Custodial vs Non-custodial Wallets: Everything You Need to Know (2025)

Table of Contents

- TL;DR Summary

- What is a Crypto Wallet and How Does it Work?

- What is a Custodial Wallet?

- What is a Non-Custodial Wallet?

- Custodial vs Non-Custodial Wallet: Complete Comparison

- Security Analysis: Which Wallet Type is Safer?

- Regulatory Compliance and Legal Considerations

- Market Statistics and Adoption Trends

- When to Use Custodial Wallets

- When to Use Non-Custodial Wallets

- Advanced Wallet Technologies: MPC and Beyond

- Best Custodial Wallets in 2025

- Best Non-Custodial Wallets in 2025

- Cost Analysis: Custodial vs Non-Custodial

- Hybrid Approach: Using Both Wallet Types

- Future of Crypto Wallets

- FAQs

- Conclusion

- Glossary

TL;DR Summary

Custodial wallets are managed by third-party services like exchanges that hold your private keys, offering convenience and account recovery but requiring trust in the custodian.

Non-custodial wallets give you complete control over your private keys and funds but require personal responsibility for security and backup.

Key Statistics:

- Global crypto wallet market: $12.59 billion in 2024, expected to reach $100.77 billion by 2033

- Over 560 million crypto owners worldwide in 2024

- $2.2 billion stolen%20protocols%20remaining%20prime%20targets.) in crypto hacks in 2024, highlighting security importance

- Non-custodial wallet market growing at 24.3% CAGR

Quick Decision Guide

Choose custodial if: You're new to crypto, want convenience, need customer support, or prioritize ease of use.

Choose non-custodial if: You value complete control, use DeFi protocols, hold long-term investments, or prioritize maximum security and privacy.

-1752233239709.png)

What is a Crypto Wallet and How Does it Work?

A cryptocurrency wallet serves as your gateway to the blockchain, enabling you to store, send, and receive digital assets. Despite the name, crypto wallets don't actually "store" cryptocurrency in the traditional sense, instead, they store the cryptographic keys that prove ownership of your digital assets recorded on the blockchain.

Essential Wallet Components

Public Key: Your wallet address that others can use to send you cryptocurrency. Think of it as your bank account number completely safe to share publicly and often displayed as a long string of characters starting with specific prefixes depending on the cryptocurrency.

Private Key: The secret cryptographic code that proves ownership of your funds and authorizes transactions. This functions like your bank account password and must be kept absolutely secure. Anyone with access to your private key can control your funds.

Seed Phrase: A sequence of 12, 18, or 24 randomly generated words that serve as the master backup for your private keys. This phrase can restore access to your entire wallet on any compatible device, making it arguably the most important element of cryptocurrency security.

Hot vs Cold Storage

Hot wallets remain connected to the internet, making them convenient for frequent transactions and DeFi interactions. Popular examples include MetaMask browser extensions for Ethereum and DeFi activities, and Trust Wallet mobile applications for on-the-go trading.

Cold wallets store your keys offline, providing maximum security for long-term holdings. Hardware devices like Ledger Nano series offer the best balance of security and usability, while paper wallets represent the most basic form of cold storage.

The Fundamental Question

The core distinction between wallet types isn't technical but philosophical:

**Who controls the private keys that govern your digital assets? **

This question leads us to the essential difference between custodial and non-custodial approaches.

What is a Custodial Wallet?

A custodial wallet represents a trust-based approach where a third-party service provider holds and manages your private keys on your behalf.

This custodian, typically a cryptocurrency exchange or specialized wallet service, assumes responsibility for securing your funds while providing you with account access through traditional login credentials.

How Custodial Wallets Operate

The custodial model mirrors traditional banking relationships where you trust the institution to safeguard your assets.

When you create an account with major exchanges, you're essentially opening a digital account where the service manages blockchain interactions while you interact through their user-friendly interface.

Account Setup Process: Account creation involves standard online registration followed by identity verification through Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures. The service then generates and stores your private keys in their secure infrastructure, often using advanced security measures like hardware security modules and multi-signature protocols.

Key Custodial Features

Professional Security Management: Custodial services employ dedicated security teams, implement multi-layered security protocols, and undergo regular third-party audits. These professional measures often exceed what individual users can implement independently.

Account Recovery Services: Password recovery becomes possible through customer support, as the custodian can verify your identity and restore account access. This safety net prevents permanent fund loss due to forgotten credentials.

Insurance Protection: Many custodial services offer insurance coverage for digital assets, with leading exchanges providing up to $250 million in coverage for customer funds through both FDIC insurance for fiat holdings and specialized crypto insurance policies.

Integrated Financial Services: Custodial wallets typically include built-in trading, staking, lending, and other financial services, allowing users to seamlessly transition between different activities without managing multiple platforms.

Leading Custodial Wallet Examples

Coinbase stands out for strong US regulatory compliance and FDIC insurance for USD holdings, making it popular among American users seeking regulatory certainty.

Binance offers global reach and extensive trading features, serving as both exchange and wallet with comprehensive cryptocurrency support.

Kraken has built a reputation for security excellence and institutional-grade custody services, appealing to both retail and professional traders.

Gemini operates as a New York trust company with regulatory compliance focus, providing additional legal protections for customer assets.

What is a Non-Custodial Wallet?

A non-custodial wallet, also known as a self-custody wallet, puts you in complete control of your private keys and, by extension, your digital assets. No third party can access your funds, freeze your account, or control your transactions, embodying the cryptocurrency ethos of "not your keys, not your coins."

Self-Custody Operation

Wallet Generation: Creating a non-custodial wallet involves generating cryptographic keys locally on your device, ensuring that no external service ever accesses your private information. You receive a seed phrase that serves as the master key to your wallet, which you must store securely and never share.

Transaction Authorization: All transactions happen directly on your device, where they're cryptographically signed using your private keys before being broadcast to the blockchain network. This process ensures that only you can authorize fund movements, regardless of external circumstances.

Types of Non-Custodial Wallets

Software wallets offer convenience and functionality across different platforms:

Desktop Applications like Electrum and Exodus install directly on your computer, providing full-featured wallet capabilities with offline transaction signing options.

Mobile Applications such as Trust Wallet and Phantom bring crypto management to smartphones, enabling DeFi access and transaction capabilities on-the-go.

Browser Extensions like MetaMask integrate seamlessly with web-based decentralized applications, making DeFi protocols and NFT marketplaces easily accessible.

Hardware Wallets represent the gold standard for non-custodial security:

- Ledger Nano Series devices store private keys on specialized hardware isolated from internet-connected computers, requiring physical confirmation for transactions.

- Trezor Models offer similar security with user-friendly interfaces and open-source firmware that can be independently verified.

Core Self-Custody Principles

Complete Ownership: The fundamental principle means you bear full responsibility for asset security. Lost private keys or seed phrases result in permanent loss of access, with no customer support or recovery mechanism available.

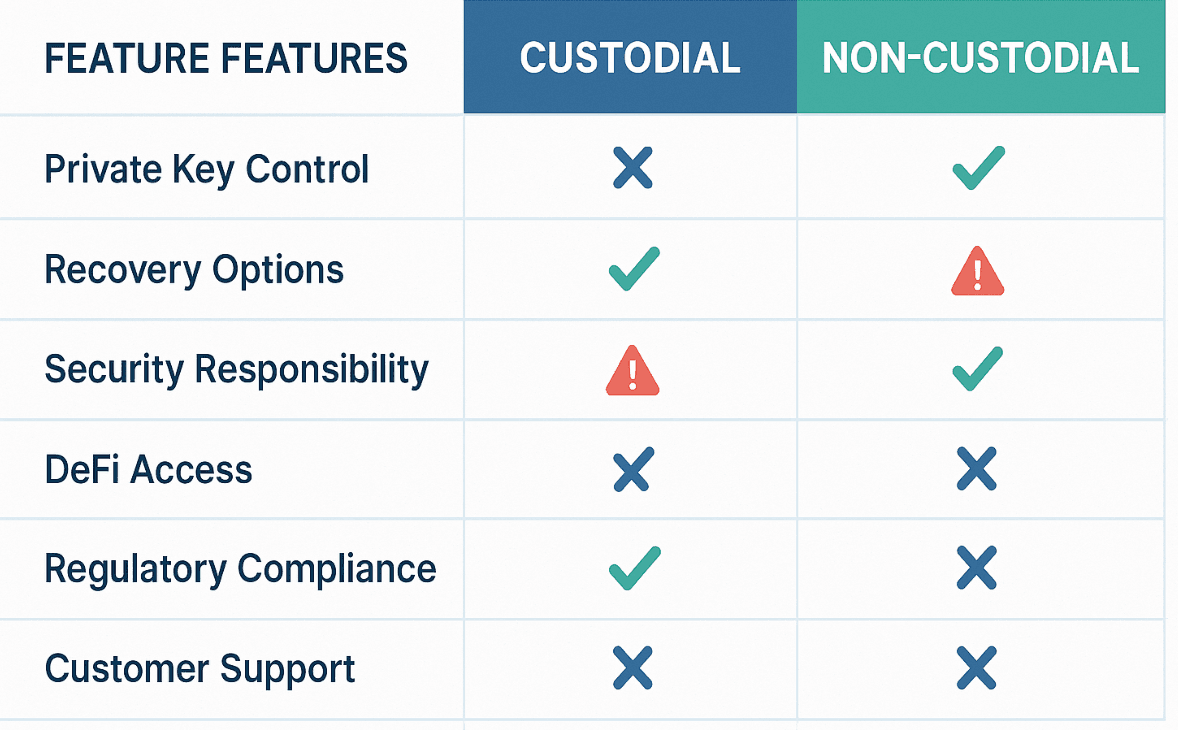

DeFi Compatibility: Non-custodial wallets provide unrestricted access to decentralized finance protocols, yield farming opportunities, and innovative blockchain applications that custodial services often can't support due to regulatory constraints.

Privacy and Censorship Resistance: These wallets allow creation without identity verification, offer enhanced transaction privacy, and resist censorship or account freezing by authorities or service providers.

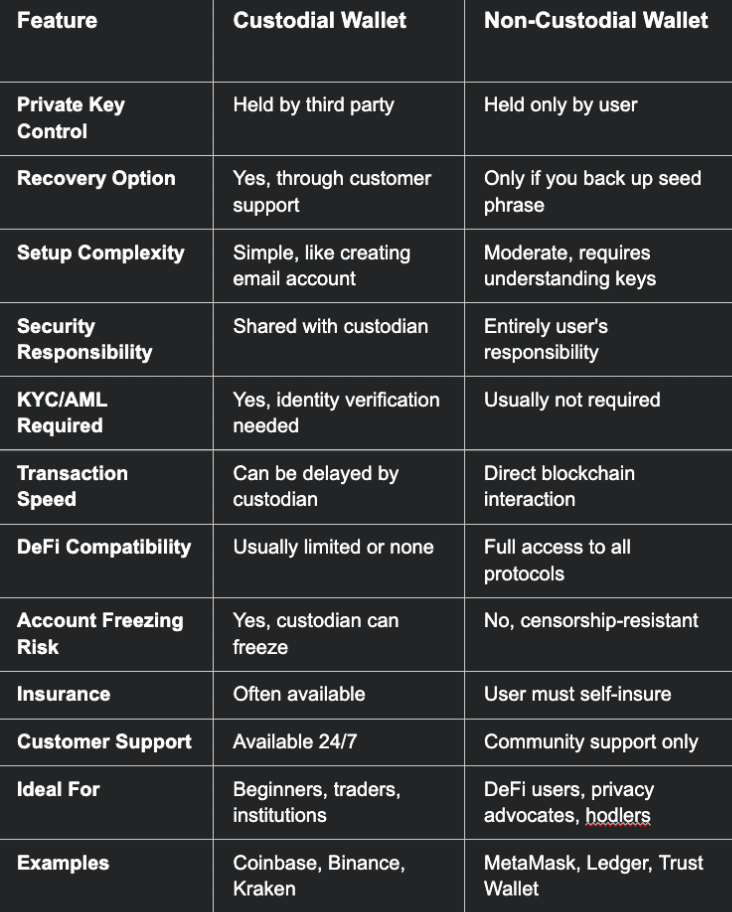

Custodial vs Non-Custodial Wallet: Complete Comparison

Understanding the practical differences between custodial and non-custodial wallets requires examining how each approach handles critical aspects of cryptocurrency management.

For businesses seeking middle-ground approaches, embedded wallet solutions combine elements of both custodial and non-custodial models while addressing specific regulatory compliance requirements.

Control and Ownership Dynamics

Private Key Management represents the fundamental philosophical difference. Custodial services manage keys professionally but create dependency relationships, while non-custodial wallets provide complete sovereignty at the cost of personal responsibility.

Recovery Mechanisms illustrate practical trade-offs clearly. Custodial users benefit from account recovery through identity verification and customer support processes, while non-custodial users must rely entirely on properly stored seed phrases or face permanent fund loss.

User Experience Differences

Setup Complexity varies dramatically between approaches. Custodial wallets offer familiar account creation processes similar to email or social media platforms, while non-custodial wallets require understanding of cryptographic concepts and careful seed phrase management.

Transaction Processing differs in speed and control mechanisms. Custodial services may implement delays for security reviews or compliance checks, while non-custodial transactions proceed at blockchain speed without intermediary approval requirements.

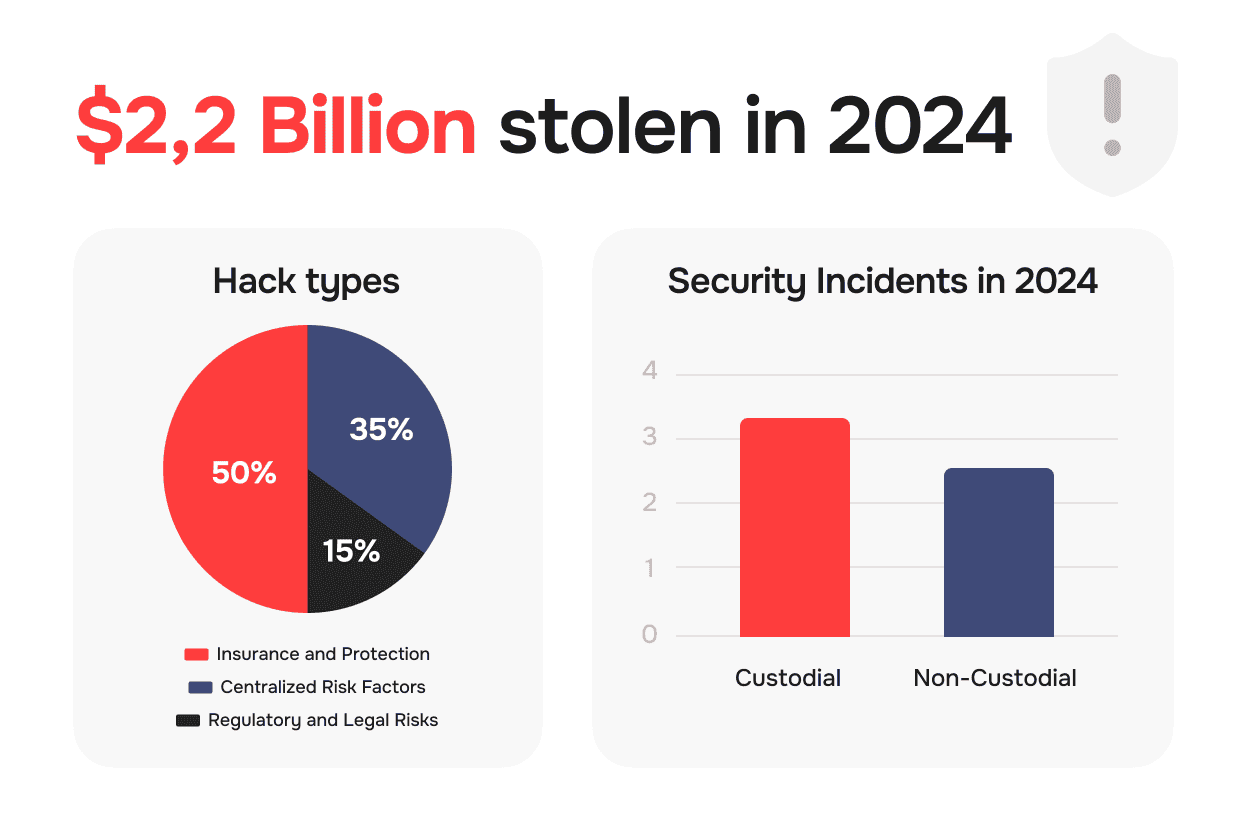

Security Analysis: Which Wallet Type is Safer?

Security considerations represent the most critical factor in wallet selection, with 2024 data revealing important insights about cryptocurrency security risks across both custodial and non-custodial approaches.

Financial institutions must implement comprehensive digital wallet security best practices including end-to-end encryption, multi-factor authentication, and AI-driven fraud detection systems.

2025 Security Overview

According to Chainalysis research, $2.2 billion was stolen in cryptocurrency hacks during 2024, representing a 21% increase from the previous year. Understanding how these losses occurred helps inform wallet choice decisions.

Custodial Wallet Security Profile

Professional Infrastructure Advantages: Custodial services benefit from dedicated security teams employing former government cybersecurity experts, implementing multi-layered security protocols, and undergoing regular third-party security audits. These professional measures often exceed what individual users can implement independently.

Insurance and Protection: Leading exchanges offer substantial insurance coverage, with some providing up to $250 million in protection for customer digital assets. This insurance combines FDIC coverage for fiat holdings with specialized cryptocurrency insurance policies.

Centralized Risk Factors: However, custodial services create attractive targets for attackers due to concentrated fund storage. Historical incidents demonstrate this vulnerability clearly the FTX collapse in 2022 resulted in billions in customer fund losses, while the Mt. Gox hack in 2014 led to 850,000 Bitcoin disappearing permanently.

Regulatory and Legal Risks: Government seizure represents another consideration, as authorities can freeze accounts or force asset forfeiture through legal processes, regardless of individual user innocence.

Non-Custodial Wallet Security Profile

Elimination of Counterparty Risk: Non-custodial approaches eliminate third-party risks entirely, making users immune to exchange hacks, bankruptcy, or regulatory action. Your security depends entirely on your own practices rather than external organizations.

Hardware Wallet Excellence: Hardware wallets provide exceptional security by storing private keys on air-gapped devices requiring physical confirmation for transactions. Even if your computer becomes compromised with malware, hardware wallets maintain security through isolated key storage.

User Responsibility Challenges: The primary risks involve user error and personal security failures. Lost seed phrases result in permanent fund loss with no recovery mechanism available. Malware infections can compromise software wallets, while phishing attacks trick users into revealing sensitive information.

Security Best Practices

For Custodial Users: Choose reputable, regulated exchanges with strong security track records and insurance coverage. Enable two-factor authentication, use unique passwords, and monitor accounts regularly for suspicious activity.

For Non-Custodial Users: Use reputable hardware wallets for significant amounts, store seed phrases in multiple secure physical locations, implement multi-signature configurations when possible, maintain updated wallet software, and consider using dedicated devices for cryptocurrency activities.

Security Verdict

The optimal choice depends largely on user technical competency and risk tolerance. Beginners often benefit from custodial services' professional security management and insurance coverage, while experienced users who follow proper security practices achieve superior protection through non-custodial approaches that eliminate third-party risks entirely.

Regulatory Compliance and Legal Considerations

The regulatory landscape for cryptocurrency wallets evolved significantly throughout 2024, with new compliance requirements affecting both custodial and non-custodial wallet providers across multiple jurisdictions worldwide.

Custodial Wallet Regulations

Money Service Business Requirements: Custodial wallet providers must register as Money Service Businesses (MSBs) in most jurisdictions, triggering extensive compliance obligations. These include implementing Know Your Customer (KYC) procedures, maintaining Anti-Money Laundering (AML) monitoring systems, reporting suspicious transactions to authorities, and keeping comprehensive transaction records.

Travel Rule Implementation: Based on FATF Recommendation 16, custodial services must collect and share transaction information for transfers above specified thresholds, typically $1,000 or €1,000. FATF's 2024 update revealed concerning gaps, with nearly one-third of surveyed jurisdictions making insufficient progress implementing these requirements.

Insurance and Capital Standards: Regulatory frameworks increasingly require minimum capital reserves, FDIC insurance for USD holdings in the United States, and private insurance coverage for cryptocurrency assets. While these requirements provide customer protection, they also increase operational costs for service providers.

Non-Custodial Wallet Regulations

Current Regulatory Status: Non-custodial wallets remain relatively unregulated, as authorities generally treat them as software tools rather than financial services. Users typically face no KYC requirements for wallet creation and can maintain greater transaction privacy compared to custodial alternatives.

Emerging Regulatory Trends: However, new regulations are beginning to affect non-custodial users. The European Union's Markets in Crypto-Assets (MiCA) regulation, effective in 2024, introduces increased reporting requirements for large transactions. Similarly, the US infrastructure bill expanded reporting requirements for cryptocurrency transactions. European crypto service providers must navigate MiCA regulation compliance requirements, which create unified regulatory frameworks affecting both custodial and non-custodial wallet operations across EU member states.

Tax Compliance Requirements

Universal Obligations: Both wallet types create identical tax obligations for users, who remain responsible for maintaining detailed transaction records, reporting capital gains and losses accurately, and declaring income from DeFi activities regardless of their chosen wallet approach.

New IRS Requirements: A significant development for US users involves new IRS cost basis rules requiring crypto investors to switch from Universal to Per-Wallet cost basis tracking by January 1, 2025. This change affects tax calculations for both custodial and non-custodial wallet users, potentially increasing record-keeping complexity significantly.

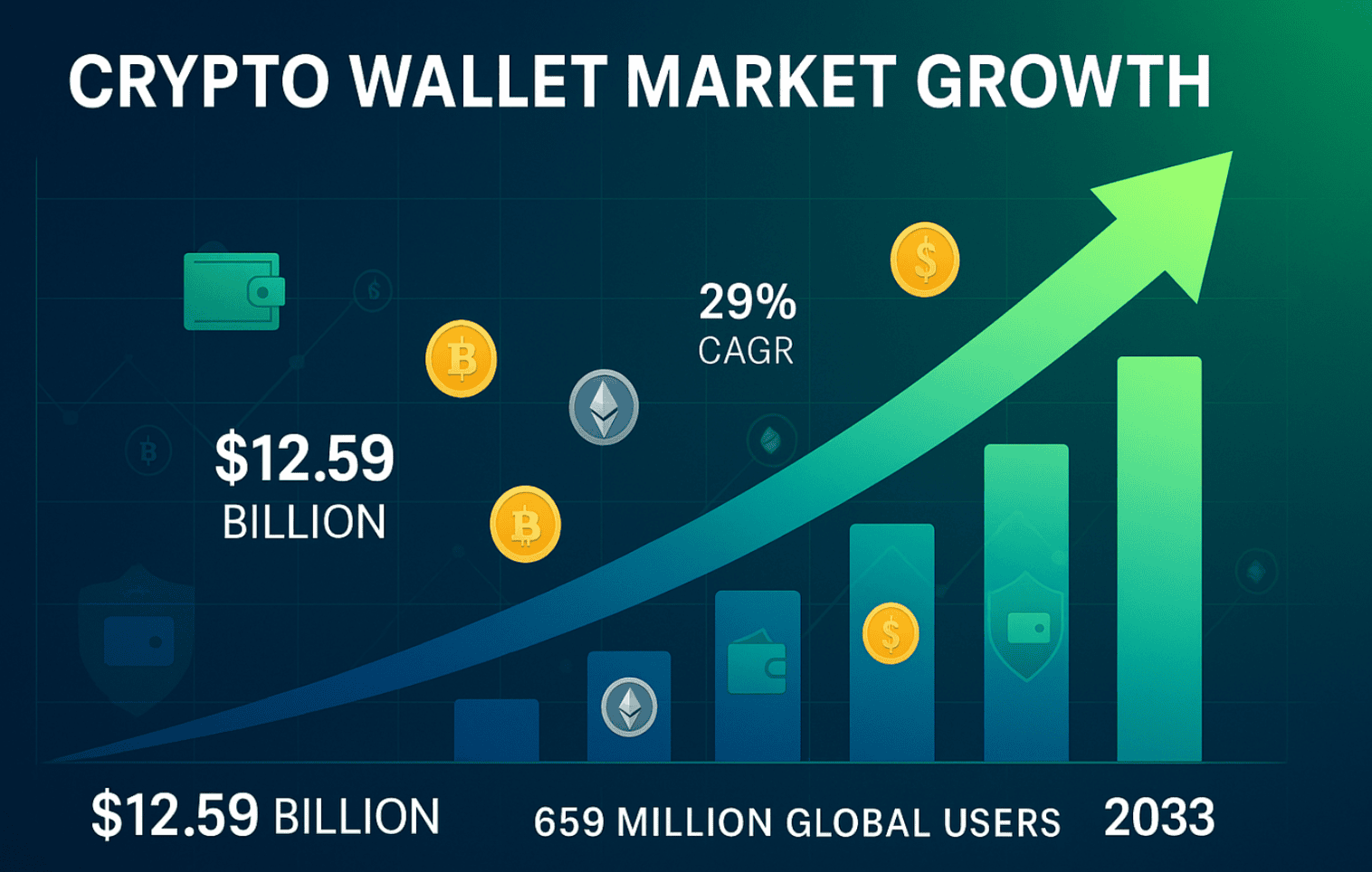

Market Statistics and Adoption Trends

The cryptocurrency wallet market experienced remarkable expansion in 2024, driven by increasing institutional adoption, improving regulatory clarity, and expanding use cases for digital assets across various industries.

Major financial institutions like Morgan Stanley, Fidelity, and BlackRock are driving institutional digital asset adoption, with 51% of institutional investors maintaining positive perceptions of digital assets despite market volatility.

Global Market Growth

Market Size Expansion: The total crypto wallet market reached $12.59 billion in 2024 with projections indicating growth to $100.77 billion by 2033, representing a compound annual growth rate of 26.3%. This impressive growth reflects not only increased user adoption but also the maturation of wallet technology and enhanced security features.

User Adoption Statistics: Global cryptocurrency ownership reached 659 million users as of 2024, representing a 13% increase from the previous year. This translates to approximately 6.8% global cryptocurrency ownership rate, with mobile crypto wallets achieving a record high of 36 million active wallets in the fourth quarter alone.

Market Segmentation Trends

Non-Custodial Growth: The non-custodial wallet market, valued at $1.5 billion in 2023, projects growth to $8.4 billion by 2032, expanding at a compound annual growth rate of 24.3%. This acceleration indicates increasing user sophistication and growing desire for self-custody solutions.

Regional Adoption Patterns: Central and Southern Asia and Oceania lead global cryptocurrency adoption according to Chainalysis's 2024 Global Crypto Adoption Index. Developing markets often show higher adoption rates due to currency instability, limited traditional banking access, and younger, tech-savvy populations.

Institutional Adoption Impact

Professional Market Entry: Traditional financial institutions increasingly offer cryptocurrency custody services and wallet solutions, validating the market while driving professionalization of custody practices and security standards. This institutional entry provides legitimacy and attracts previously skeptical corporate and individual users.

DeFi Integration: Decentralized Finance protocols reached 27.3 million unique wallet addresses in 2024, highlighting the growing importance of non-custodial wallets for accessing yield farming, liquidity provision, and other advanced financial services unavailable through traditional custodial platforms.

When to Use Custodial Wallets

Custodial wallets excel in specific scenarios where convenience, support, and integrated services outweigh the trade-offs of third-party control over private keys.

Large enterprises and financial institutions requiring professional-grade security should evaluate whether to build or buy institutional crypto custody solutions, with most finding third-party providers more cost-effective than internal development.

Ideal User Profiles

Cryptocurrency Beginners: New users benefit significantly from custodial wallets' familiar user interfaces, comprehensive customer support, and built-in educational resources. The learning curve for understanding private keys, seed phrases, and blockchain interactions can overwhelm newcomers, making custodial services an excellent entry point.

Active Traders: Frequent traders appreciate integrated exchange functionality, advanced trading tools, and instant access to multiple cryptocurrency pairs. Custodial platforms typically offer superior liquidity, margin trading capabilities, and professional-grade charting tools unavailable in basic non-custodial wallets.

Business and Institutional Users: Companies requiring accounting integration, compliance reporting, and multi-user access controls find custodial solutions better suited to their operational needs. These platforms often provide APIs, detailed transaction histories, and regulatory reporting tools essential for business use.

Specific Use Cases

Regulatory Compliance Needs: Users in heavily regulated industries or jurisdictions may require the KYC/AML compliance, transaction monitoring, and reporting capabilities that custodial services provide by default.

Customer Support Requirements: Individuals who value having human support available for technical issues, account problems, or transaction disputes benefit from custodial platforms' comprehensive customer service infrastructure.

Integrated Financial Services: Users interested in earning yield through staking, lending, or savings products often find custodial platforms offer more user-friendly access to these services compared to navigating complex DeFi protocols independently.

Risk Tolerance Considerations

Insurance Preference: Risk-averse users who prioritize insurance coverage and professional security management over complete personal control often prefer custodial solutions, especially when dealing with significant amounts.

Convenience Over Control: Users who prioritize ease of use, password recovery options, and simplified account management over maximum privacy and control find custodial wallets align better with their preferences and technical comfort levels.

When to Use Non-Custodial Wallets

Non-custodial wallets serve users who prioritize control, privacy, and access to the full spectrum of blockchain applications and services. With security breaches affecting major exchanges and $100 million lost in recent wallet hacks, now is the optimal time to launch a self-custody crypto wallet that prioritizes user control and security."

Ideal User Profiles

DeFi Enthusiasts: Users actively participating in decentralized finance protocols require non-custodial wallets for unrestricted access to yield farming, liquidity provision, governance voting, and experimental financial applications unavailable through custodial platforms.

Long-term Holders: "HODLers" who plan to hold cryptocurrency for extended periods often prefer eliminating counterparty risk entirely. Non-custodial storage removes concerns about exchange bankruptcy, regulatory seizure, or service discontinuation affecting long-term holdings.

Privacy-Conscious Users: Individuals prioritizing financial privacy, transaction anonymity, and resistance to surveillance find non-custodial wallets better aligned with their values and requirements.

Specific Use Cases

Maximum Security Requirements: Users holding significant cryptocurrency amounts often prefer non-custodial hardware wallets for security that doesn't depend on third-party competence or honesty.

DeFi Protocol Interaction: Accessing decentralized exchanges, yield farming protocols, NFT marketplaces, and governance systems typically requires non-custodial wallets for full functionality and optimal user experience.

Cross-Chain Activities: Users operating across multiple blockchain networks benefit from non-custodial wallets' flexibility in supporting various networks and tokens without relying on exchange listing decisions.

Technical Competency Requirements

Security Management Skills: Users comfortable with managing seed phrases, understanding transaction fees, and implementing personal security protocols can leverage non-custodial wallets' advantages while mitigating associated risks.

Troubleshooting Capabilities: Self-sufficient users who can research solutions, understand error messages, and troubleshoot technical issues independently are better positioned to succeed with non-custodial approaches.

Advanced Wallet Technologies: MPC and Beyond

The cryptocurrency wallet landscape continues evolving with innovative technologies addressing traditional limitations of both custodial and non-custodial approaches.

Multi-Party Computation (MPC) Wallets

Technology Overview: MPC wallets use advanced cryptographic techniques to split private keys into multiple shares distributed across different parties or devices. This approach eliminates single points of failure while maintaining the security benefits of self-custody.

Operational Advantages: MPC technology allows multiple parties to collectively manage a wallet without any single party having complete access to the private key. Transactions require cooperation between multiple key shares, significantly reducing the risk of unauthorized access while maintaining user control.

Institutional Applications: Financial institutions increasingly adopt MPC wallets for cryptocurrency custody, as they provide institutional-grade security while maintaining compliance with regulatory requirements for segregated customer asset storage.

Smart Contract Wallets

Enhanced Functionality: Smart contract wallets operate as programmable accounts on blockchain networks, enabling advanced features like spending limits, time-delayed transactions, and automated investment strategies.

Social Recovery Features: These wallets can implement social recovery mechanisms where trusted contacts can help restore access to lost accounts without compromising security or requiring custodial services.

Account Abstraction: Emerging account abstraction technologies simplify user experience by handling gas fees, enabling batch transactions, and providing more flexible authentication methods while maintaining self-custody principles.

Future Wallet Innovations

Biometric Integration: Upcoming wallet technologies integrate biometric authentication, using fingerprints, facial recognition, or other biological markers to enhance security while maintaining user convenience.

Cross-Chain Compatibility: Next-generation wallets focus on seamless interaction across multiple blockchain networks, automatically handling cross-chain transactions and asset management without requiring technical expertise.

AI-Powered Security: Artificial intelligence integration helps detect suspicious activity, optimize transaction fees, and provide personalized security recommendations based on user behavior patterns.

Best Custodial Wallets in 2025

Selecting the optimal custodial wallet requires evaluating security track records, regulatory compliance, insurance coverage, and feature sets across leading platforms.

Coinbase

Regulatory Excellence: Coinbase operates as a publicly-traded company under comprehensive US regulatory oversight, providing transparency and accountability rarely found in the cryptocurrency industry. Their compliance with SEC, CFTC, and state money transmitter regulations offers users significant legal protections.

Insurance and Security: The platform provides FDIC insurance for USD holdings up to $250,000 per user, plus private insurance coverage for cryptocurrency assets. Their security infrastructure includes offline cold storage for the majority of customer funds and comprehensive employee background checks.

User Experience: Coinbase offers an intuitive interface ideal for beginners, comprehensive educational resources, and integrated services including staking, lending, and NFT marketplace access.

Kraken

Security Leadership: Kraken has maintained an exemplary security record since 2011, with no major security breaches affecting customer funds. Their approach emphasizes paranoid security practices, regular audits, and transparent communication about security measures.

Professional Services: The platform caters to both retail and institutional users with advanced trading features, margin trading, futures contracts, and professional custody services meeting institutional standards.

Global Accessibility: Kraken serves users in numerous countries with local currency support, competitive fee structures, and comprehensive customer support in multiple languages.

Gemini

Trust Company Status: Operating as a New York trust company, Gemini provides additional legal protections and regulatory oversight compared to typical cryptocurrency exchanges. This status requires segregated customer asset storage and regular financial audits.

Security Focus: The platform emphasizes security through offline cold storage, multi-signature protection, and comprehensive insurance coverage for digital assets. Their Gemini Earn program previously offered yield on cryptocurrency holdings.

Regulatory Compliance: Gemini's strong regulatory compliance makes it attractive for users prioritizing legal certainty and protection, particularly in the United States market. Bank executives entering the digital asset space must understand comprehensive regulatory compliance for custody solutions, including SEC, MiCA, and FATF requirements that affect both custodial and non-custodial approaches."

Best Non-Custodial Wallets in 2025

Choosing the right non-custodial wallet depends on your specific needs for security, functionality, and blockchain network support.

Hardware Wallets

Ledger Nano X: This hardware wallet represents the gold standard for cryptocurrency security, storing private keys on a secure element chip isolated from internet-connected devices. The Nano X supports over 5,500 cryptocurrencies and integrates with popular software wallets for enhanced functionality.

Key features include Bluetooth connectivity for mobile use, a larger screen for transaction verification, and Ledger Live software providing comprehensive portfolio management. The device requires physical confirmation for all transactions, making it extremely resistant to remote attacks.

Trezor Model T: Trezor's flagship device offers an intuitive touchscreen interface and open-source firmware that can be independently verified. The Model T supports numerous cryptocurrencies and integrates with various third-party wallets and services.

Notable features include advanced passphrase protection, Shamir backup for seed phrase splitting, and comprehensive security features developed through years of community feedback and security research.

Software Wallets

MetaMask: As the leading Ethereum wallet, MetaMask dominates the DeFi ecosystem with seamless integration to decentralized applications. The browser extension and mobile app provide easy access to Ethereum-based protocols, NFT marketplaces, and Layer 2 networks.

Recent updates include improved security features, multi-network support, and enhanced mobile functionality. MetaMask's widespread adoption makes it essential for anyone participating in Ethereum-based DeFi activities.

Trust Wallet: This mobile-first wallet supports an extensive range of cryptocurrencies and blockchain networks. Trust Wallet's user-friendly interface makes it popular among mobile users, while its decentralized exchange integration enables seamless token swapping.

Key advantages include built-in staking for various cryptocurrencies, NFT support, and comprehensive multi-chain functionality covering major blockchain networks.

Phantom: Phantom leads the Solana ecosystem as the premier wallet for SOL and SPL tokens. Its clean interface and seamless DeFi integration make it ideal for Solana-based applications and services.

Features include built-in token swapping, NFT management, and integration with popular Solana DeFi protocols. Phantom's focus on user experience has made it the default choice for Solana ecosystem participation.

Cost Analysis: Custodial vs Non-Custodial

Understanding the total cost of ownership for different wallet types helps inform decision-making beyond initial convenience considerations.

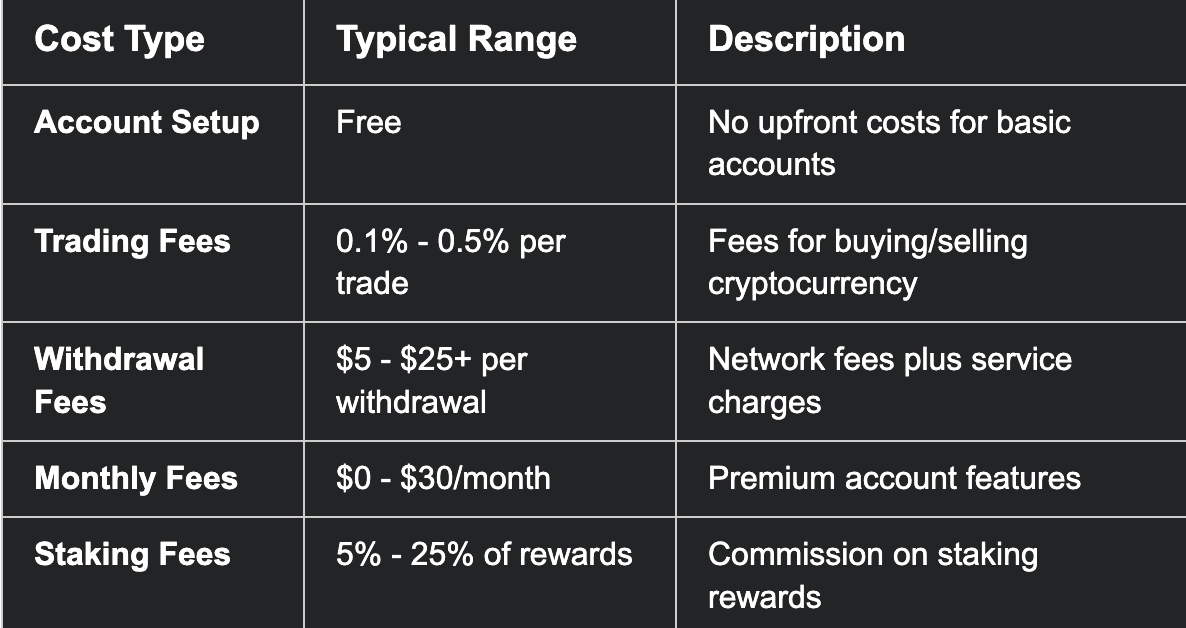

Custodial Wallet Costs

Hidden Costs Considerations: Custodial platforms often implement spread markups on cryptocurrency purchases, effectively increasing costs beyond advertised fees. Additionally, withdrawal restrictions during high volatility periods can create opportunity costs for active traders.

Premium Service Costs: Advanced features like margin trading, institutional custody, or premium support often require monthly or annual subscription fees ranging from $30 to several hundred dollars monthly.

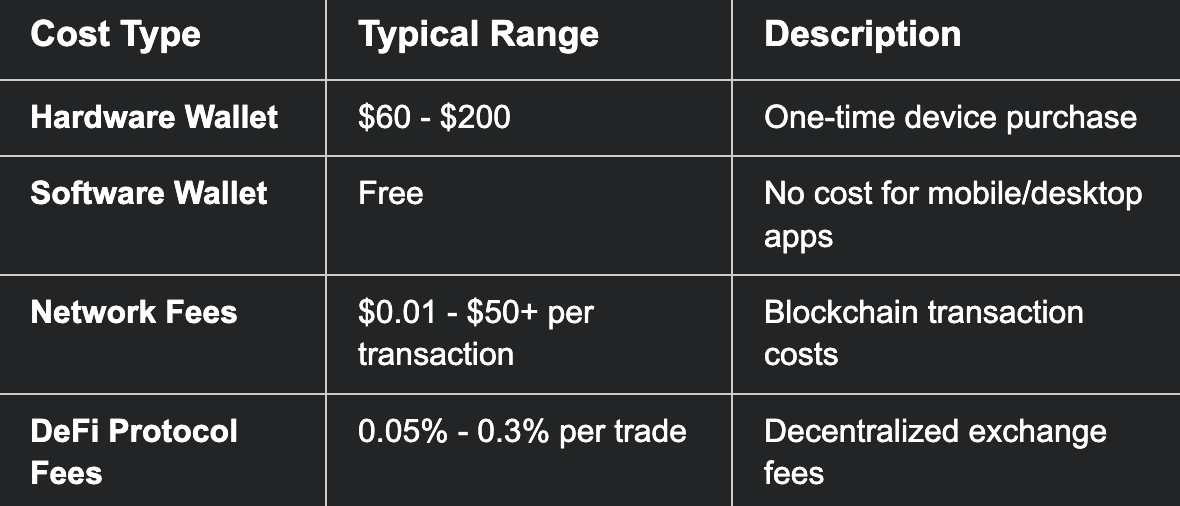

Non-Custodial Wallet Costs

Long-term Cost Advantages: Non-custodial wallets eliminate ongoing service fees, trading commissions, and withdrawal charges. Users pay only blockchain network fees, which are often significantly lower than custodial platform fees for frequent transactions.

Hidden Costs: Failed transactions still incur network fees, and learning curve costs include potential losses from user errors. Additionally, hardware wallet replacement costs should be factored into long-term planning.

Cost-Benefit Analysis

Break-even Analysis: For users making frequent transactions, non-custodial wallets typically become more cost-effective within 3-6 months due to eliminated trading and withdrawal fees. Long-term holders may find hardware wallet costs justified by enhanced security and eliminated counterparty risk.

Total Cost of Ownership: Including security, convenience, and opportunity costs, the optimal choice depends on individual usage patterns, technical competency, and risk tolerance rather than simple fee comparisons.

Hybrid Approach: Using Both Wallet Types

Many experienced cryptocurrency users adopt hybrid strategies, leveraging the advantages of both custodial and non-custodial wallets for different purposes and risk management.

Strategic Allocation

Hot Money vs Cold Storage: A common approach involves using custodial wallets for active trading and daily-use amounts while storing long-term holdings in non-custodial hardware wallets. This strategy balances convenience with security, keeping most assets protected while maintaining trading flexibility.

Risk Diversification: Spreading assets across multiple wallet types and providers reduces the impact of any single point of failure. This approach protects against exchange hacks, user errors, and regulatory actions while maintaining access to various services and features.

Practical Implementation

Custodial for Trading: Use regulated exchanges like Coinbase or Kraken for active trading, taking advantage of advanced order types, margin trading, and instant liquidity. Keep only active trading amounts on exchanges, withdrawing profits regularly to non-custodial storage.

Non-Custodial for Holdings: Store long-term investments in hardware wallets like Ledger or Trezor, benefiting from maximum security and complete control. Use these wallets for DeFi participation, staking, and accessing protocols unavailable on custodial platforms.

Software Wallets for DeFi: Maintain browser-based wallets like MetaMask for DeFi interactions while keeping minimal balances for transaction fees and small experimental positions. This approach provides flexibility while limiting exposure to software wallet risks.

Management Strategies

Regular Rebalancing: Periodically move profits from trading activities to long-term storage, maintaining predetermined allocation percentages across different wallet types and risk levels.

Security Protocols: Implement consistent security practices across all wallet types, including unique passwords, two-factor authentication, and regular security reviews. Maintain detailed records for tax compliance regardless of wallet choice.

Emergency Planning: Develop contingency plans for various scenarios including exchange closures, device failures, and regulatory changes. Ensure access to funds through multiple methods and maintain updated backup procedures.

Future of Crypto Wallets

The cryptocurrency wallet landscape continues evolving rapidly, with emerging technologies and changing user needs driving innovation across both custodial and non-custodial approaches.

Emerging Wallet-as-a-Service (WaaS) solutions enable businesses to integrate digital wallet functionality through APIs without extensive blockchain expertise, reducing deployment complexity and accelerating time-to-market.

Technological Advancements

Account Abstraction: Ethereum's account abstraction improvements will enable more user-friendly wallet experiences, allowing gas fee payments in any token, batch transactions, and social recovery features without compromising self-custody principles.

Cross-Chain Integration: Future wallets will seamlessly handle assets across multiple blockchain networks, automatically optimizing transaction routes and costs while abstracting away technical complexity from end users.

AI-Powered Features: Artificial intelligence integration will provide personalized security recommendations, automatic portfolio rebalancing, and intelligent transaction optimization based on user behavior patterns and market conditions.

Regulatory Evolution

Increased Compliance Requirements: Both custodial and non-custodial wallet providers face expanding regulatory obligations, with potential requirements for enhanced reporting, user verification, and transaction monitoring. These changes may blur traditional distinctions between wallet types as compliance becomes mandatory across the ecosystem.

Global Standardization: International coordination efforts through organizations like FATF are pushing toward unified global standards for cryptocurrency wallet regulation, potentially creating more consistent user experiences across jurisdictions while maintaining local compliance requirements.

Privacy vs Compliance Balance: Future regulations will likely attempt to balance privacy rights with anti-money laundering requirements, potentially creating new categories of semi-custodial or privacy-preserving compliant wallets that satisfy both user preferences and regulatory demands.

User Experience Evolution

Simplified Self-Custody: Emerging technologies like social recovery, biometric authentication, and automated backup systems will make non-custodial wallets more accessible to mainstream users without sacrificing security or control principles.

Institutional Adoption: Growing institutional demand will drive development of enterprise-grade wallet solutions combining the security of self-custody with the compliance and operational features required by traditional financial institutions.

Mobile-First Design: The shift toward mobile-first cryptocurrency adoption will continue driving wallet innovation focused on smartphone integration, simplified interfaces, and seamless integration with existing mobile payment systems.

FAQs

What's the main difference between custodial and non-custodial wallets?

The fundamental difference lies in private key control. Custodial wallets have third parties (like exchanges) hold your private keys, while non-custodial wallets give you complete control over your own keys. This difference affects everything from security responsibilities to recovery options and regulatory compliance.

Which type of wallet is safer?

It depends on your technical competency and risk tolerance. Custodial wallets from reputable providers offer professional security management and insurance coverage, making them safer for beginners. Non-custodial wallets eliminate counterparty risk and provide superior security when proper practices are followed, making them safer for experienced users who can manage their own security effectively.

Can I recover my funds if I lose access to my wallet?

Custodial wallets: Yes, through customer support and identity verification processes. The service provider can restore your account access since they control your private keys.

Non-custodial wallets: Only if you have your seed phrase backup. Without the seed phrase, funds are permanently lost with no recovery mechanism available.

Do I need to pay taxes on crypto held in different wallet types?

Yes, tax obligations are identical regardless of wallet type. You must report capital gains, losses, and income from cryptocurrency activities whether using custodial or non-custodial wallets. The new IRS per-wallet cost basis tracking requirement (effective January 2025) affects both wallet types equally.

Can I use DeFi protocols with custodial wallets?

Generally no. Most custodial wallets don't support direct interaction with DeFi protocols due to regulatory constraints and technical limitations. Some exchanges offer limited DeFi-like services internally, but true DeFi participation typically requires non-custodial wallets like MetaMask or hardware wallets.

Are custodial wallets regulated?

Yes, extensively. Custodial wallet providers must register as Money Service Businesses, implement KYC/AML procedures, comply with Travel Rule requirements, maintain insurance coverage, and submit to regular audits in most jurisdictions.

What happens if a custodial exchange goes bankrupt?

Customer funds are at risk. Despite insurance coverage and segregated storage requirements, exchange bankruptcy can result in customer fund losses, as demonstrated by FTX's collapse in 2022. This counterparty risk represents a key disadvantage of custodial approaches.

How much does it cost to use different wallet types?

Custodial wallets typically charge trading fees (0.1%-0.5%), withdrawal fees ($5-$25+), and may have monthly subscription costs for premium features.

Non-custodial wallets have upfront costs for hardware devices ($60-$200) but only ongoing network transaction fees, often resulting in lower total costs for active users.

Conclusion

The choice between custodial and non-custodial wallets represents one of the most important decisions in cryptocurrency adoption, with far-reaching implications for security, privacy, functionality, and regulatory compliance.

Technical competency remains the primary consideration. Users comfortable with managing private keys, understanding blockchain mechanics, and implementing personal security protocols often benefit from non-custodial approaches that provide maximum control and eliminate counterparty risk.

Use case requirements significantly influence optimal wallet choice. Active traders benefit from custodial platforms' integrated services and liquidity, while DeFi participants require non-custodial wallets for protocol access. Long-term holders often prefer non-custodial storage for maximum security.

Risk tolerance shapes preferences between professional security management with counterparty risk (custodial) versus personal security responsibility with complete control (non-custodial). Neither approach eliminates risk entirely. They simply shift risk types and responsibility.

Glossary

- Cold Wallet: A cryptocurrency wallet that stores private keys offline, typically using hardware devices or paper storage methods, providing maximum security against online attacks.

- Custodial Wallet: A cryptocurrency wallet where a third-party service provider holds and manages the user's private keys, requiring trust in the custodian for fund security and access.

- DeFi (Decentralized Finance): Financial services and applications built on blockchain networks that operate without traditional intermediaries, typically requiring non-custodial wallets for access.

- Hardware Wallet: A physical device designed specifically for cryptocurrency storage that keeps private keys offline and requires physical confirmation for transactions.

- Hot Wallet: A cryptocurrency wallet connected to the internet, enabling convenient transactions but with increased exposure to online security risks.

- KYC (Know Your Customer): Identity verification procedures required by regulated financial services to confirm customer identities and comply with anti-money laundering regulations.

- MPC (Multi-Party Computation): Advanced cryptographic technology that splits private keys into multiple shares.