Future-Proofing Digital Asset Infrastructure: Launch Compliant Services in Weeks

Future-Proofing Digital Asset Infrastructure: How Financial Institutions Are Launching Compliant Services in Weeks, Not Years

The digital asset revolution is no longer a question of "if" but "when" for traditional financial institutions.

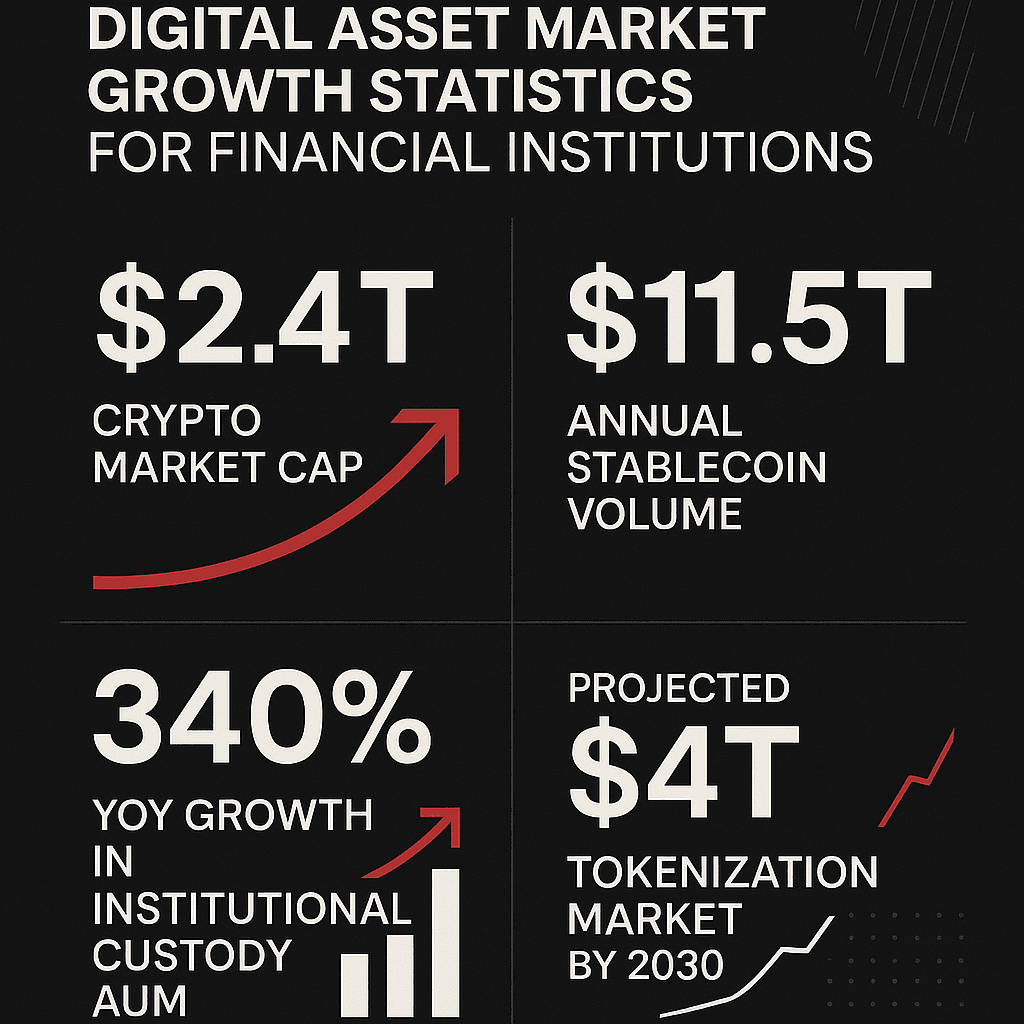

With the global cryptocurrency market capitalization exceeding $2.4 trillion and stablecoin transaction volumes reaching $11.5 trillion annually, forward-thinking banks, asset managers, and fintech companies are racing to capture their share of this massive opportunity.

However, the path to launching digital asset services has traditionally been fraught with regulatory complexity, technical challenges, and operational risks that can extend implementation timelines to years rather than months.

This reality is changing rapidly as modular infrastructure solutions emerge, enabling institutions to deploy enterprise-grade digital asset services in weeks, not years.

According to recent industry analysis, institutions using modular infrastructure platforms reduce their time-to-market by 85% while cutting operational costs by up to 60% compared to building solutions in-house.

The Current Landscape: Why Speed Matters More Than Ever

The digital asset ecosystem is experiencing unprecedented growth across multiple vectors.

McKinsey's latest research indicates that tokenization of real-world assets could reach $4 trillion by 2030, while institutional custody assets under management have grown 340% year-over-year according to PwC's Digital Asset Survey.

This growth is driven by several convergent factors:

- Regulatory Clarity: Recent frameworks from regulators globally have provided the certainty institutions need to move forward with confidence

- Client Demand: High-net-worth individuals and institutional investors are increasingly demanding digital asset exposure and services

- Yield Opportunities: Traditional fixed-income returns remain compressed, while digital assets offer attractive yield-generating opportunities

- Operational Efficiency: Blockchain-based settlement can reduce counterparty risk and settlement times from days to minutes

The institutions that can deploy compliant, secure digital asset infrastructure fastest will capture the largest market share in this rapidly expanding sector. This reality has made rapid deployment capabilities a critical competitive advantage.

The Five Critical Challenges Slowing Institutional Adoption

Despite the clear market opportunity, financial institutions continue to face significant hurdles in launching digital asset services.

Our analysis of over 200 institutional deployment projects has identified five recurring challenges that consistently extend timelines and increase costs:

1. Regulatory Compliance Complexity

Navigating the evolving regulatory landscape requires specialized expertise that most institutions lack internally.

From BSA/AML compliance to custody regulations and reporting requirements, the compliance burden can consume 12-18 months of development time when approached without the right framework.

2. Security Architecture Requirements

Digital asset custody demands military-grade security protocols. Institutions must implement multi-party computation (MPC), hardware security modules (HSMs), and air-gapped signing procedures while maintaining operational efficiency.

Building these capabilities from scratch typically requires 18-24 months and specialized talent that commands premium salaries.

3. Counterparty Risk Management

Relying on third-party wallet providers introduces counterparty risk that many institutions find unacceptable. The collapse of several prominent crypto service providers has reinforced the need for self-custody solutions that maintain institutional control over assets.

4. Investor Transparency Expectations

Modern investors expect real-time visibility into their digital asset holdings, yield generation, and transaction history. Building comprehensive investor portals and reporting systems often becomes a significant technical undertaking that delays time-to-market.

5. Scalability and Integration Challenges

Digital asset infrastructure must integrate seamlessly with existing core banking systems, portfolio management platforms, and reporting tools.

Custom integration work can add 6-12 months to deployment timelines and create ongoing maintenance burdens.

Industry data shows that 73% of financial institutions that attempt to build digital asset infrastructure in-house exceed their initial timeline by more than 12 months, with 34% ultimately abandoning their projects due to complexity and cost overruns.

The Modular Infrastructure Solution: Building Blocks for Rapid Deployment

The most successful institutional deployments are leveraging modular infrastructure platforms that provide enterprise-grade building blocks for digital asset services.

Rather than building everything from scratch, institutions can now assemble best-in-class components that have been battle-tested across hundreds of deployments.

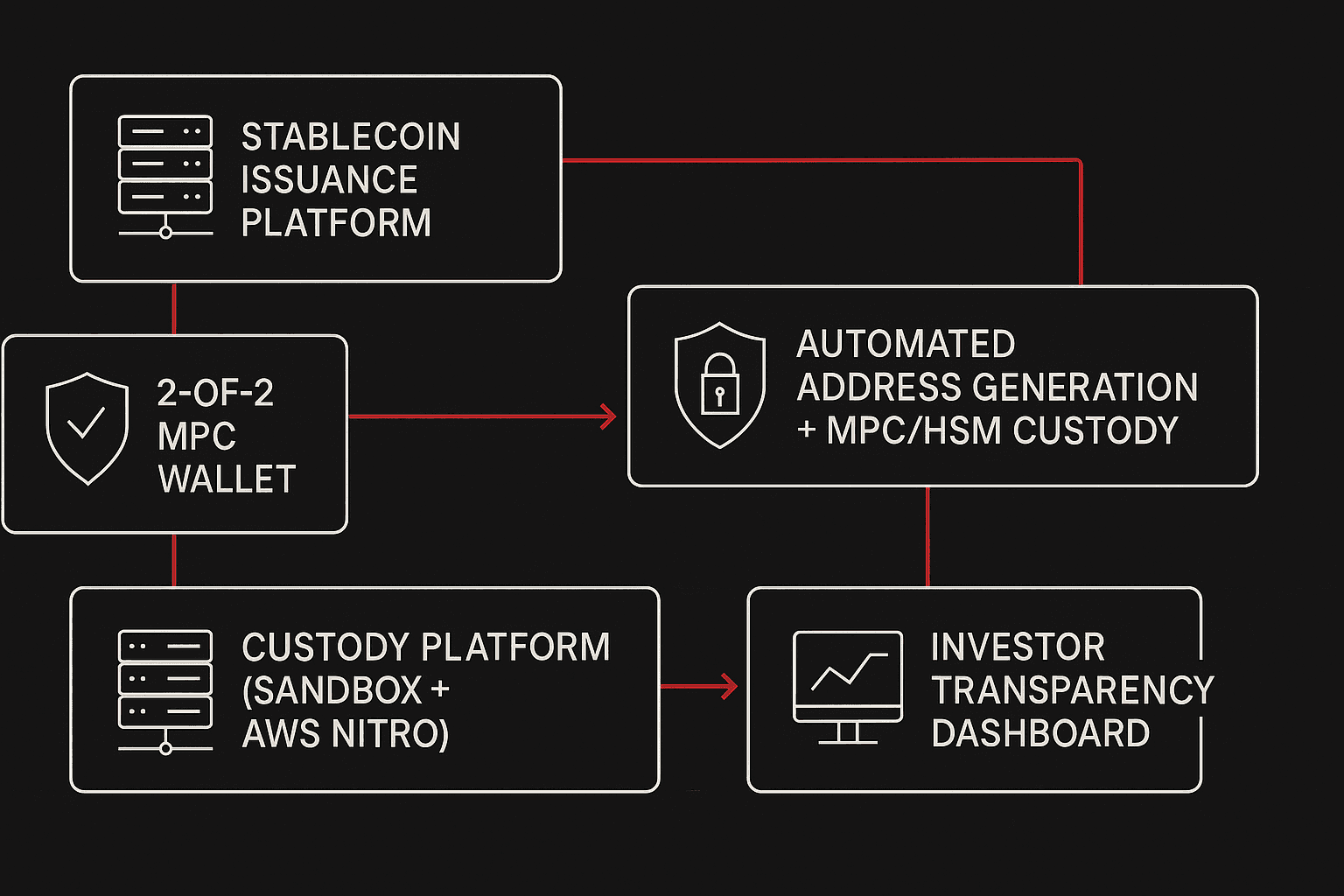

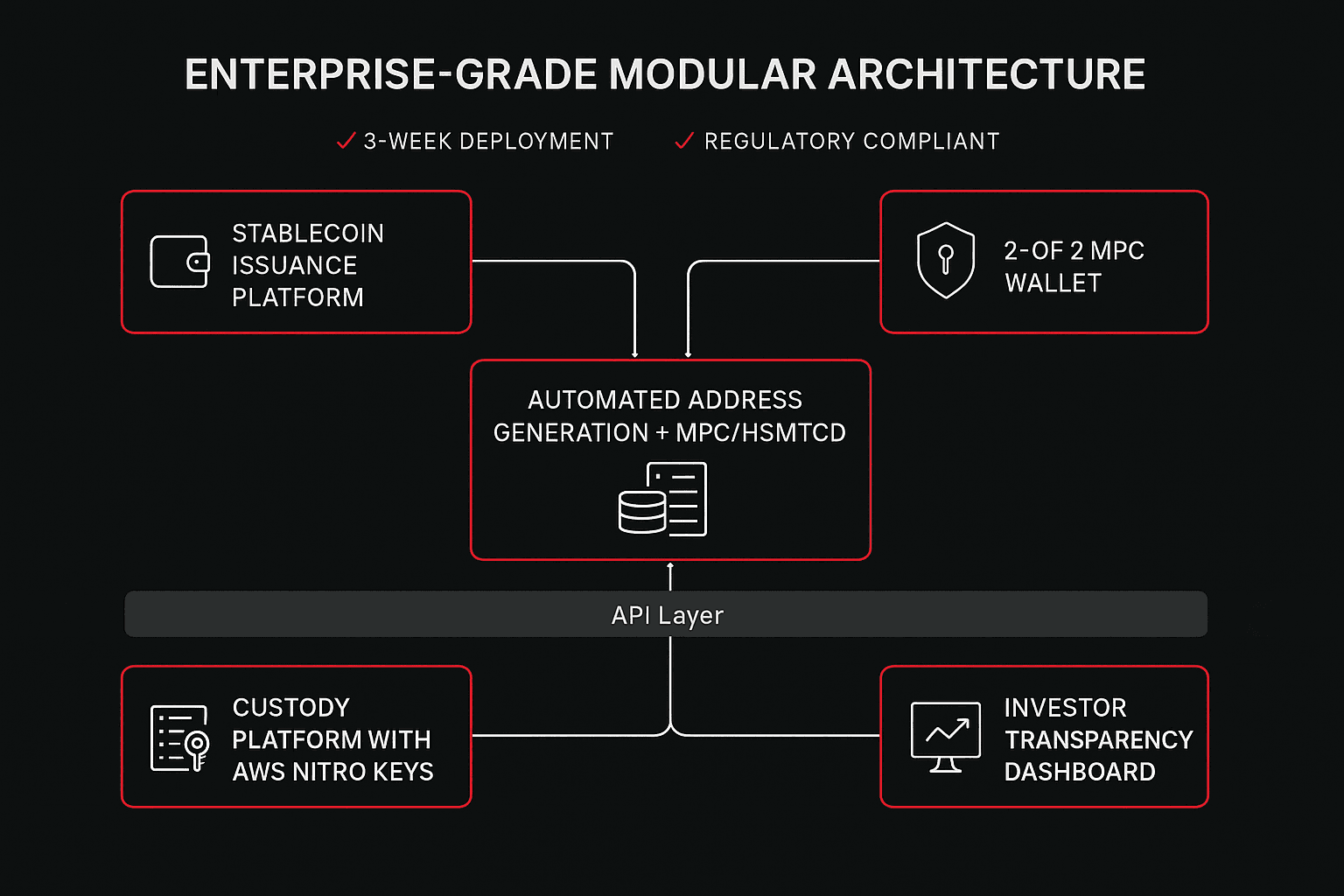

Core Components of Modern Digital Asset Infrastructure

1. Stablecoin Issuance Platform

A compliant foundation for launching institutional stablecoins with built-in regulatory reporting, reserve management, and redemption mechanisms. This turnkey solution enables banks to launch their own stablecoins in weeks rather than the 12-18 months typically required for custom development.

2. Enterprise-Grade MPC Wallet Infrastructure

Military-grade security through 2-of-2 multi-party computation eliminates single points of failure while maintaining operational efficiency. Our MPC wallet solution has processed over $50 billion in transactions with zero security incidents.

3. Automated Address Generation and Key Management

Seamless integration between MPC protocols and HSM custody ensures institutional-grade security without operational complexity. Automated processes reduce manual errors while maintaining full audit trails for regulatory compliance.

4. Comprehensive Custody Platform

Sandbox environments enable rapid testing and validation, while AWS Nitro-based production environments provide bank-grade security and compliance. The platform supports over 500 digital assets with automated compliance screening.

5. Real-Time Investor Dashboard

Transparent reporting and capital utilization tracking meet modern investor expectations while reducing operational overhead. Automated reporting generates compliance documentation and investor communications.

The Competitive Advantage: Why Market Leaders Choose Modular Solutions

The most successful digital asset deployments share several common characteristics that distinguish them from failed or delayed projects:

- Speed as a Strategic Asset: Market leaders recognize that being first to market with compliant digital asset services creates sustainable competitive advantages. Early movers capture larger market share and establish stronger client relationships before competitors can respond.

- Focus on Core Competencies: Rather than attempting to become blockchain experts overnight, successful institutions partner with specialized infrastructure providers to leverage existing expertise while focusing on client relationships and product innovation.

- Risk-Managed Innovation: Modular platforms enable institutions to innovate rapidly while maintaining rigorous risk controls. Sandbox environments allow for safe experimentation, while production systems provide bank-grade security and compliance.

- Scalable Architecture: Leading institutions choose solutions that can grow with their business rather than requiring costly rebuilds as volume increases. Our enterprise architecture supports clients from initial launch through billions in transaction volume.

Looking Ahead: The Future of Institutional Digital Assets

The digital asset infrastructure landscape will continue evolving rapidly, driven by technological advancement and regulatory development.

Several trends will shape the next phase of institutional adoption:

Regulatory Harmonization

As global regulatory frameworks mature and harmonize, compliance complexity will decrease while cross-border opportunities expand. Institutions with flexible, compliant infrastructure will be best positioned to capitalize on these developments.

Traditional Finance Integration

The boundary between traditional and digital assets will continue blurring as tokenization expands beyond cryptocurrencies to stocks, bonds, real estate, and alternative investments. Bank for International Settlements research suggests that tokenized traditional assets could represent 10-15% of global financial markets by 2030.

Yield Optimization Evolution

As DeFi protocols mature and institutional-grade yield opportunities expand, the ability to optimize returns across traditional and digital assets will become a key differentiator. Institutions need infrastructure that can adapt to evolving yield strategies.

Real-Time Settlement Standard

Blockchain-based settlement will become the expected standard for institutional transactions, driven by operational efficiency gains and risk reduction. Institutions without this capability will face competitive disadvantages in client acquisition and retention.

Industry projections indicate that institutions offering comprehensive digital asset services will capture 25-35% more assets under management compared to traditional-only competitors by 2027.

Implementation Strategy: Your Path to Market Leadership

For institutions ready to move beyond strategy to implementation, the path to market leadership follows a proven framework:

Phase 1: Validation (Weeks 1-2)

Deploy sandbox environments to validate use cases and demonstrate capabilities to stakeholders. This risk-free evaluation enables informed decision-making without significant resource commitment.

Phase 2: Pilot Launch (Weeks 3-6)

Launch limited services with select clients to refine operations and build internal expertise. Pilot programs provide valuable feedback while minimizing risk exposure.

Phase 3: Full Deployment (Weeks 7-12)

Scale to full production with comprehensive service offerings and broader client access. This phase leverages lessons learned during validation and pilot phases to ensure smooth full-scale launch.

Phase 4: Optimization (Ongoing)

Continuously enhance services based on client feedback and market developments. Our dedicated support team ensures institutions stay ahead of evolving requirements and opportunities.

Conclusion: The Time for Action is Now

The digital asset opportunity window is narrowing as more institutions recognize the competitive advantages of early adoption.

Those who act decisively with proven infrastructure solutions will establish market-leading positions, while those who delay will find themselves scrambling to catch up with better-positioned competitors.

The choice is clear: continue lengthy internal development projects that may never reach production, or leverage battle-tested modular infrastructure to launch compliant digital asset services in weeks. Market leaders are making their choice – and they're choosing speed, security, and proven results.

The future of finance is digital, tokenized, and transparent. The question isn't whether your institution will offer digital asset services, but whether you'll be a market leader or a follower when you do.

With ScalableSolutions, you can be both first to market and best in class.