Key takeaways

- July became the second worst month on the cryptocurrency market this year by spot volume after June.

- Bitcoin volume on the derivative market was cut down by more than 10%. Unlike Bitcoin, trades of Ethereum derivatives improved.

- Since the beginning of July 2022, aggregated OI of crypto futures increased by 37%.

- Futures market recorded two large liquidations of more than $500 million, mainly ETH futures.

- Bitcoin and Ethereum prices went up by 21% and 60% correspondingly.

- Market cap as of August 1, 2022, achieved $1.13 trillion, which is 21% higher than in June.

- Variant raised $450m in venture financing; Multicoin Capital created a $430M venture fund.

Spot Market

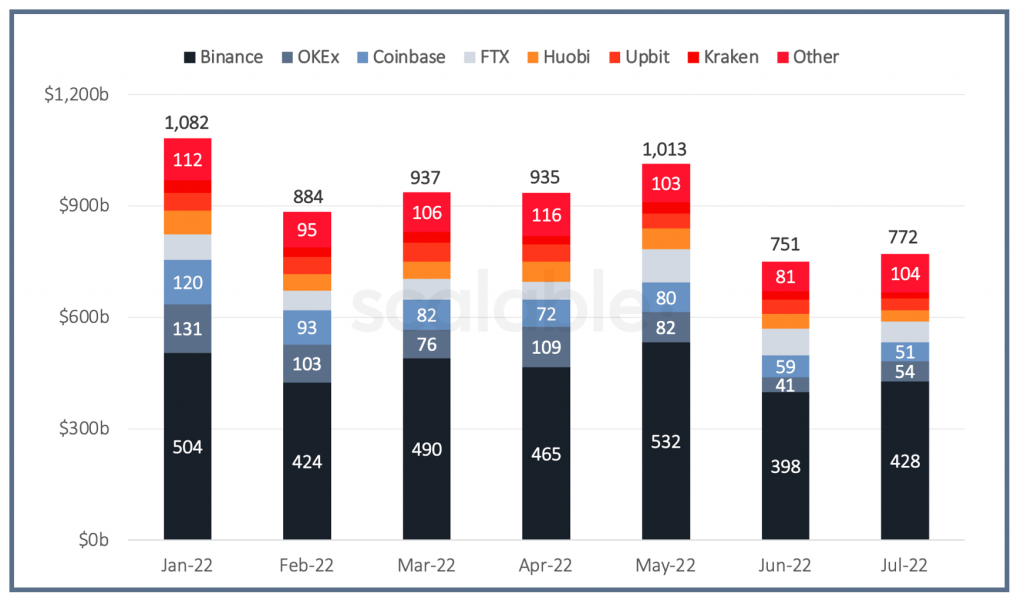

- Trading volume on 10 leading exchanges in July 2022 slightly increased compared to the previous month and totaled $772 billion.

- It became the second worst month on the cryptocurrency market this year in terms of spot volume after June 2022.

Note: Other Category includes Kucoin and Gate.io

While in June 2022 crypto exchanges experienced a strong downtrend in spot trades, in July we saw a spot trades recovery on Binance ($428b, +8% m-o-m) and OKEx ($54b, +31% m-o-m).

The rest of the tier-1 spot crypto exchanges demonstrated a negative dynamic in trades versus the previous month:

- Coinbase: $51 billion (-14% m-o-m)

- FTX: $56 billion (-22% m-o-m)

- Huobi: $31 billion (-22% m-o-m)

- Upbit: $31 billion (-19% m-o-m)

- Kraken: $17 billion (-21% m-o-m)

As of July 2022, market share of spot cryptocurrency exchanges by trades are as follows:

- Binance (~55%)

- FTX, OKEx and Coinbase (~7% per each)

- Huobi and Upbit (~5% per each)

- Kraken (~2%)

- Other (~12%)

Futures Market: Volume & OI

1| Volume

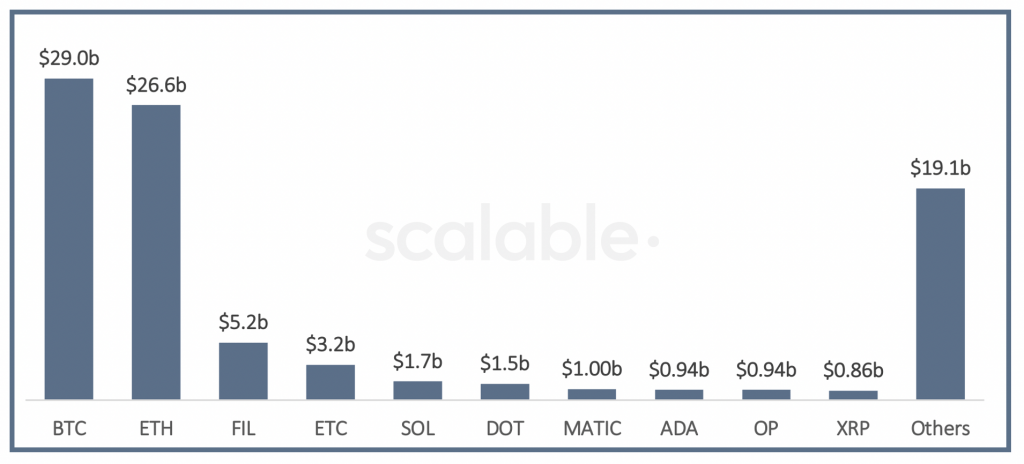

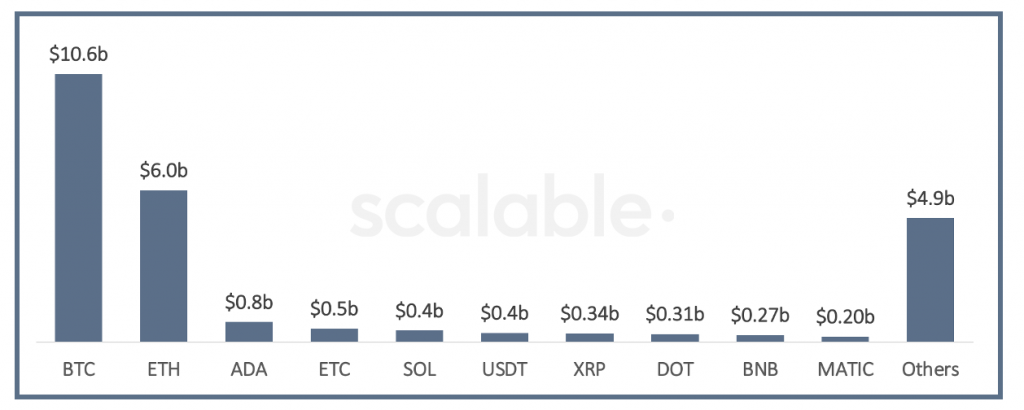

- As of 1 August 2022, Bitcoin and Ethereum futures comprise 62% of daily trading;

- Among other coins for futures trading the most popular are Filecoin, Ethereum Classic, and Solana.

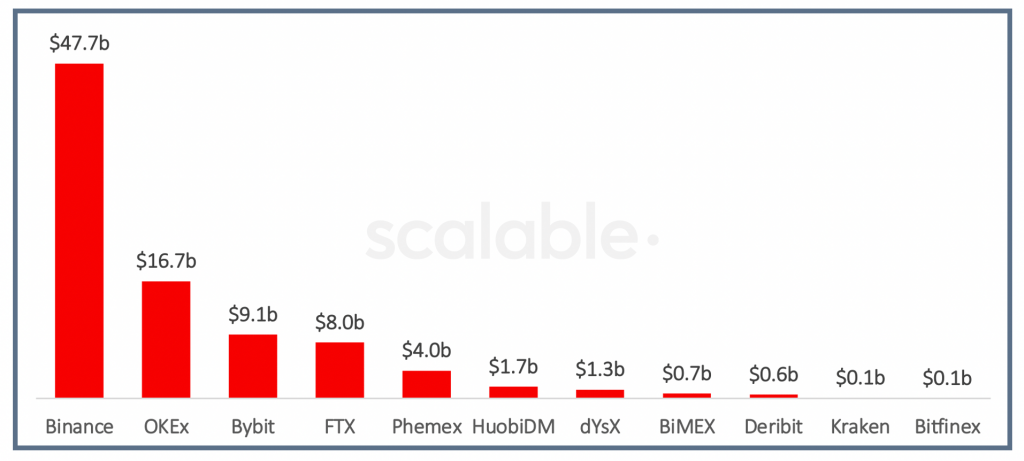

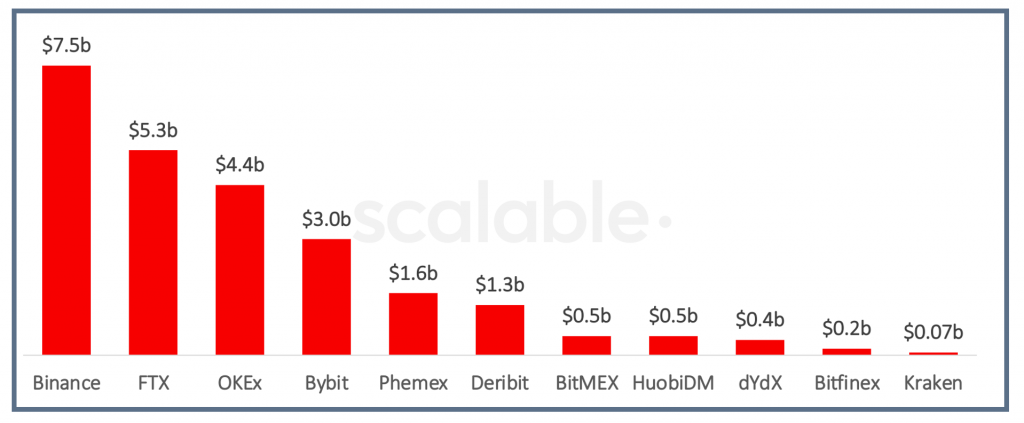

As of 1 August 2022, Binance, Okex, Bybit, CME (not presented), Bitget (not presented), and FTX are top 6 cryptocurrency exchanges by daily futures trading, which forms around 99% of daily trades.

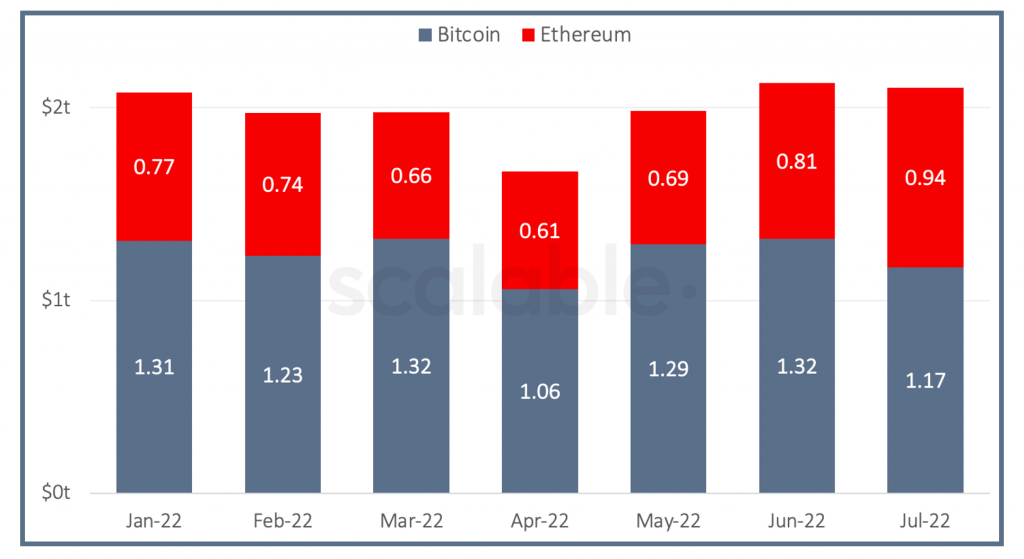

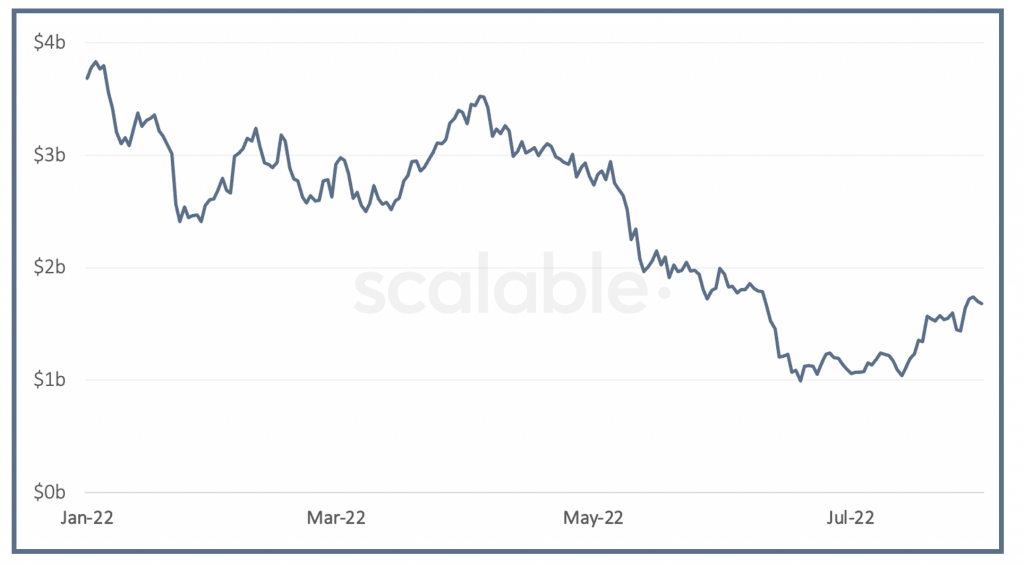

- After a gradual increase in May and June, the total trading volume of Bitcoin futures across leading cryptocurrency exchanges, in dollar terms, reduced by 11% in July to $1.17t. All cryptocurrency platforms offering BTC futures demonstrated a volume shrink;

- Unlike BTC, the volume of futures contracts of Ethereum showed progressive growth for 3 months in a row, with a 16% increase to $0.94t in July.

2| Open Interest

Definition: Open interest is the total number of outstanding contracts that are held by market participants at the end of each day. Open interest measures the total level of activity in the futures market.

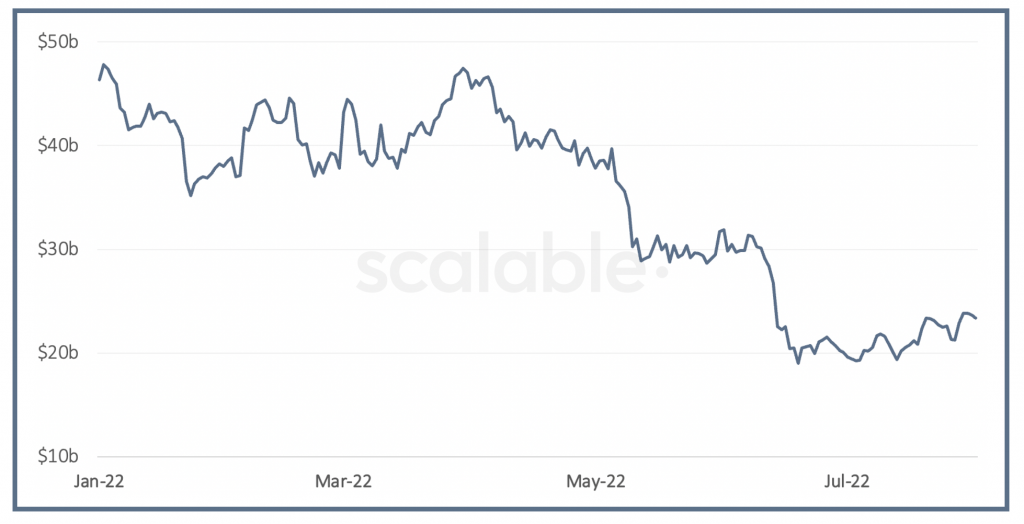

- Since the beginning of July, aggregated open interest (OI) of crypto futures increased by 37% and achieved $25b at the end of the month. In particular, OI on Bitcoin futures increased by 31%, and on Ethereum futures by 50%.

- As of 1 August 2022, dominance by open interest on the futures market is distributed as follows: BTC (42%), ETH (25%), and Others (33%).

As of 1 August 2022, Binance, FTX, Okex, Bybit, CME (not presented), and Bitget (not presented) are the top 6 cryptocurrency exchanges by open interest, which form around 99% of total open interest on the cryptocurrency market.

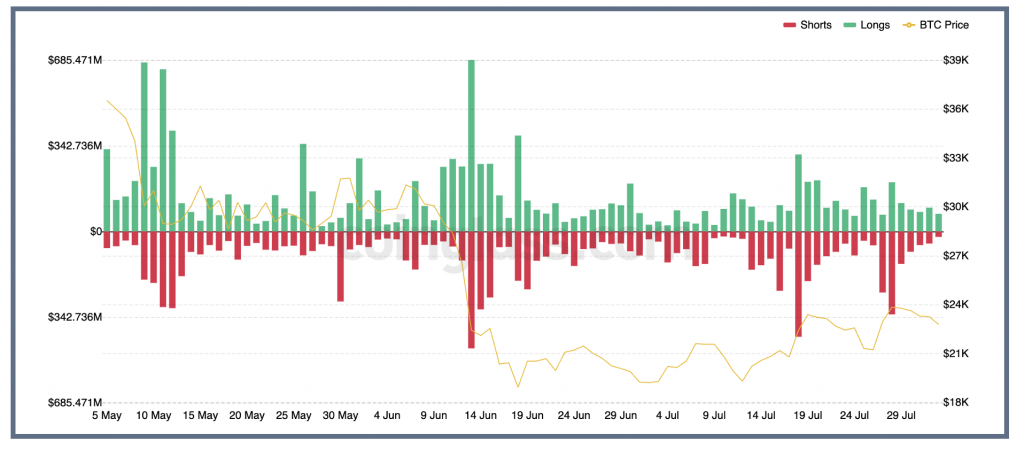

3| Liquidations

- During July, the largest liquidations on the futures market of more than $500M were recorded on 18 July ($730M) and 28 July ($529M), mainly on FTX and Okex.

- More than 50% of the total liquidation amount is accounted for Ethereum futures, where ETH price had shot up by 18%.

Options Market: Volume & OI

1| Volume

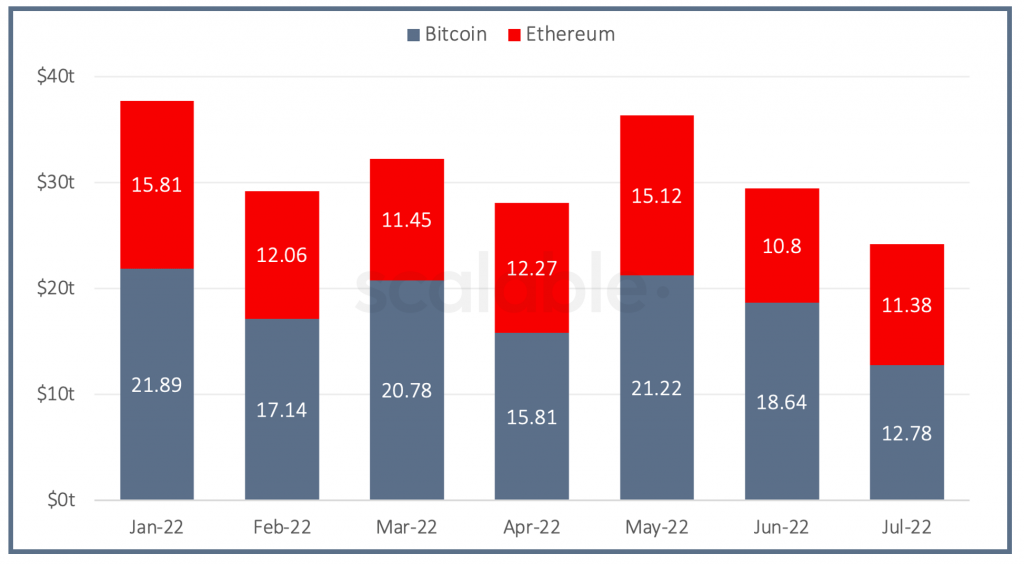

- Bitcoin options trading in July continued to slow down and achieved $12.8t, while trades on Ethereum options speeded up by 6% to $11.4t.

- CME derivatives remain a reliable metric for gauging “institutional” interest in digital assets. Month-on-month, the CME volume of Bitcoin options in July crashed down by 44% to $391m, the lowest seen since April 2022.

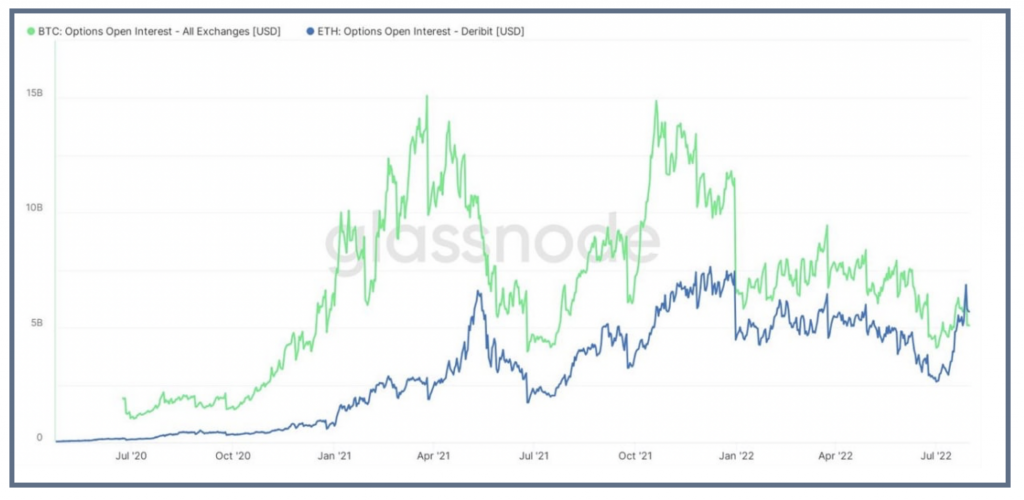

2| Open Interest

- In August 2022, open interest in Ethereum-based options exceeded OI of Bitcoin-based options for the first time in history.

- As of 1 August 2022, aggregated open interest (OI) across BTC and ETH options was $5.15b and $5.85b correspondingly.

- Deribit continues to be an unrivaled leader in the options market. The exchange has ~$10b of OI on Bitcoin and Ethereum options and as of 1 August 2022, which comprises ~92% of total OI.

- Open interest of CME Bitcoin options is $591m as of August 1, 2022, which is ~12% of total open interest.

Dynamics of Leading Assets

- Since the beginning of July, Bitcoin price went up by 20.6%, and it reached $23.6k at the end of the month.

- The second largest cryptocurrency Ethereum grew by 60% and reached $1.67k.

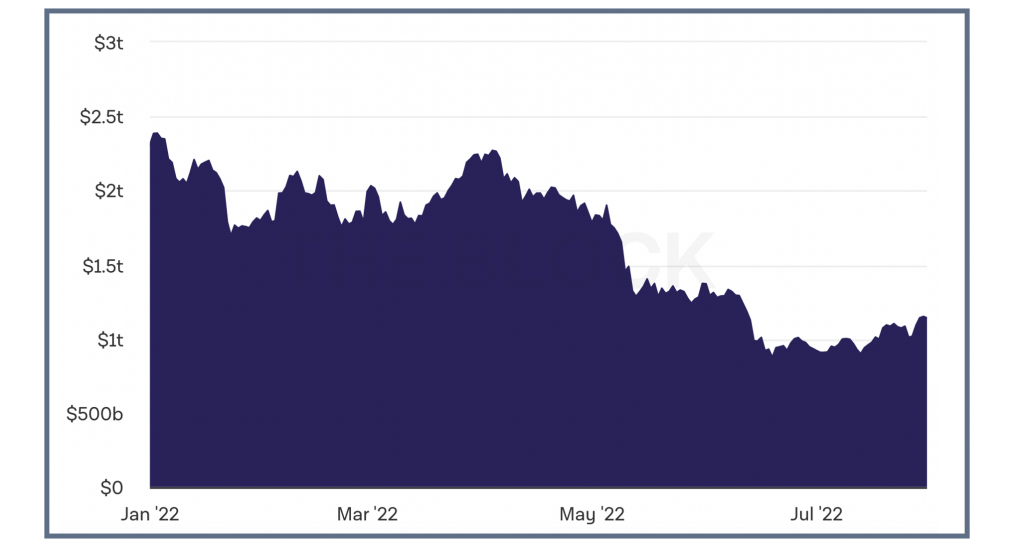

Market Capitalization

Total capitalization of the cryptocurrency market as of August 1, 2022, was $1.13 trillion, which is 21% higher compared to the capitalization of the end of June.

Large Venture Rounds & Venture Funds

- Crypto venture investment firm Variant has raised $450 million across two new funds targeting Web3 and decentralized finance [1]

- Multicoin Capital announced the creation of a $430M venture fund to invest in early and later-stage projects. [9]

- The Safe digital asset management platform, formerly known as Gnosis Safe, has raised $100 million in a strategic venture round.[3]

- Layer 1 blockchain Aptos Labs, which is made up of former employees from Facebook parent Meta Platforms, raised $150 million in a Series A funding round led by FTX Ventures and Jump Crypto.[7]

- Blockchain layer 1 network 5ire has raised $100 million in Series A funding from U.K.-based conglomerate Sram and Mram. [10]

- Gaming VC firm Konvoy Ventures raises a $150 million fund to invest in blockchain games. [8]

References

- Chapparo, F. “Variant raises $450 million for two new venture funds”. The Block, 28 July, 2022

- CoinGecko. 1 August, 2022. https://www.coingecko.com/

- Coinglass, 1 August 2022, URL: https://www.coinglass.com/pro

- Crawley, J. “Gnosis Safe Rebrands as Safe, Raises $100M”. CoinDesk, 12 July, 2022

- “Futures Markets Global Charts”. Coinalyze, August 11, 2022. URL: https://ru.coinalyze.net/futures-data/global-charts/

- Glassnode Insights. 1 August, 2022. https://insights.glassnode.com/

- Knight, O. “Aptos Labs Raises $150M in Funding Round Led by FTX Ventures”. CoinDesk, 25 July, 2022

- Miller, H. “Gaming VC Firm Konvoy Ventures Raises $150 Million Fund”. Bloomberg, 06 July, 2022.

- Napolitano, E. “Multicoin Capital Announces $430M Venture Fund for Crypto Startups”. CoinDesk, 12 July, 2022

- Singh, A. “5ire Raises $100M to Fund Expansion of Sustainable Blockchain”. CoinDesk, 15 July, 2022

- The Block Crypto, 1 August, 2022, URL: https://www.theblockcrypto.com/data/crypto-markets/