At Scalable Solutions, we are continuously working on bringing more features and products to our clients and users. On this occasion, we have integrated Perpetual Futures into our white-label digital asset exchange solution. We want to use this space to review exactly what futures are, their characteristics, benefits and more.

Defining Derivatives

Before tackling the question “What are futures?”, we first need to take a step back and understand that a future is part of a broader financial asset category: Derivatives.

A derivative is a contract that derives its value from the price and variation of an underlying asset.

Derivatives have a number of purposes, the main one being hedging against price movements of underlying assets. In fact, the first modern derivatives appeared in the Dutch Republic and Osaka during the 17th century; these were created as vehicles for rice farmers to hedge against the variability of their harvests.

Derivatives can be categorized into different classes — the most commonly known are options, forwards, swaps, and, as you might have deducted, futures. Within each class, the underlying asset can be any type of investment vehicle or financial instrument. It can be equity, bonds, interest rates, commodities, market indexes, etc.

Defining Future Contracts

In traditional financial markets futures contracts are agreements between two parties to buy or sell a company stock, bond, currency, or another instrument at a predetermined price and at a specified time in the future.

Unlike mainstream spot markets, futures contracts do not enable engaged parties to directly purchase or sell the underlying asset. Instead, they trade a representation of the said asset, with the actual trading occurring on settlement days.

Futures contracts are usually cash-settled and — unlike forwards contracts — live within centralized markets with clearinghouses counterparties. Quarterly futures contracts expire every four months, where the price of the future tends to merge with the underlying price. Additionally, we can find perpetual futures. As their name explains, perpetual futures lack prespecified delivery (expiration) dates, allowing indefinite roll-over.

Instead of using daily settlements, perpetual futures contracts use a different mechanism to maintain a direct relationship with the underlying asset — funding.

“Long and short traders exchange a funding cost periodically (say every 8 hours) to reflect the price expectations during each funding interval (i.e. the spread between the perpetual contract price and spot price) and the cost of funding.” [1]

Leverage, margin call and liquidation risk

Futures contracts allow for leverage trading. The most basic understanding of leverage is borrowing/lending money. Traders can carry out trades bigger than their net position (Leverage = 1x), by borrowing money at varying rates (funding rates). In this case, anyone can post trades that are 5x, 10x or even 100x greater than originally possible, while only providing a small security position to ensure that they can pay off any losses. Because of leverage, future markets are very liquid and extremely capital-efficient.

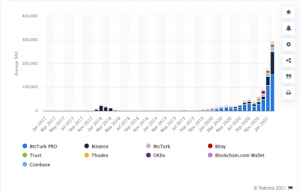

According to The Block Research, the trading volume of BTC and ETH futures in 2021 has risen beyond USD $32 trillion, a 338% increase when compared to 2020.

Also, total spot trading volume on centralized exchanges reached $14 trillion in 2021, 57% less than that of futures.

Source: Volume of BTC and ETH Futures (Jan. 18th, 2022). Coinglass.

Still, in order to borrow funds, users need to post collateral; this is also otherwise known as ‘initial margin’ (the minimum value you must pay to open a leveraged position). In addition to the initial margin, traders need to maintain a certain ‘maintenance margin’; this is the minimum amount of collateral that must be held to keep a trading position open. In those cases where the margin balance drops below the maintenance level, traders will receive a margin call (asking them to add more funds to their account). If the margin is not met, the exchange will trigger a position liquidation, draining a trader’s funds and leaving them with no spot asset.

You can find more on margin trading, options and futures in our blog.

Advantages of Futures Contracts

Below you can find the most common uses and advantages of futures contracts.

- Futures enable hedging and risk management by providing exposure to many assets.

- When expecting an adverse price movement, traders can post short positions and take advantage of the downward movement. This case would not be possible if one could just buy and sell spot positions alone.

- Traders can enter positions that are larger than their account balance by the use of leverage — borrowing funds from liquidity providers in order to carry out big trades and realize greater profits.

- Futures markets tend to improve the liquidity of any asset pair.

Scalable Solutions Exchanges

Scalable has integrated Perpetual Futures into its white-label exchange solution. The feature is now available under the “Futures” tab, along with a futures market overview for the current time and the updated Terms of Trading. Currently, Scalable exchanges support the most predominant perpetual futures tokens, and is working on including several more.

The current list includes:

BTC, ETC, LINK, ADA, LUNA, SOL, DOT, BNB, MATIC, EOS, AVAX, LTC, SHIB, TRX, MANA, ZEC, XLM, UNI, AAVE, XRP, BCH AND HIT.

You can get in touch with our team to schedule a demo or find out more about Scalable’s white label exchange infrastructure and features.

References

[1] “What Are Perpetual Contracts?” Bybit Learn, 10 Nov. 2021, https://learn.bybit.com/trading/what-are-perpetual-contracts/.