Key Takeaways:

- In the first half of 2022, aggregated trading volume on the leading spot cryptocurrency exchanges decreased by 35% compared to the second part of 2021.

- In H1 2022 Bitcoin aggregated trading volume on the derivative market cut down by more than 20% versus H2 2021. Ethereum trading volume on the futures market dropped by 15%, while it was improved by 32% on the options market.

- The aggregated open interest of Bitcoin and Ethereum futures fluctuated steadily month-over-month in the first semester of 2022.

- Around ten large liquidations of more than $500 million were recorded on the futures market during the first half of the year.

- Since the beginning of the year, Bitcoin and Ethereum prices went down by 58% and 72% correspondingly, updating their local minimums.

- As of June 30, 2022, market capitalization is $893 billion, a local minimum since January 2021.

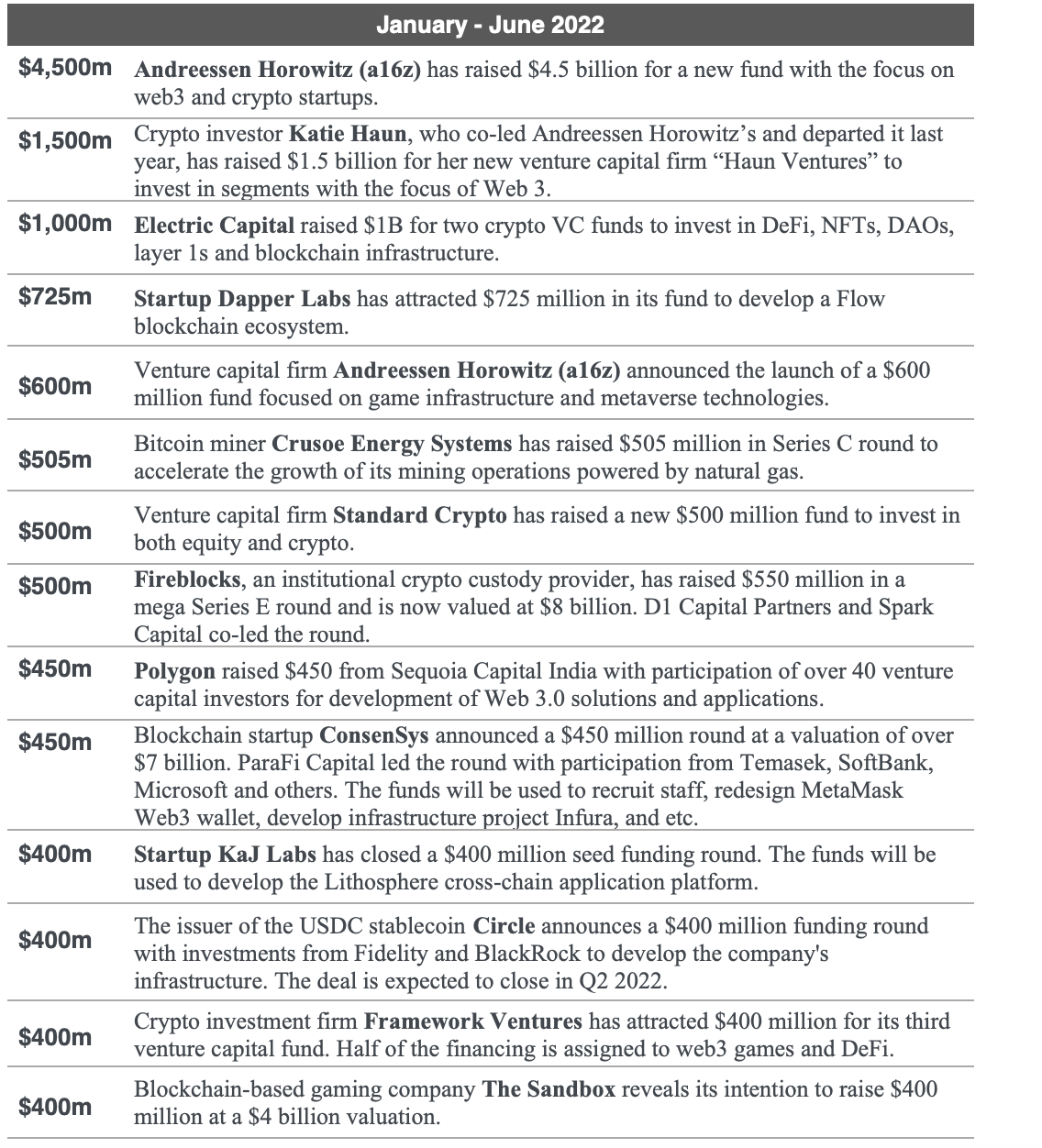

- A16z, Katie Haun, Electric Capital raised more than $1 billion in venture funding rounds in H1 2022.

- M&A activity: Wyre was acquired by Bolt; Sam Bankman-Fried bought a 7.6% stake in Robinhood; OpenSea acquired Gem.

Spot Market

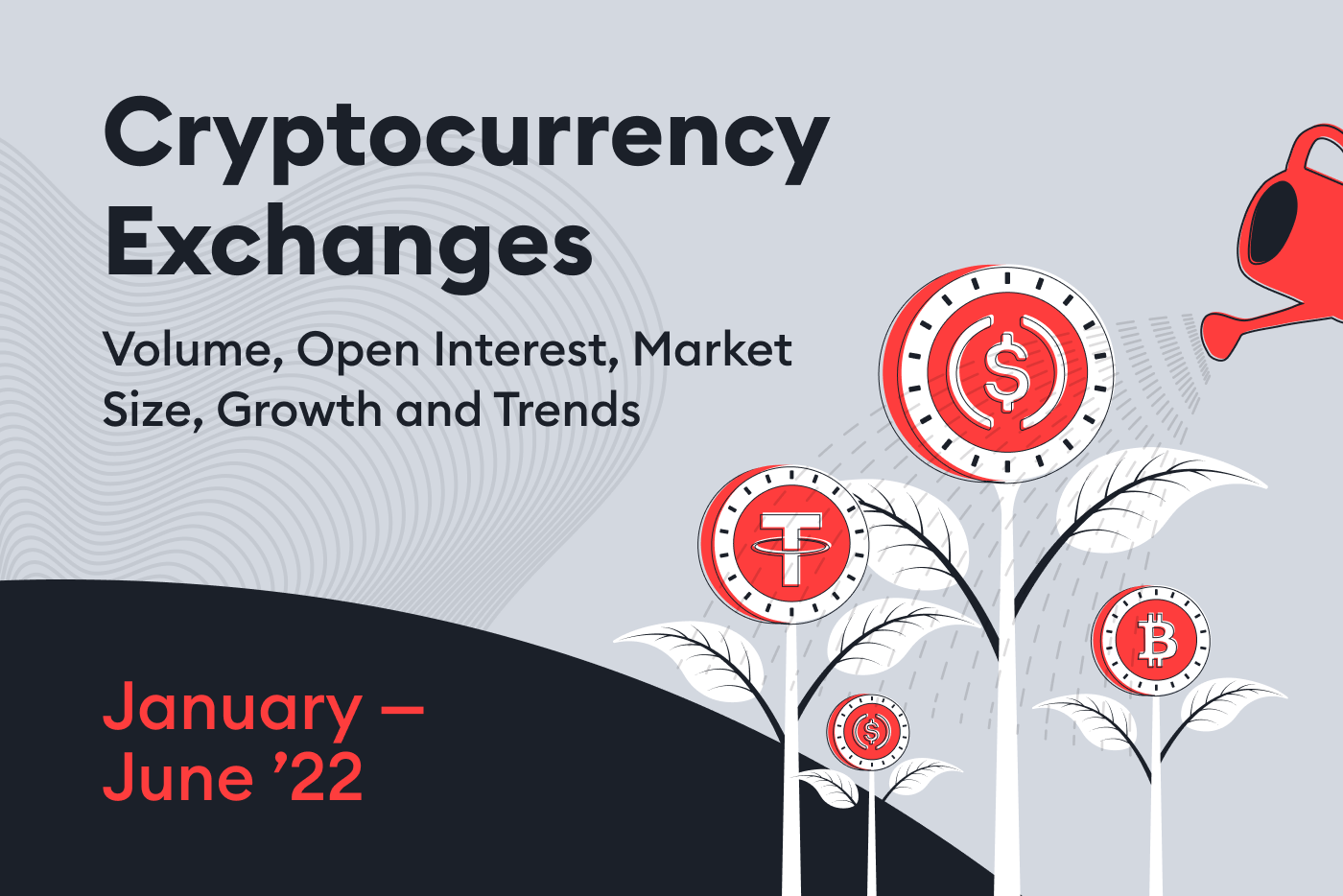

According to The Block [2], trading volume on the 10 leading exchanges in H1 2022 reached $5.6 trillion, which is almost twice lower than in the first semester of 2021 and 35% less than in the second part of 2021.

In January — June 2022 we haven’t seen much volatility, where monthly trading volumes were consolidated within the $0.8 — $1.1 trillion range, while in the previous half of the year spot trading volume varied in the $0.8 — $1.7 trillion range.

In 2022 the highest monthly trading volume of $1.1 trillion corresponds to January.

Graph 1. Cryptocurrency Exchange Volume [2]

Note: Other Category includes Kucoin, Gate.io, and LMAX Digital

As of June 2022, Binance holds the dominant position across cryptocurrency exchanges on the spot market with a market share of ~53%, followed by FTX ~10%, Coinbase ~8%, OKEx ~6%, Huobi ~5%, and Upbit ~5%.

In the first half of 2022 versus the latter half of 2021, most of the leading spot exchanges experienced a downtrend in spot trading volumes:

- Binance: $2.8 trillion (-37% vs H2 2021),

- OKEx: $543 billion (-46% vs H2 2021),

- Coinbase: $506 billion (-31% vs H2 2021),

- FTX: $384 billion (-13% vs H2 2021),

- Huobi: $307 billion (-63% vs H2 2021)

- Upbit: $271 billion (-33% vs H2 2021)

- Kraken: $163 billion (-29% vs H2 2021)

Trading volume on Kucoin and Gate.io evidenced not typical behavior for crypto providers in H1 2022, with a 138% increase in trading volume on Kucoin versus H2 2021 ($256 billion in H1 2022) and 56% growth in trading volume on Gate.io ($237 billion in H1 2022).

Futures Market

1) Futures Volume

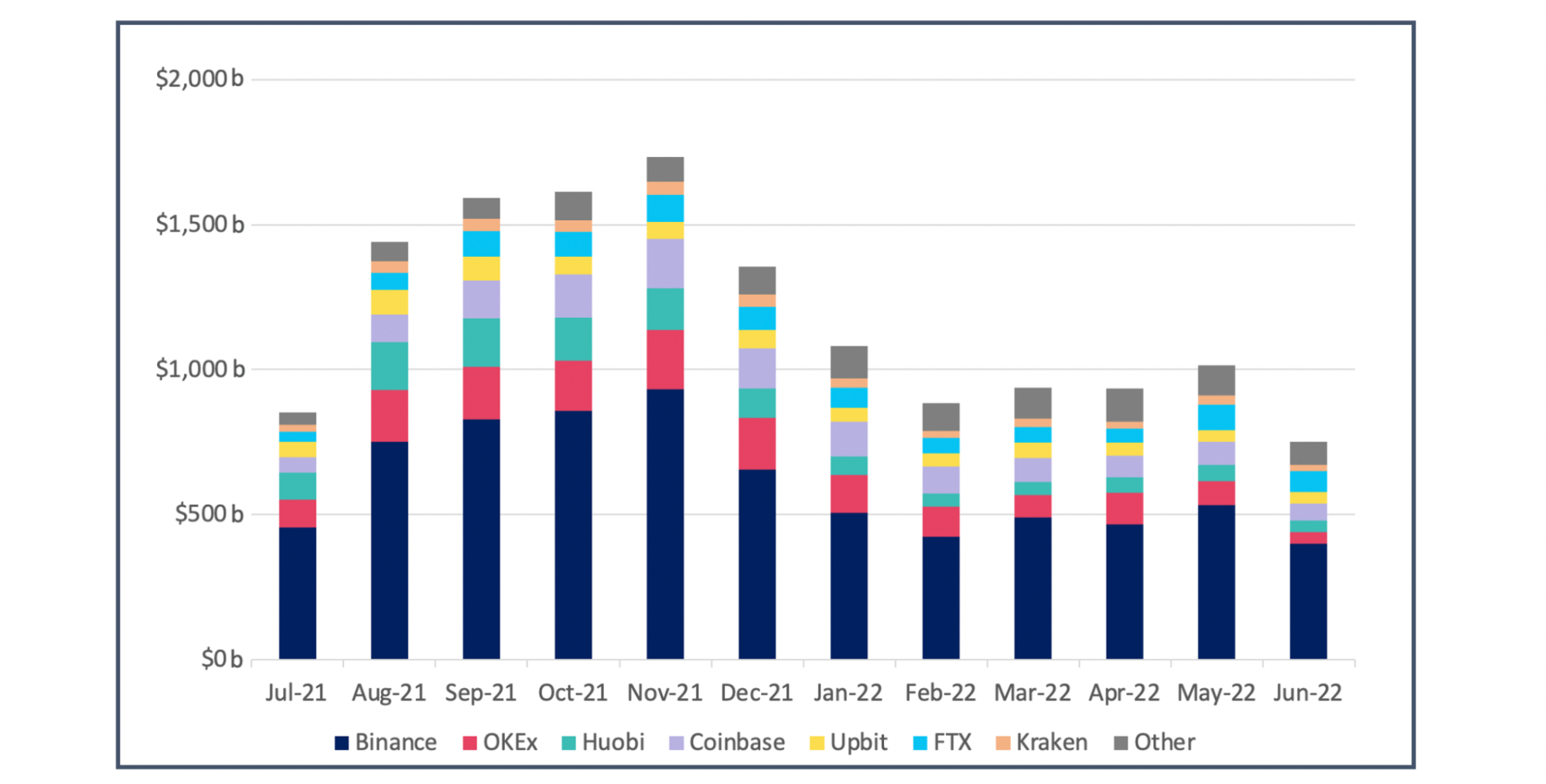

In 2022, interest in the derivative market remained high, total trading volume varied moderately during the year.

- In the first half of 2022, the total trading volume of Bitcoin futures across the largest exchanges with trustworthy reporting metrics achieved $7.5 trillion, which is 19% less compared to H2 2021.

- Alike Bitcoin, futures contracts on Ethereum dropped to $4.3 trillion in H1 2022 compared to the previous half of the year. The drop amounted to 15%.

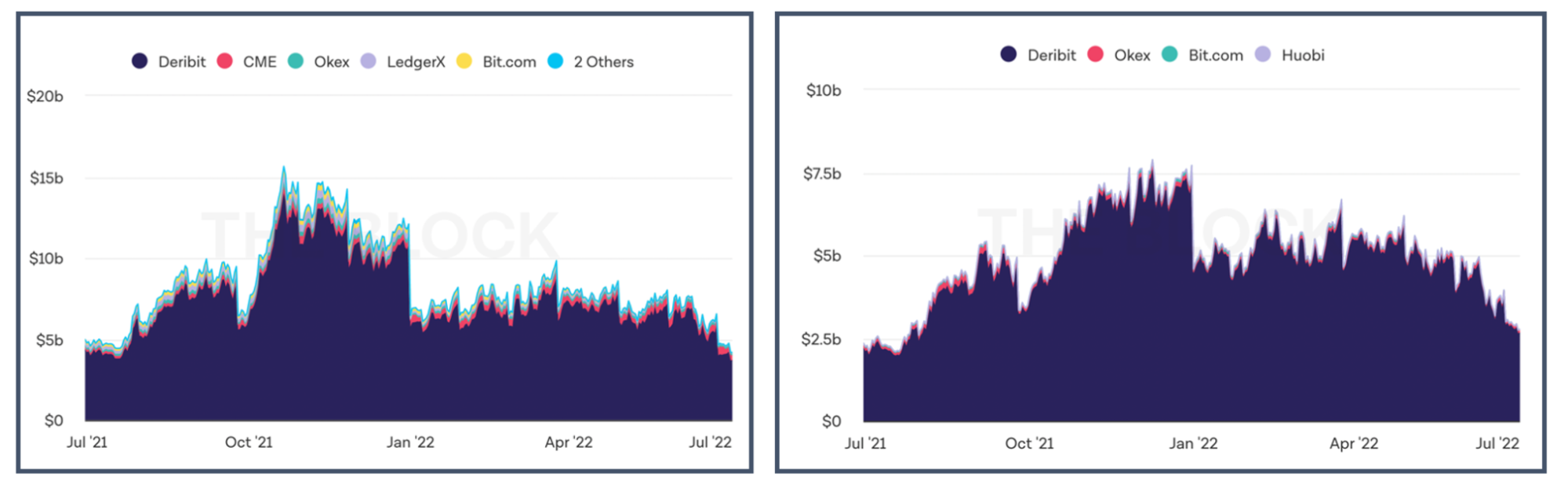

Graph 2. Volume of Bitcoin Futures [2] Graph 3. Volume of Ethereum Futures [2]

2) Aggregated Open Interest

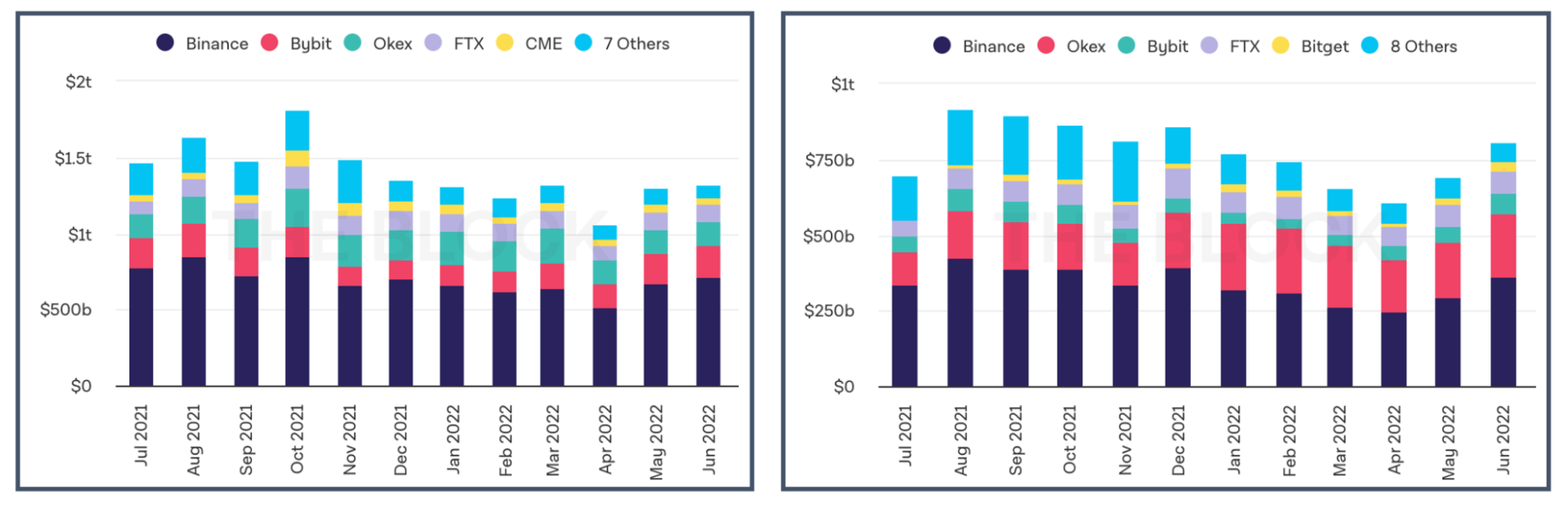

2.1 Bitcoin futures

- Aggregated open interest (OI) of Bitcoin futures on the largest exchanges with trustworthy reporting metrics fluctuated steadily month-over-month in the first semester of 2022 in comparison with last year. It reached its lowest value of $9.4 billion at the end of June. This value corresponds to the results of June 2021, where daily aggregated OI was $10-$12 billion.

- In April 2021 and November 2021, aggregated open interest of Bitcoin futures reached local maximums with a daily interest of more than $26 billion.

- Binance takes the biggest stake in the open interest of futures contracts across cryptocurrency exchanges, and its share continues to grow.

- At the end of June, the share of open interest of Bitcoin futures was the following: Binance (30%), Okex (16%), FTX (11%), CME (14%), Bybit (13%), and others (16%).

2.1 Ethereum futures

- The aggregated open interest of Ethereum futures showed similar dynamics to Bitcoin futures. The estimated notional value of all open Ethereum futures positions demonstrated a downtrend since April 2022 and at the end of June, it dropped to a new low of $5 billion. This downtrend was accompanied by many liquidations predominantly of long positions in May and June.

- At the end of June, the share of open interest of Bitcoin futures was the following: Binance (29%), FTX (19%), Okex (16%), Bybit (10%), Bitget (7%), and others (19%).

3) Long/ Short ratio

According to The Block [2], in June 2022, there was strong domination of BTC long positions over short positions on Binance, which indicates bullish investor sentiment.

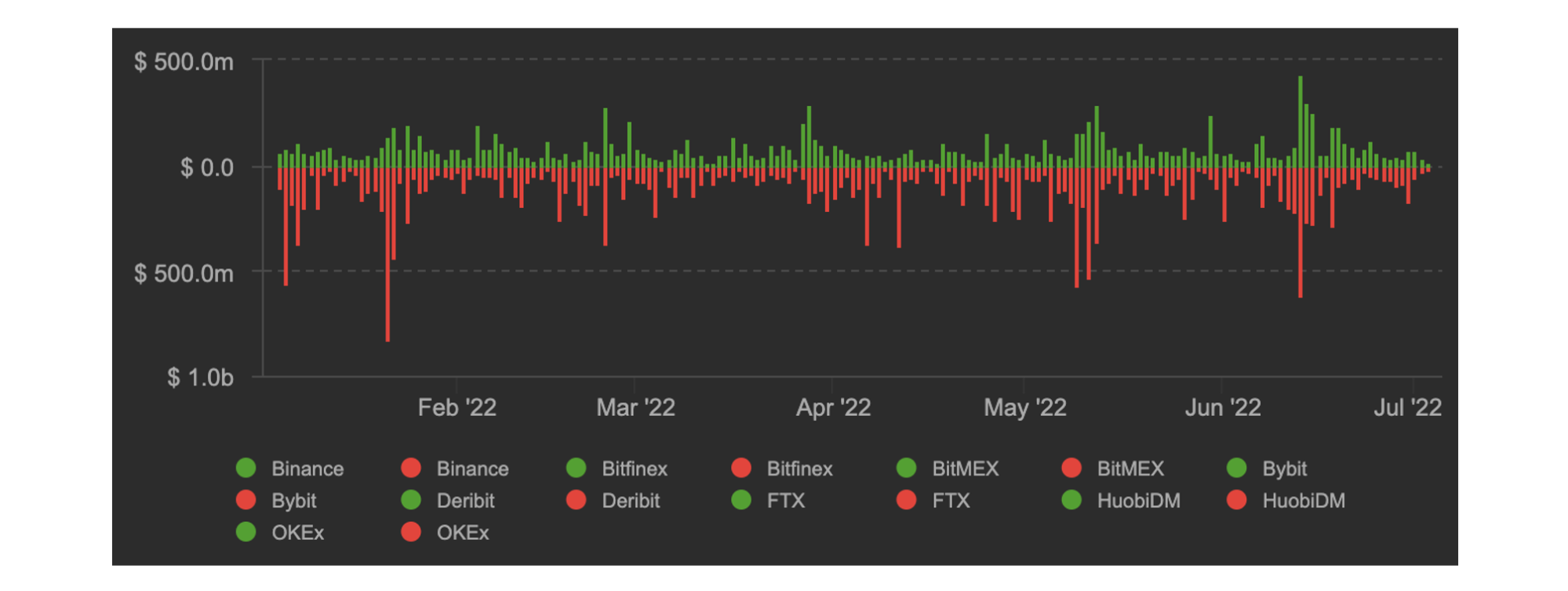

4) Liquidations

In the first half of 2022, aggregated losses from liquidations were higher for long positions than for short ones. Within this period, there were around 10 liquidations of more than $500 million.

The highest intraday liquidations were $973 million (January 21, 2022) and $1.1 billion (June 13, 2022), a large fraction of it attributed to Binance, OKEx, and FTX.

Options Market

1) Options Volume

- The options market in H1 2022 has shown similar dynamics to the Bitcoin futures market. The volume of Bitcoin options in the first six months of 2022 plunged by 24% and reached $115.5 billion vs H2 2021, which was fueled by the volume drop on the Deribit exchange.

- CME derivatives remain reliable metrics for gauging “institutional” interest in digital assets. Unlike Deribit, the CME volume of Bitcoin options in H1 2022 grew by 36% to $4.2 billion compared to H2 2021.

- The Ethereum options volume, unlike Bitcoin options volume jumped by 32% and totaled $77.5 billion in the first half of 2022.

2) Aggregated Open Interest (OI)

As of 30 June 2022, aggregated open interest (OI) across BTC and ETH options was $4.6 billion and $2.9 billion correspondingly. During the first part of 2022, total OI across Bitcoin and Ethereum options varied slightly.

Deribit continues to be an unrivaled leader in the options market. The exchange has ~$4.1 billion of BTC open interest as of the end of June, which comprises ~89% of total OI.

The open interest of CME Bitcoin options is $319 million as of June 30, 2022, which is ~6% of the total open interest.

Dynamics of Leading Assets

The second quarter of 2022 will be remembered for massive corrections since 2011. Bitcoin price started the year at $47.74 thousand, it updated to a local minimum of $18.95 thousand and closed June at $19.9 thousand. Overall, the Bitcoin price deteriorated by 58% from the beginning of the year.

Since January 2022, the second-largest cryptocurrency Ethereum plunged by 72% and reached $1.07k. On the 18th of June, 2022, it updated its local minimum of $994.

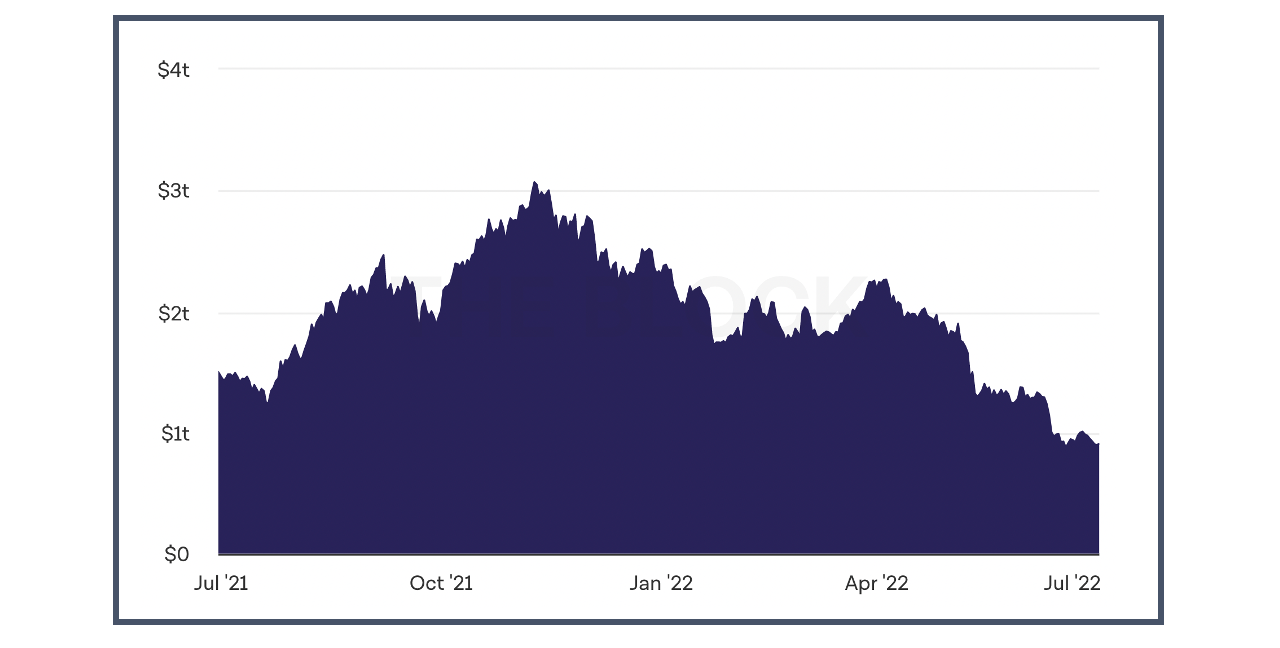

Market Capitalization

The total capitalization of the cryptocurrency market as of June 30, 2022, reached $893 billion, a local minimum since January 2021.

Since the beginning of 2022, total market capitalization has shrunk by 61%.

Venture Rounds

M&A activity

References:

- “Futures Markets Global Charts”. Coinalyze, July 01, 2022. URL: https://ru.coinalyze.net/futures-data/global-charts/

- The Block, 01 July, 2021, URL: https://www.theblockcrypto.com/data/crypto-markets