As the new year fast approaches, Scalable Solutions has been busy at work finalising some exciting product updates for our current and future clients to enjoy in 2022.

Let’s take a quick look at some of the highlights of the past year.

2021 Rewind

- Scalable integrated SumSub, an identity verification platform that provides an all-in-one technical and legal toolkit to cover KYC/KYB/AML needs. The partnership with SumSub helped our clients to easily tackle all onboarding and compliance challenges that come with identity verification. Moreover, it optimized KYC and AML procedures by converting existing policies into automated digital processes that allow faster and safer customer onboarding.

- We introduced Scalable Audits, a product aimed at helping smart contract projects ensure robust security. Through a thorough analysis of the source code architecture, Scalable identifies vulnerabilities and provides a Security Audit report with recommendations to guard against potential attack vectors.

- Additionally, Scalable is one of the few to support the FIX protocol — standard in global financial markets, but unusual in the digital assets sector. It allows established financial institutions to integrate trading algorithms designed for traditional markets seamlessly into the world of digital assets. The Scalable platform uses the most advanced APIs. Also, it supports FIX protocol 4.2 (standard in US equities today), 4.4 and 5.0 for MD feeds and managing orders. These battle-tested protocols are optimized for minimum latency.

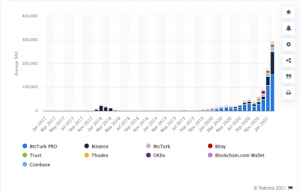

- Scalable also took a deeper dive in digital asset adoption, developing a series of articles exploring cryptocurrency adoption and regulatory frameworks in regions around the world — find them here.

Stepping into 2022 with Scalable Solutions

For 2022, we have planned an array of positive updates, both to our products and the way we work. Our team has expanded substantially to accommodate the growing demand for advanced trading infrastructure and our company growth plans for the new year.

Below you will find some of the new products and features you can benefit from straight away.

Scalable Mobile Wallet App

We’re delighted to share that from 2022, Scalable will offer clients its own white label custodial wallet. The wallet is an add-on integration to Scalable Solution’s digital asset exchange, allowing for a comprehensive white label offering. With the Scalable wallet, users can easily buy, send, receive and swap every asset listed on the exchange.

The digital asset wallet features include:

- An intuitive interface that makes it simple to navigate and trade, regardless of experience

- It ensured high level security through advanced cryptography

- Cross-platform functionality

- Tailored news feed per digital asset

- It supports the most popular payment methods

- An option to customize the wallet according to your brand, with a variety of language options

Perpetual Futures

Scalable has integrated Perpetual Futures into the exchange solution. The new derivatives instrument acts similarly to traditional futures contracts. The main difference is that it has no expiration date and can be held indefinitely.

This feature is supported by the Futures Tab with a futures market overview for the current time and the updated Terms of Trading.

Scalable Solutions New Platform Integrations

SumSub Liveness Check

We are partnered with SumSub to provide a secure and easy KYC process, especially with the new Liveness Check feature. Users no longer need to take a selfie with a passport to prove their identity, or wait for the manual verification that causes delays in the KYC process.

In brief, Liveness Check is based on a biometrics verification. This is a safer and more user-friendly verification method, as opposed to selfies. The ability to perform automated checks reduces officers’ workload and users’ wait times. Trading clients can pass verification in as little as 4 seconds, drastically reducing drop off rates.

Simplex & XanPool Payment Gateways

Simplex and XanPool are the newest additions to our platform, facilitating fiat to crypto payments. Our clients now have a choice of five cryptocurrency payment gateways — Banxa, MoonPay, Mercuryo, and the aforementioned Simplex and XanPool.

Prime Trust

The integration with Prime Trust, an innovative open-banking financial solutions provider, allows users to move fiat on the exchange in real time and on a limitless basis. Hence, we can reduce the time to market in a secure and regulated manner.

Scalable Solutions New User Features

Hidden Orders (HO)

The feature allows users to place hidden orders. Thus, we can exclude the influence of the order on the market, enabling a more profitable order execution.

The feature is now available through API, but will soon be available on the web.

Reduce-Only Orders (RO)

When users place a close order, they need to ensure that it doesn’t flip the position. In order to do this, we propose a Reduce Only feature for orders.

Reduce Only is a parameter for buy or sell orders. When specified, the order is limited by the size of the current position and orders before it. Reduce Only orders are compatible with any type of order (except for Scaled orders on the web) and any Time in Force instructions, but are available only on margin and derivatives.

The feature is now available through API, but soon will be available on the web.

Take Profit Orders (TP)

We have added a new order type called Take Profit order (Take). Similar to a stop-loss order, it is activated only when a certain price is reached on the market, but with the reversed price condition. TP Orders are available on all markets, including spot, margin and derivatives.

The feature is now available through API, but will soon be available on the web.

Welcome to 2022!

At Scalable Solutions, we are excited for what 2022 will bring and the innovations we have in store for our clients.

We would like to take this opportunity to thank you for your support and wish you a wonderful year ahead. Happy 2022 from Scalable Solutions!