While the discussion on digital asset adoption and regulatory framework is a nuanced one that requires a continuous update, it is time to set a temporal hiatus to the review on Latin American countries. On this occasion, we have chosen to close this series by analyzing a special case – that of digital asset adoption in Colombia.

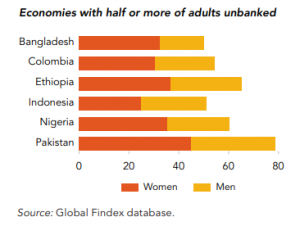

Financial inclusion in Colombia

According to the World Bank, there is a significant portion of the population in Colombia that is not part of the traditional financial system. Only 46% of Colombian adults have a bank account, which leaves a great deal of opportunity for fintech start-ups. While ~84% of Colombians have had access to some kind of financial product in their lives, it is believed that only 30% of them use it regularly. Given this situation, the Colombian government launched a National Development Plan accompanied by a regulatory sandbox that allows fintech companies to obtain temporary certificates to experiment with business models without meeting all the requirements of a traditional financial services license [1].

Source: Global Findex database [2].

Digital asset adoption in Colombia

As may be expected, digital asset adoption has been gathering momentum and gaining ground in Colombia for some years now. The main difference is based on the relative growth rate it has had when compared to similar economies. While currently in the 11th place of Chainalysis’ Global Crypto Adoption Index, it peaked a year before, ranking ninth [3][4].

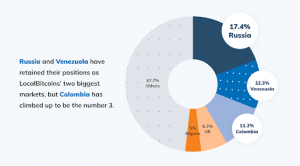

According to LocalBitcoins – the world’s largest peer-to-peer Bitcoin marketplace and proxy to cryptocurrency adoption- Colombia has climbed to reach the third biggest global Bitcoin volume, with a 11.3% of total volume – only behind Russia (17.4%) and Venezuela (12.3%), effectively taking the second place on the regional LATAM podium.

Source: Biggest Markets of LocalBitcoins in 2020 [5].

Strangely enough, this adoption does not translate into special digital asset uses, such as the eminent DeFi; for instance, Colombia does not even appear in the top 20 Global DeFi Adoption Index [6]. We can therefore infer that Colombia is primed and ready to tap into actual use-cases of digital assets, besides treating them as a typical investment asset class.

Digital asset regulatory framework in Colombia

While its Central Bank declared that cryptocurrencies are not considered as currency or legal tender, Colombia’s law structure has failed to provide a clear classification of cryptocurrencies.

Colombia’s digital asset tax framework:

Currently, the tax framework is unclear and contradictory, as various Colombian agencies disagree as to how cryptocurrencies should be taxed. Depending on the entity, digital assets can be considered as material goods, intangible assets, or simply considered valueless. Therefore, these differences of opinion between Colombian agencies have provided a blurred tax framework for cryptocurrencies [7].

Attempts at inclusion and regulation in Colombia

By January 2021, Colombia’s SFC announced a yearlong project to test new capabilities and possible implementations of digital assets within the financial industry. Furthermore, nine digital asset firms (out of 14) were chosen to test banking services for cryptocurrency platforms. According to the announcement, the goal of the pilot was firstly to allow fintech firms and the national government to safely test cryptocurrency use cases under the regulatory sandbox [8].

Banks will be working with digital asset platforms to test on/off ramps for deposits and withdrawals, but won’t touch any cryptocurrencies. The main objective is for all participating authorities to be able to measure the effectiveness of recent technological developments in verifying digital identity, as well as traceability in transactions within the scope of their assigned powers in the current framework.

AML/CFT

According to subsection 4.2.6 of the AML/CFT circular published on December 2020 [9], digital asset companies fall within the scope of application of the Comprehensive Risk Management and Self-Control Regime LA/FT/FPADM, and have to carry out a series of processes – including but not limited to:

- Intensified due diligence,

- Alerts for unusual and suspicious activities,

- Educate employees on current regulations,

- Report to the UIF on KYC/KYT, etc.

Conclusion

Similar to several sister countries in the region, Colombia has been fighting for a while now with low financial inclusion rates, thus enabling the scene for financial technology companies to flourish. With an implementation of a comprehensive regulatory framework, digital assets could follow a similar path – and carry out a social and economic revolution in the country.

Hence, we sum up our chapter on LATAM digital asset adoption and regulatory framework, and turn our attention to new regions.

We welcome you to follow our socials for updates and more information, and subscribe to not miss any news!

References

[1] “Fintech in Colombia.” CMS Expert Guide, 31 Mar. 2021, cms.law/en/int/expert-guides/fintech-in-latin-america/colombia.

[2] Asli Demirgüç-Kunt, Leora Klapper, Dorothe Singer, Saniya Ansar, Jake Hess, The Global Findex Database 2017: Measuring Financial Inclusion and Opportunities to Expand Access to and Use of Financial Services, The World Bank Economic Review, Volume 34, Issue Supplement_1, February 2020, Pages S2–S8, https://doi.org/10.1093/wber/lhz013

[3] Chainalysis (2020). The Chainalysis 2020 Geography of Cryptocurrency Report. Chainalysis. Available at: https://go.chainalysis.com/rs/503-FAP-074/images/2020-Geography-of-Crypto.pdf

[4] Chainalysis (2021). The Chainalysis 2021 Geography of Cryptocurrency Report. Chainalysis. Available athttps://blog.chainalysis.com/reports/2021-global-crypto-adoption-index.

[5] LocalBitcoins. “These Are the Biggest Markets Of LocalBitcoins in 2020.” Medium, LocalBitcoins Blog, SatoshienVenezuela, 8 Dec. 2020, blog.localbitcoins.com/these-are-the-biggest-markets-of-localbitcoins-in-2020-6ef07bf3f4c8.

[6] Chainalysis (2021). The Chainalysis 2021 Global DeFi Adoption Index. Chainalysis. Available at https://blog.chainalysis.com/reports/2021-global-defi-adoption-index.

[7] Freeman, Jason B. “Colombia and Cryptocurrency.” Freeman Law, 19 July 2021, freemanlaw.com/cryptocurrency-blockchain/colombia/.

[8] Handagama, Sandali. “Colombia’s Crypto Use Soars, and Local Regulators Step In.” CoinDesk, 30 Apr. 2021, www.coindesk.com/policy/2021/04/30/colombias-crypto-use-soars-and-local-regulators-step-in/.

[9] Superintendencia de sociedades. Circular externa 100-000016 24 Dec. 2020. Available at: https://www.supersociedades.gov.co/nuestra_entidad/normatividad/NormatividadCircularbasicaJuridica/Circular_100-000016_de_24_de_diciembre_de_2020.pdf

Sources

Handagama, Sandali. “’No Middle Ground’: Inside Colombia’s Race to Become a Major Regional Crypto Market.” CoinDesk, 13 Jan. 2021, www.coindesk.com/markets/2021/01/13/no-middle-ground-inside-colombias-race-to-become-a-major-regional-crypto-market/.

Colombia

Colombia Argentina

Argentina Brazil

Brazil Mexico

Mexico