Introduction

Following our series of posts regarding DeFi, we’ll take the opportunity to dive deeper into exchanges. We will carry out a brief introduction and jump straight into the technicalities that characterize exchanges.

What are Exchanges?

As initially described in our article on the Decentralization of Finance, exchanges are traditional financial institutions that act as intermediaries between parties. Exchanges function as marketplaces and bring together users that intend to trade different assets. Historically, only physical assets (such as commodities) could be traded in these exchanges, but this has evolved by leveraging the benefits of technology, thus establishing online venues to shorten the distance between participants. Nowadays, the most frequent assets traded on these exchanges include not only commodities, but also derivatives and other financial instruments (stocks, bonds, etc).

How do Exchanges work?

Traditional (centralized) exchanges (CEX) are run by organizations that oversee their day-to-day operations such as (technical) maintenance, security, and growth. Essentially, they provide a chain of direct services that include Custody, Transfer and Matching. The opening part of a classic exchange process can be summarized as:

- Users deposit funds from a “personal” account into exchange’s account

- Funds go to custody storage

- Increased balance on trading account

- User is able to trade

Nonetheless, background processes entail dynamic interactions between various agents that transfer detailed information, such as regulatory bodies (SEC, for example), brokers, various markets (primary, OTC), electronic communication networks, exchange’s and users “wallets,” and others.

The specific attributes of exchanges that are valuable depend on whether the participant is a user, market maker, the exchange handler, etc. There are, however, some that share common ground and are of vital importance, influencing the economic outcome of those involved:

Scalability and its costs. Traditional exchanges still possess the largest quantity of players and deepest order books.

Custody – Security. Centralized exchanges have custody of their users’ funds. Having loose security over custodial wallets produce an incentive for hacker attacks. Plenty of hacks have been carried out on exchanges over the past nine years, with losses exceeding USD 300 million in 2019 alone [1].

Established clients. Regardless of the ground-breaking technology an exchange may be based on, it will not thrive without a base of market makers that can provide liquidity at scale. Liquidity is provided by market makers (suppliers), and taken by retail and large institutions (demand). An intrinsic circular problem persists in that mass adoption is required to generate liquidity (attract market makers), but liquidity is in itself a driver of adoption (demand users). Essentially, liquidity breeds liquidity.

Latency. Fundamentally, this is the time it takes for a transaction to make a round trip and be processed. The lower the latency, the better it is for taking advantage of market opportunities and the lower probability of being taken advantage of.

Up/down time. Since cryptocurrencies are highly volatile and listed on hundreds of secondary markets, exchange downtime means major losses for the user in terms of opportunity costs, not to mention the importance of the possibility to swiftly unwind losing positions [2].

Back office. Regulatory authorities require KYC (Know Your Customer) and AML (Anti Money Laundering) applications to oversee market practices in the spirit of protecting customers. It can be seen as both a benefit or a disadvantage, having to provide personal information as a requirement for trading digital assets in centralized exchanges.

A list of advantages and disadvantages of classic CEX includes but is not limited to:

| Advantages | Disadvantages |

| High liquidity | |

| Margin trading | Custody Risks |

| HFT & Algorithms | Regulation |

| Fiat Bank Accounts | No anonymity |

| More trading pairs |

Decentralized Exchanges

Alternatively, state-of-the-art Decentralized Exchanges (DEX) operate through a set of rules – or smart contracts – that allow users to trade cryptocurrencies in a peer-to-peer manner. The most common platform to create DEXs is Ethereum, a public network (blockchain) that provides first layer infrastructure that anyone can develop on.

A true decentralized exchange needs no accounts, sign-ups from users, or any form of ID verification. It also minimizes or avoids altogether major fees seen with centralized exchanges (deposit, withdrawal, transactional fees, and the like). There are, however, transaction fees [3] that pertain to the blockchain use and are conventionally denominated ‘gas’ prices for executing smart contracts.

Still, the main attribute that defines them is that they are non-custodial. Essentially, DEX doesn’t have access (either through custodial wallets or private keys) over users’ funds.

These key characteristics of DEX introduce some much needed advantages over traditional exchanges; the anonymity that comes from no registration processes, the relative safeness in the face of honey-pot hacking [4], transparency, and lower costs.

In contrast to centralized exchanges who can trade crypto-to-fiat (USD, EUR), DEX can only trade crypto-to-crypto pairs. The reason behind this difference mainly resides in KYC and other regulations. Analogously, DEX can currently only provide a small number of market orders (buy, sell, stop limit, etc) when compared to its centralized counterpart, and is only now developing other services (such as margin trading).

The path to fully decentralized exchanges

Even with the cardinal improvements on Blockchain technology applied to exchanges, there is still a considerable way to go to achieve full decentralization [5]. The road included advances that evolved from traditional central limit order book, to off-chain order book, off-chain execution/on-chain settlement, and automatic market makers (AMM). These advances are often thought out to be enhancements over specific CEX shortcomings, but end up with difficulties of their own.

DEX and the impact on Liquidity

As we previously mentioned here, at SCALABLE we believe liquidity to be a major factor to the success of any exchange. Unfortunately, it is a characteristic that DEX has yet to conquer. This resides in the current ability of DEX to only handle a fraction of the volume of CEX, impeding the back and forth conversion of large amounts of currency.

Some inherent issues in decentralized exchanges that affect its ability to challenge centralized liquidity include:

- On chain trade collision. Open order-book methods allow for various market “takers” to simultaneously attempt to fill the same order.

- Limited exchange pairs. The decentralized nature prevents the option of exchange participants to trade crypto-fiat currency pairs.

- Front-running. Open order-book methods also permit front-runners (actors that gain the ability to see order flow before it is processed) profit by placing intermittent trades with a higher transaction fee, incentivizing miners to include their transaction in the block ahead of the trade they were able to view in the order book. There are indications that next-gen DEX [5] can resolve this issue by adopting the concept of virtual balances.

- False liquidity. In a series of cases, exchange handlers faked their order book by replicating other exchanges [6].

There are, however, projects that aim to algorithmically provide liquidity utilizing automated market makers (AMM). Uniswap, for instance, is getting predominant attention. Buyers and sellers pull liquidity from the smart contract directly and receive a price quote based on the token quantity desired and the liquidity available. Uniswap will always quote a price regardless of the order size by asymptotically increasing the price as the size of the order increases.

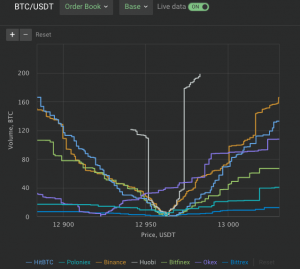

Below we can appreciate the liquidity of the main crypto trading pairs on coin360. coin360 provides data aggregation services on the different liquidity pools on trading pairs over various exchanges, as well as their price quotations and spreads for distinct order sizes. Tight quotation differences for various order sizes minimizes slippage in trades, a characteristic specially dominant for traders or institutional participants who execute sizeable trades.

Source: coin360 liquidity book [7]

Source: coin360 liquidity book [7]

Main exchange’s order books for BTC/USDT, price/volume data

Main exchange’s order books for BTC/USDT, price/volume data

Conclusion

Despite constant advances in the exchange space relating to centralization and its shortcomings, there is still a long road ahead of improvements to carry out before reaching full decentralization for those that desire it. Centralized exchanges continue to carry a range of benefits that give their users peace of mind and easier accessibility to trading, such as choice when it comes to matching pairs and ability to buy cryptocurrencies with fiat. KYC and AML practices can also provide a sense of security for exchange users.

SCALABLE Exchange Technology

At SCALABLE, we are committed to provide the best of both worlds. Through our technology, we’ve helped a multitude of both centralized and decentralized exchanges launch and grow to new heights. Our exchanges speed meets the highest industry standards with door to-door latency of less than 800 microseconds, sophisticated cryptography and robust internal controls to form an all-in-one solution that has never been compromised, direct orders to the industry’s deepest books, and up-time > 99.99% under institutional grade SLA.

References:

[1] “A Comprehensive List of Cryptocurrency Exchange Hacks.” SelfKey, 13 Feb. 2020, selfkey.org/list-of-cryptocurrency-exchange-hacks/.

[2] K. Christidis and M. Devetsikiotis, “Blockchains and Smart Contracts for the Internet of Things,” in IEEE Access, vol. 4, pp. 2292-2303, 2016, doi: 10.1109/ACCESS.2016.2566339.

[3] These fees can be quite sizable for small traders when inefficient systems are used, such as Ethereum.

[4] In January 2018, Kraken initiated an upgrade estimated to take 2 hours that ended being +48 hours down and costing users thousands of dollars.

[5] Such is the case of Synthetix.Exchange’s improvement proposal. To account for front-running, the post-trade waiting period gives oracle the time to verify between the new prices and initial ones, and in case the price was affected by the trade, the trader is now owed/owes Synth. The process repeats itself, calling a settle function that settles each trade difference.

[6] Lin, L. X. (2019). Deconstructing decentralized exchanges. Stanford Journal of Blockchain Law & Policy, 58-77.

[6] Shevchenko, Andrey. “For Some Reason, Wash Trading Happens on Decentralized Exchanges Too.” Cointelegraph, Cointelegraph, 25 July 2020, cointelegraph.com/news/for-some-reason-wash-trading-happens-on-decentralized-exchanges-too.

[7] https://coin360.com/liquidity-book. Accessed October 23nd, 2020 at 13.30 UK time.

General sources:

“All You Need to Know About A Decentralized Exchange.” ICOholder Blog, 7 Dec. 2018, icoholder.com/blog/decentralized-exchange/.

CoinGecko, Ong, B., Lee, T. M., Lau, D., Azmi, E., Kho, K., Jin, T. S., … Gries, M. (2020). How to DeFi.

“Decentralized Exchanges vs. Centralized Exchanges: Overview.” ConsenSys, consensys.net/blog/news/decentralized-exchanges-overview-benefits-and-advantages-over-centralized-exchanges/.

Deme, Balazs. “Decentralized vs. Centralized Exchanges.” Medium, Herdius, 24 Jan. 2018, medium.com/herdius/decentralized-vs-centralized-exchanges-bdcda191f767.

Wearn, Alex. “CEXs Vs. DEXs: The Future Battle Lines.” CoinDesk, CoinDesk, 5 Oct. 2020, www.coindesk.com/cexs-vs-dexs-the-future-battle-lines.

“What Is a Decentralized Exchange(DEX)?” DCX Learn, 19 Mar. 2020, www.dcxlearn.com/trading/what-is-a-decentralized-exchange-dex-2/.

Xie, Linda J. “A Beginner’s Guide to DeFi.” NAKAMOTO, NAKAMOTO, 4 Jan. 2020, nakamoto.com/beginners-guide-to-defi/.