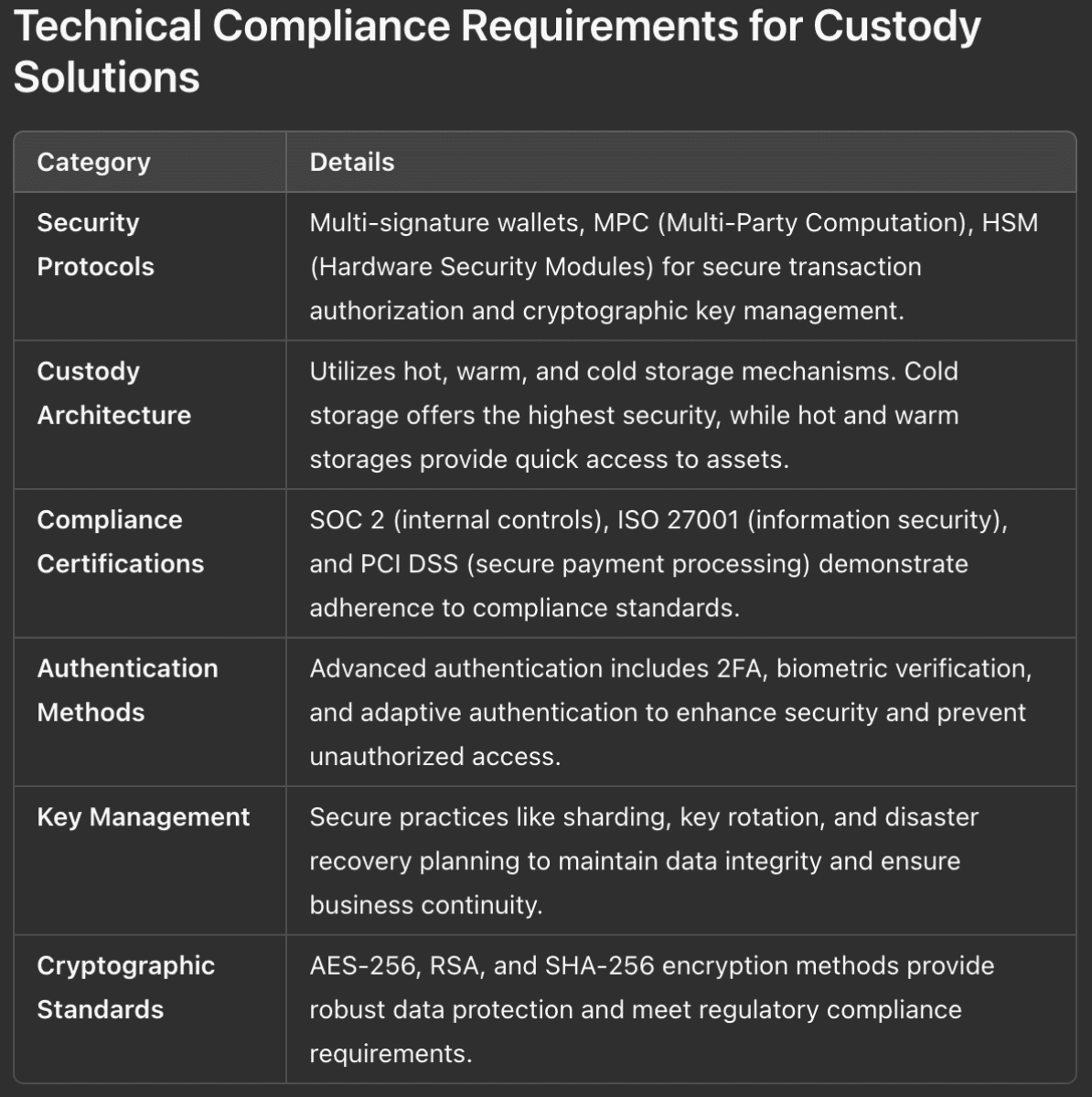

Technical Compliance Requirements for Custody Solutions

The essential part for any custody process implementation. The table below shows most important aspects of these requirements:

Banks must also develop strong internal controls, including implementing risk assessment frameworks and conducting regular audits. Incident response strategies aligned with regulatory requirements are also vital. These strategies include clear protocols for detecting and responding to security incidents, ensuring quick recovery, and maintaining transparent communication with regulatory bodies to avoid penalties and reputational damage.

“The era of operating without a license is over. Today, if a project enters a specific jurisdiction, it must comply with local regulations. This means that operating from offshore locations is no longer a viable option. Compliance now extends to adhering to established standards, including AML and other regulatory requirements.” - Adam Berker, Head of Legal at Scalable Solutions.

Best Practices for Achieving Compliance

Developing a robust compliance strategy that integrates business goals ensures that regulatory requirements are met without hindering growth. Building strong partnerships with legal and regulatory advisors helps banks stay informed about legal changes. Finally, continuously monitoring regulatory updates and adapting compliance practices is key to staying ahead of evolving regulations.

RegTech solutions automate compliance tasks, reducing manual errors and enhancing efficiency. Blockchain technology offers transparency and traceable transaction records, aiding regulatory reporting. Artificial Intelligence (AI) and machine learning tools support compliance by detecting anomalies and monitoring transactions in real-time. Smart contracts can be utilized to automate compliance checks during digital asset transactions, ensuring that regulatory conditions are consistently met.

Future Trends in Regulatory Compliance for Custody Solutions

The regulatory landscape for digital assets is expected to evolve with new laws and guidelines shaping custody solutions. Banks must prepare for these changes by adopting flexible compliance strategies and staying informed about potential regulatory shifts. Global regulatory bodies are likely to have a stronger influence, promoting standardization across jurisdictions. This trend may lead to the development of a unified regulatory framework for digital assets, simplifying compliance and enhancing security in digital finance.