April, 2022

Key Takeaways:

- Month-on-month trading volumes on spot cryptocurrency exchanges deteriorated by 7% in April.

- The volume of BTC on the derivative market was cut down by more than 20%. Unlike futures, the volume of Ethereum options went up by 7%.

- Aggregated open interest of Bitcoin and Ethereum futures along with its prices showed a downward trend during April.

- The futures market recorded two large liquidations of more than $400 million.

- Bitcoin and Ethereum prices went down by 18.7% and 21% correspondingly.

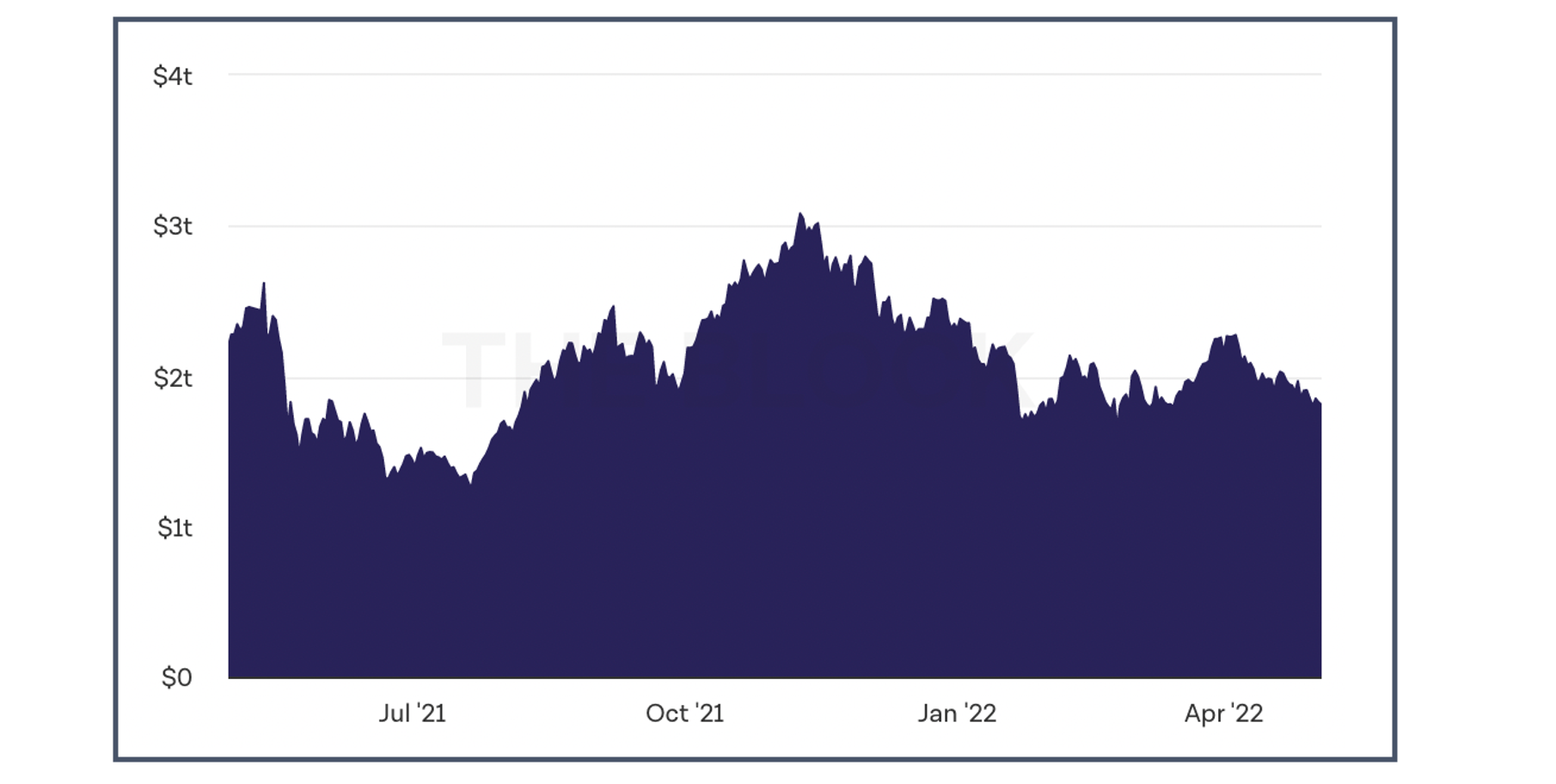

- Market capitalization as of April 30, 2022 achieved $1.85 trillion, which is 16% lower compared to the capitalization at the end of March.

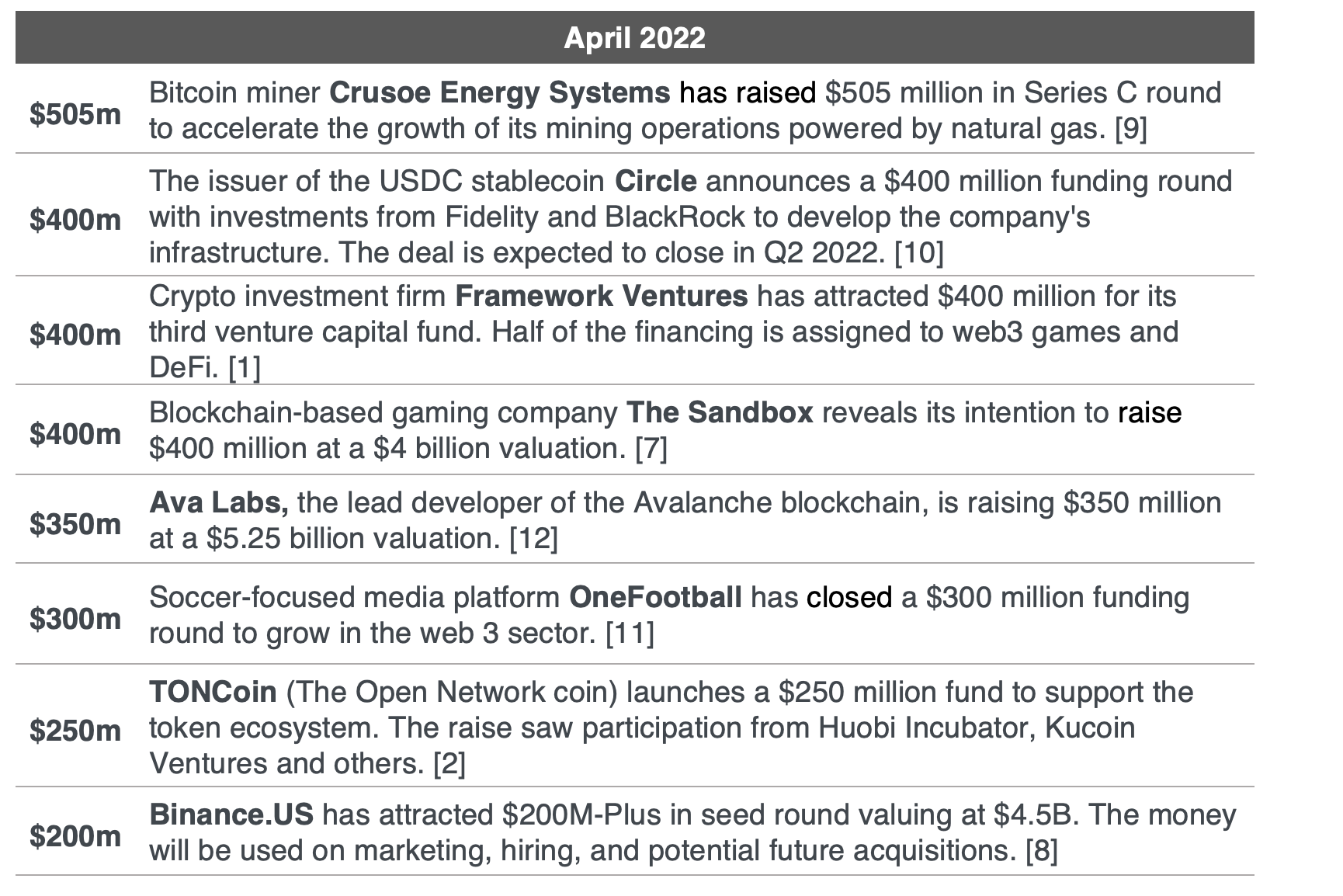

- Crusoe Energy Systems, Circle, Framework Ventures and The Sandbox raised more than $400m in venture funding rounds.

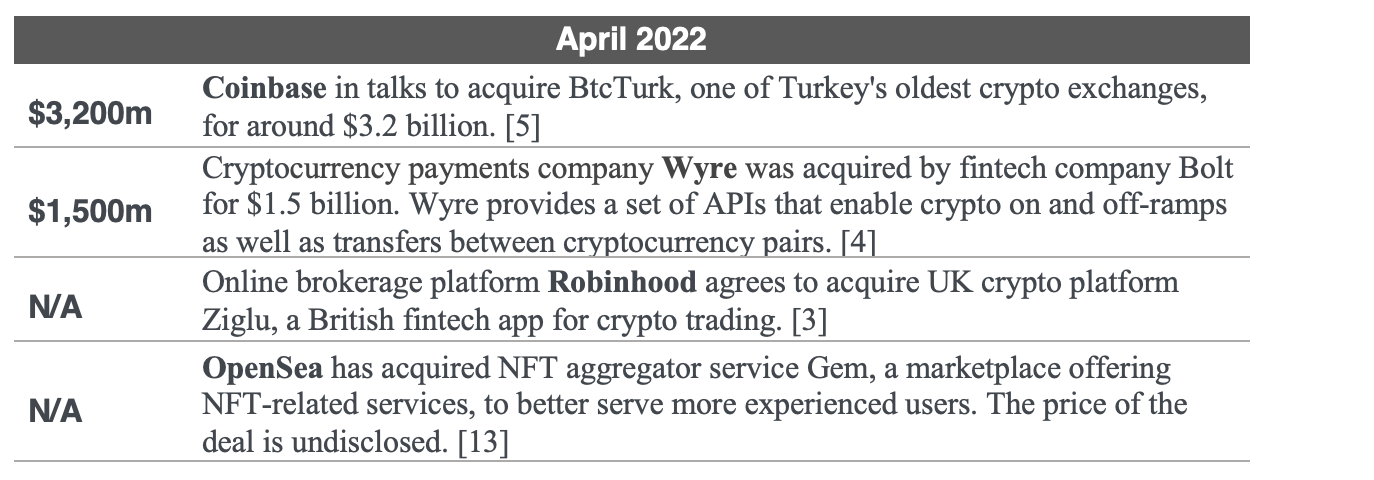

- M&A activity: Coinbase is in talks to acquire BtcTurk: Wyre was acquired by Bolt.

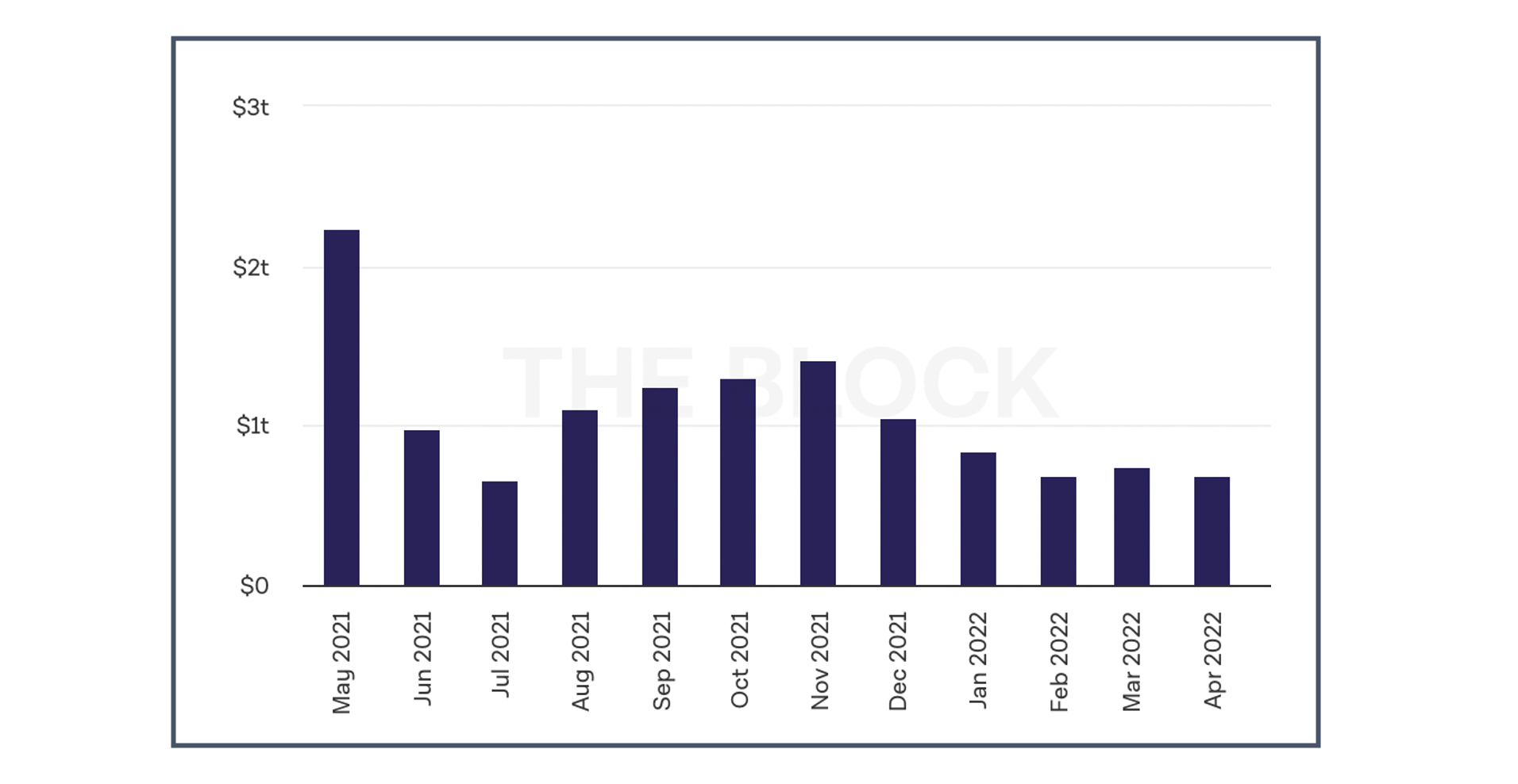

Spot Market

According to The Block’s legitimate volume index [14], trading volume on 24 cryptocurrency exchanges varied insignificantly over the last 4 months in comparison with 2021. In April, it achieved $687.85b, which is 7% lower compared to the previous month.

Graph 1. Cryptocurrency Exchange Volume (The Block Legitimate Index) [14]

Note: The Block legitimate volume is a group of 24 exchanges vetted by The Block: Binance, Coinbase, FTX, Kraken, LMAX Digital, Bitfinex, Binance US, Bitstamp, BTSE, Gemini, BitFlyer, Poloniex, Coincheck, Bittrex, Bitbank, Indodax, CEX, OKCoin, itBit, Bitso, Luno, Korbit, Zaif, GOPAX

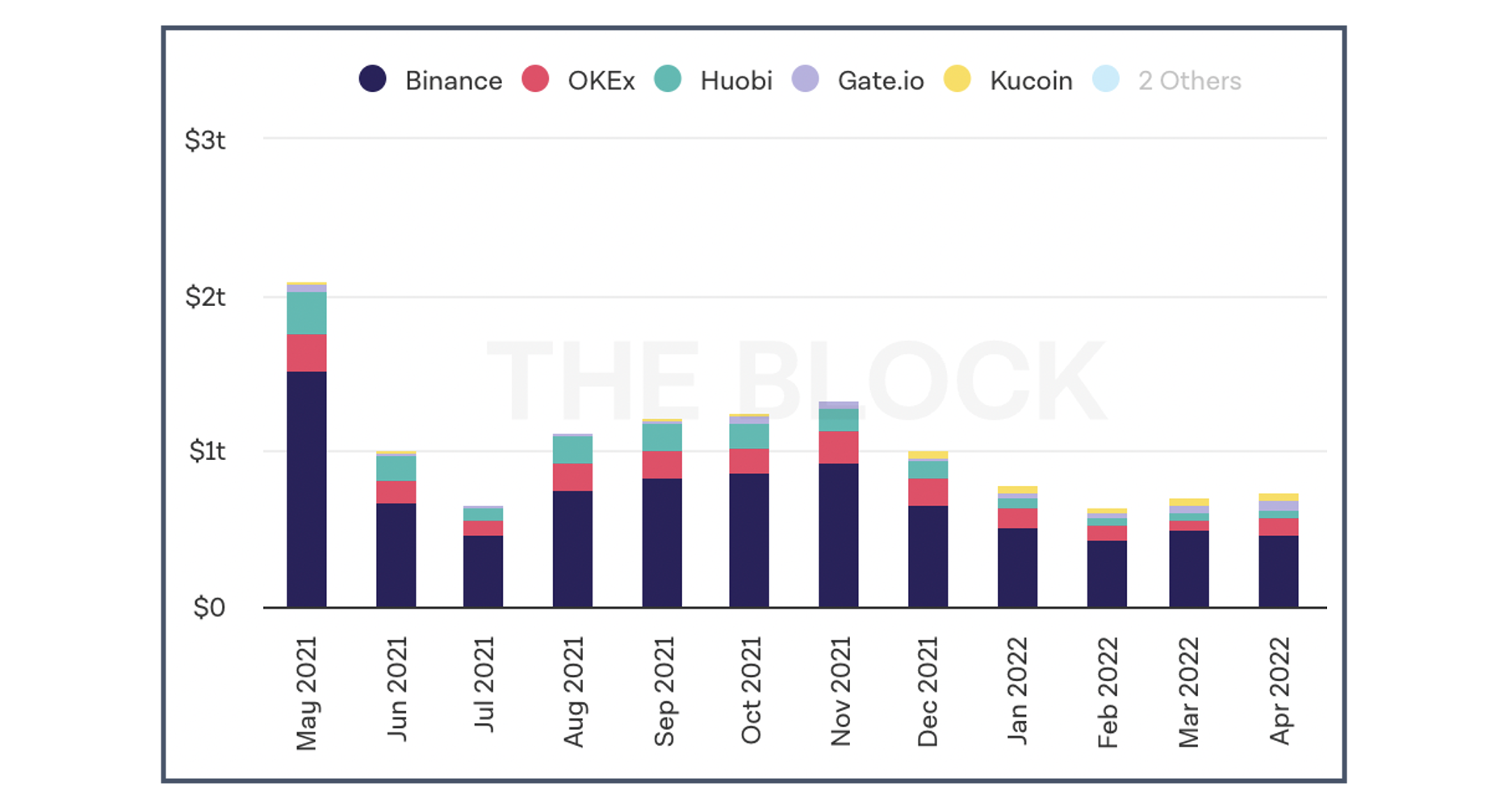

- Crypto only trading volume on the largest crypto exchange, Binance, in April went down by 5% to $465.3b. However, this result has exceeded the February trading volume by 10%.

Unlike Binance, trading volume on other leading spot cryptocurrency exchanges has gone in the opposite direction.

- Crypto-only exchange volume on OKX (formerly known as OKEx) in April soared by 44% to $109.35b versus March and outperformed February results by 6%.

- Gate.io demonstrated a 17% upside in terms of trading volume, which reached $52.9b in April. It was the highest monthly trading volume over Gate.io’s existence.

- Trading volume on Huobi exchange has grown gradually since February 2022. In April it rose by 17% versus March and reached $54.31b.

- KuCoin trading volume showed 17% upturn in April compared to March. This number corresponds to the December 2021 results.

Graph 2. Crypto-only Exchange Volume [14]

Note: Spot market share of cryptocurrency exchanges with primarily only crypto support

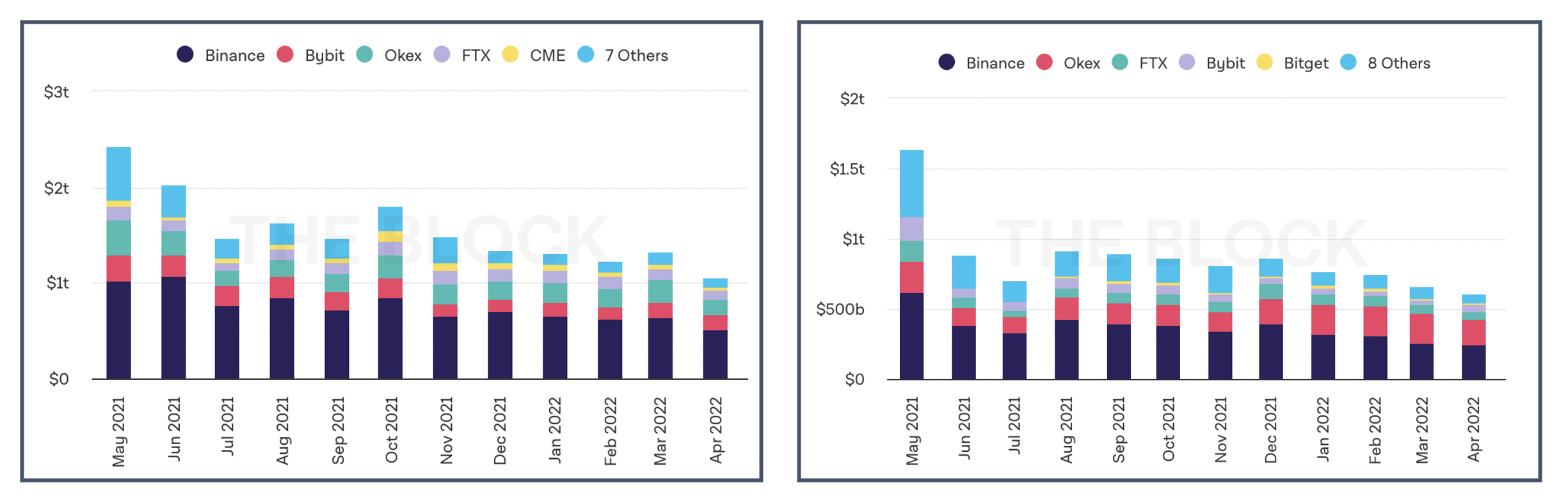

Futures Market

1)Futures Volume

- Total trading volume of Bitcoin futures across leading cryptocurrency exchanges, in dollar terms, reduced by a fifth in April to $1.06t, where all the platforms demonstrated a volume shrink.

- Similar to BTC, futures contracts on Ethereum decreased by 7% in April to $0.61t versus the March results and continued their downward trend since December 2021.

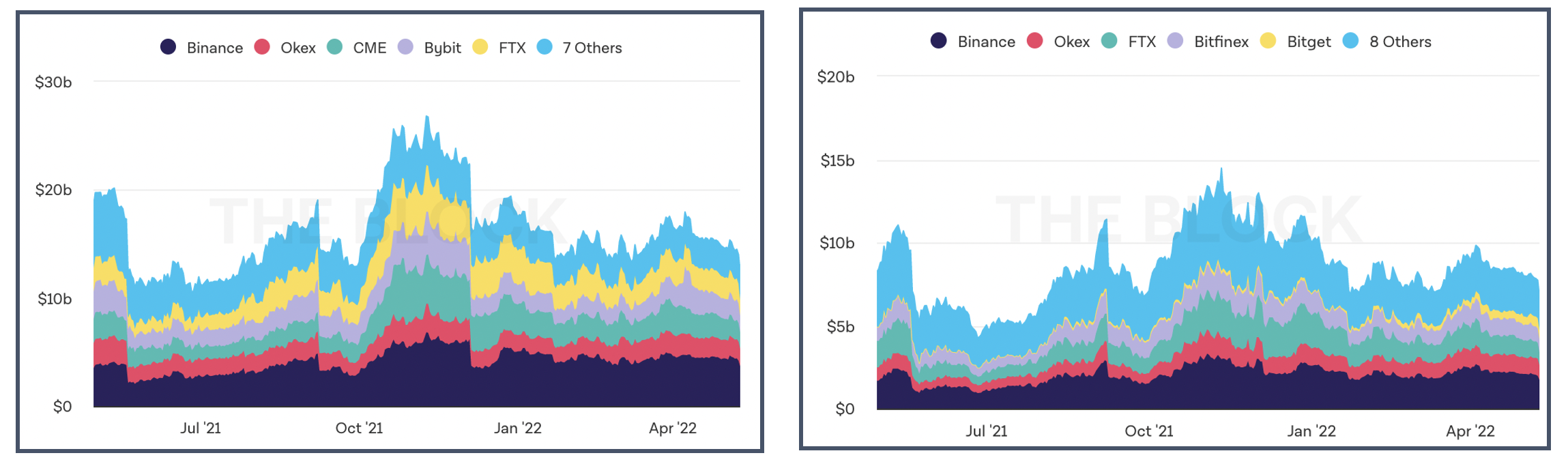

Graph 3. Volume of Bitcoin Futures [14] Graph 4. Volume of Ethereum Futures [14]

2) Aggregated Open Interest

- Aggregated open interest (OI) of BTC and ETH futures along with its prices had a downward trend in April, and at the end of the month it reached its lowest values of $14.72b and $8.11b for BTC and ETH correspondingly.

- Binance share of the open interest across futures continues to grow and at the end of April it achieved ~30% on BTC futures and ~26% on ETH futures.

- At the end of April, CME, OKX, FTX, Bybit share of open interest on Bitcoin and Ethereum futures were spread almost evenly, about 10-15% per exchange.

Graph 5. Open Interest on BTC Futures [14] Graph 6. Open Interest on ETH Futures [14]

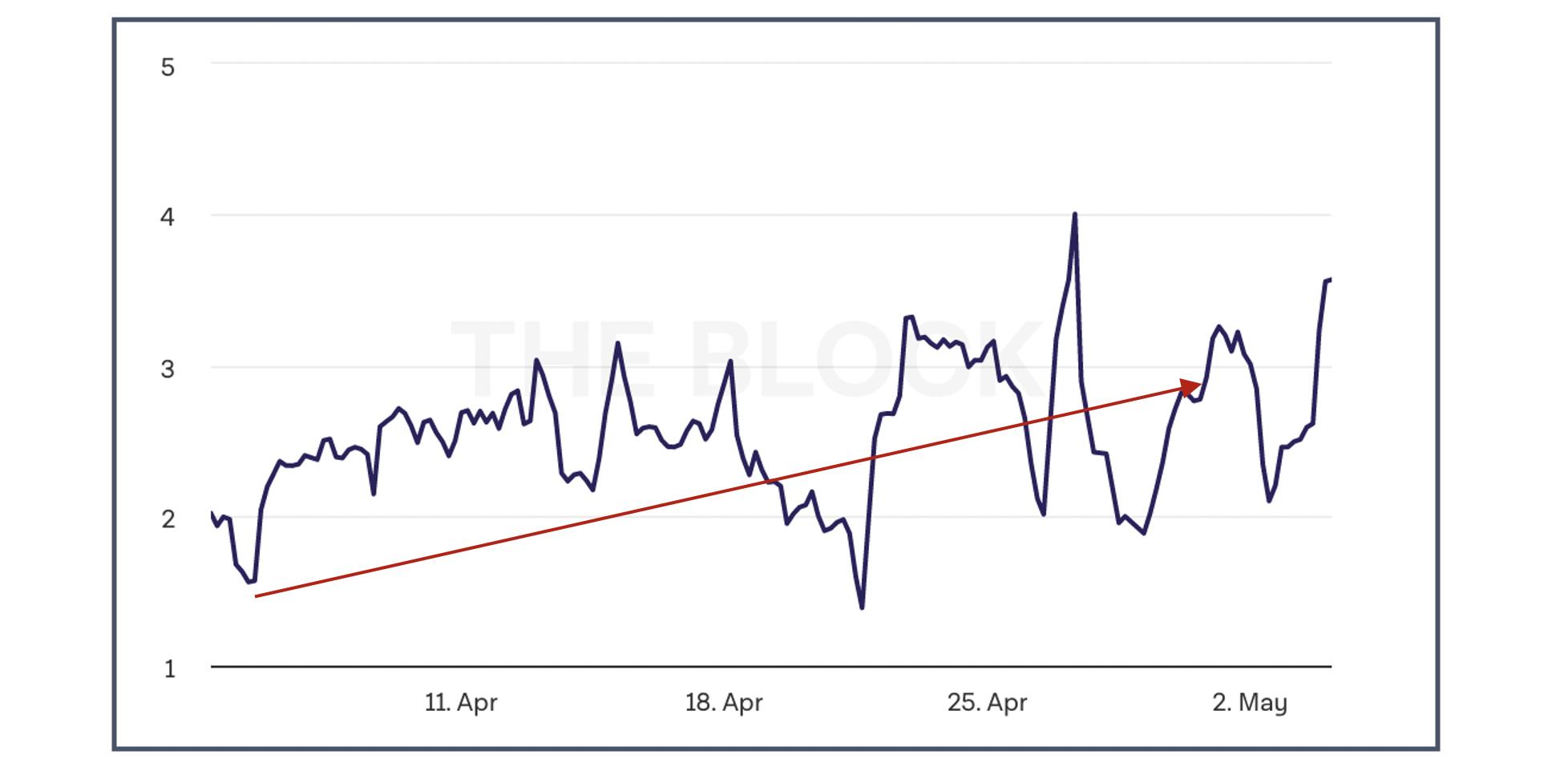

3) Long/Short ratio

According to data from The Block [14], in April there was strong domination of BTC long positions over short positions in Binance, which indicates bullish investor sentiment.

Graph 7. BTC Long/Short Ratio on Binance [14]

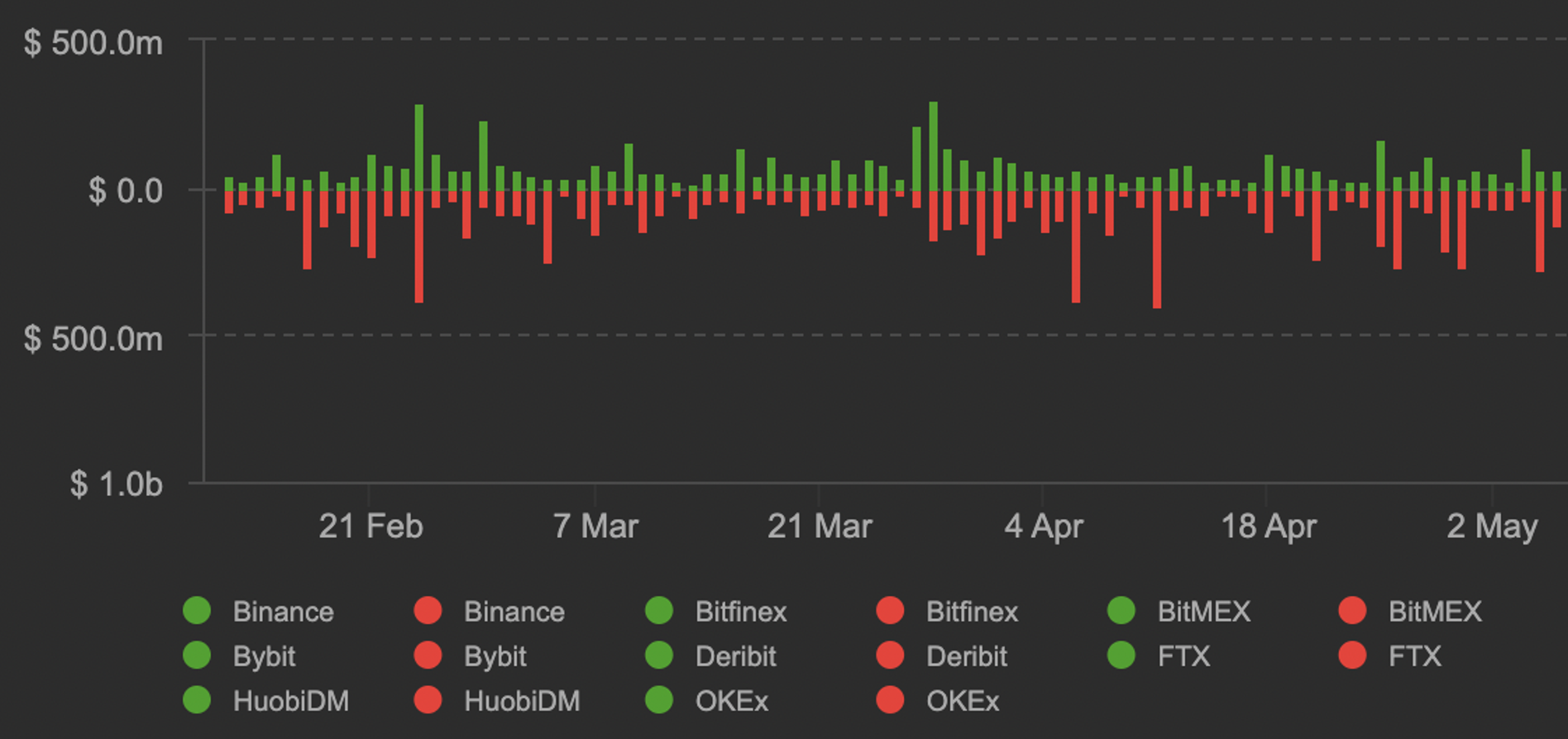

4) Liquidations of all coins

In April, there were predominantly liquidations of long positions, where the highest of over $400m were recorded on April 6 and April 11, when BTC price went down by more than by 5%. The drop is mainly accounted to Binance and OKX.

Graph 8. Liquidations [6]

Options Market

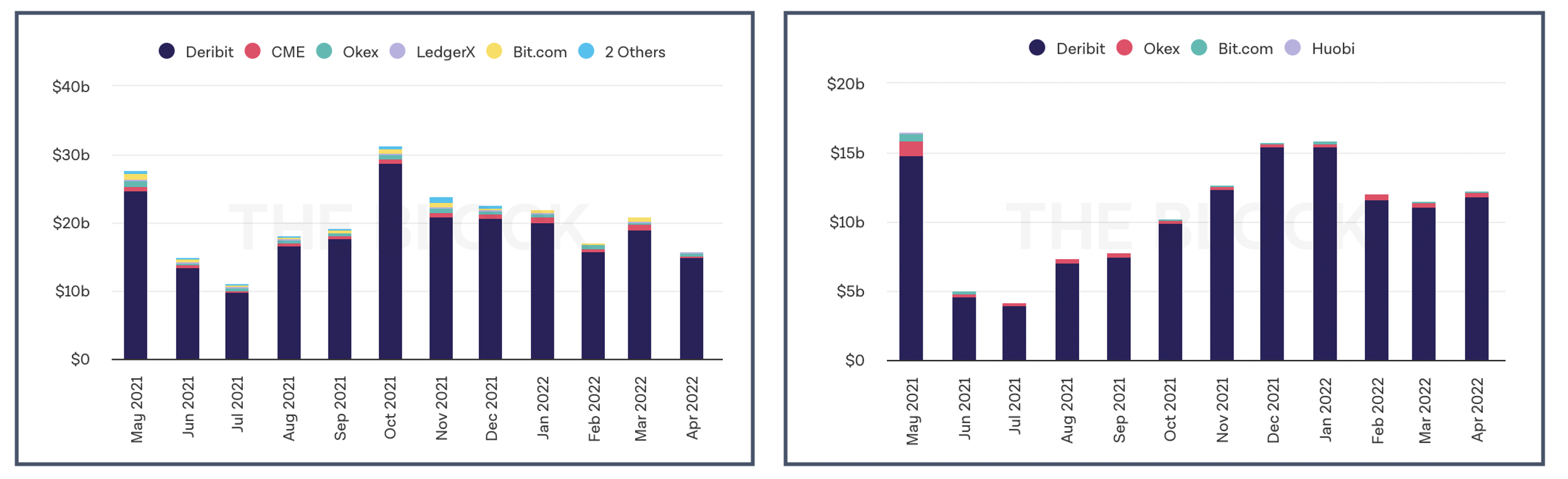

1) Options Volume

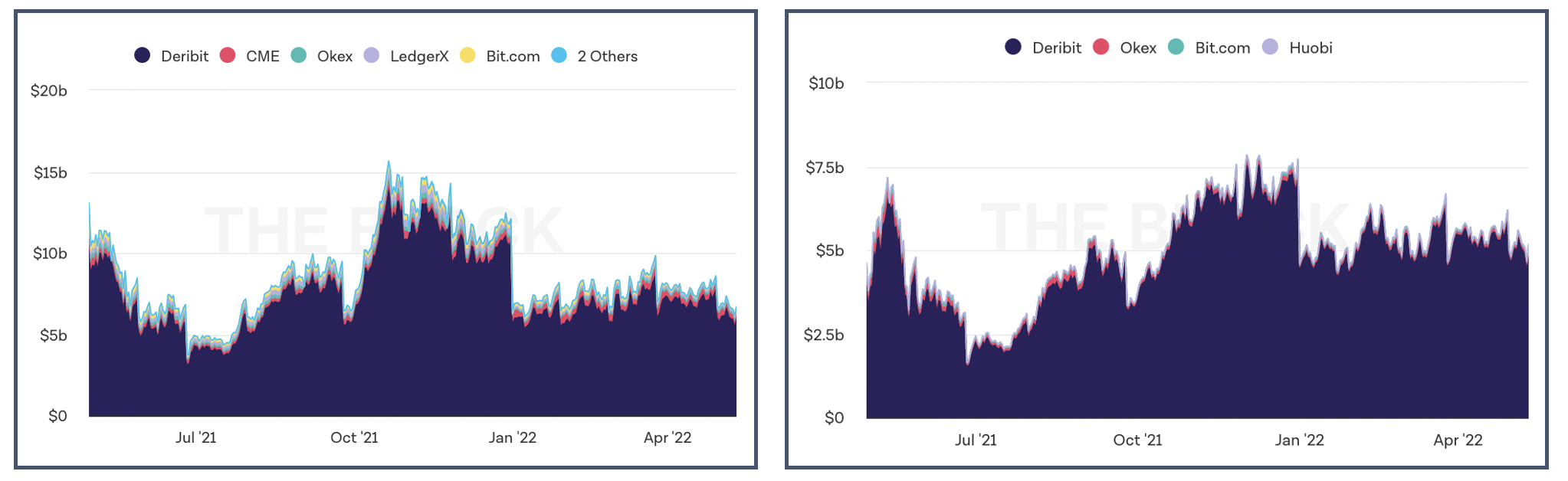

- The options market in April has shown similar dynamics to the futures market. The volume of BTC options plunged by 24% and reached $15.8b, which was fueled by the volume drop on Deribit exchange.

- CME derivatives remain reliable metrics for gauging “institutional” interest in the digital assets. Month-on-month, the CME volume of Bitcoin options in April crashed down by 71% to $246.7m, the lowest seen since July 2021.

- The volume of ETH options, unlike Bitcoin options, increased by 7% and totalled $12.3b.

Graph 9. Volume of BTC options [14] Graph 10. Volume of ETH options [14]

2) Aggregated Open Interest (OI)

- As of 30 April 2022, aggregated open interest (OI) across BTC and ETH options was $6.73b and $4.99b correspondingly. During the month, total OI across Bitcoin and Ethereum options varied slightly.

- Deribit continues to be an unrivaled leader on the options market. The exchange has ~$6.7 billion of BTC open interest as of the end of April, which comprises ~90% of total OI.

- Open interest of CME Bitcoin options is $365m as of April 30, 2022, which is ~5% of the total open interest.

Graph 11. Open Interest of BTC options [14] Graph 12. Open Interest of ETH options [14]

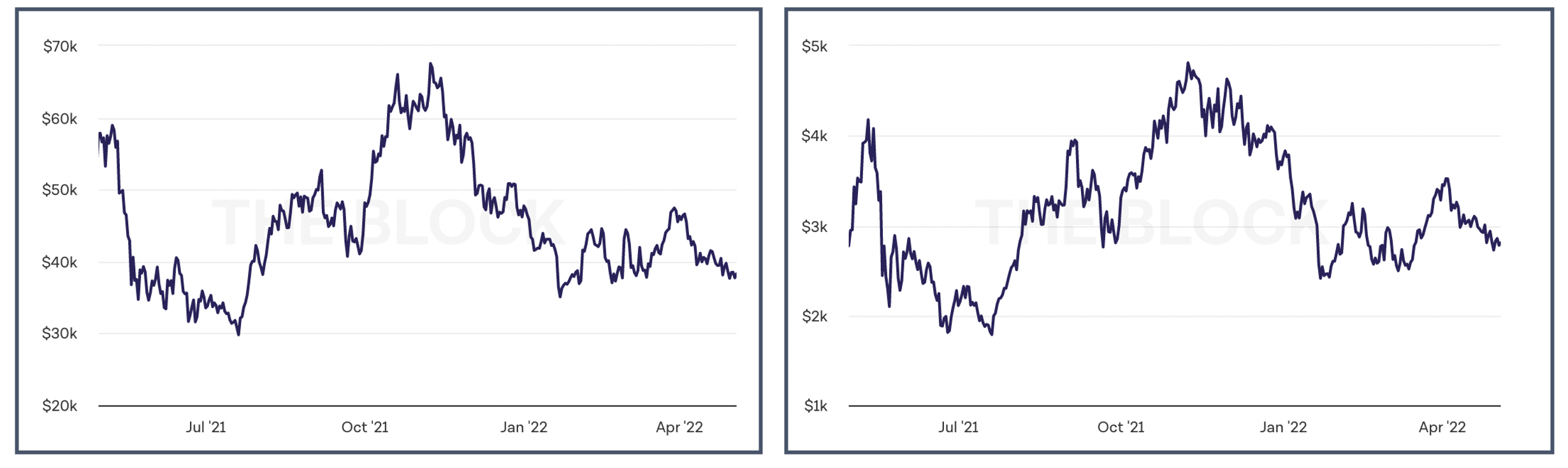

Dynamics of Leading Assets

By the April results, Bitcoin price went up by 18.7%, and at the end of the month it reached $37.65k.

The price of the second largest cryptocurrency Ethereum plunged by 21% and reached $2.73k.

Graph 13. BTC price [14] Graph 14. ETH price [14]

Market Capitalization

Total capitalization of the cryptocurrency market as of April 30, 2022 was $1.85 trillion, which is 16% lower compared to the capitalization of the end of March.

Graph 15. Total Market Capitalization [14]

Large Venture Rounds

M&A Deals

Read more:

Cryptocurrency Exchanges: Mar’22 Market Overview

World Crypto Regulatory News: April 2022

References:

- 1. Betz, B. “Framework Ventures Launches $400M Fund to Back Web 3 Gaming, DeFi”. CoinDesk, April 19, 2022

- Crawley, J. “Huobi, Kucoin, Others Lead $250M Toncoin Ecosystem Fund”. СoinDesk, April 11, 2022

- Crawley, J. “Robinhood Agrees to Acquire UK Crypto Platform Ziglu”. CoinDesk, April 19, 2022

- “Crypto payments firm Wyre acquired by Bolt for $1.5 billion”. Ledger Insights, April 7, 2022.

- Gkritsi, E. “Coinbase in Talks to Acquire BtcTurk for About $3.2B: Report”. CoinDesk, April 22, 2022

- “Futures Markets Global Charts”. Coinalyze, May 5, 2022.

- Harley-McKeown, L. “The Sandbox gears up to raise $400 million at a $4 billion valuation: report”. The Block Crypto, April 19, 2022

- Metinko, C. “Crypto Exchange Binance.US Raises $200M-Plus ‘Seed’ Round At $4.5B”. Crunchbase, April 6, 2022

- Moura, C. “Flare gas-powered Bitcoin miner Crusoe Energy Systems raises $505 million”. The Block Crypto, April 21, 2022

- Seward, Z. “Circle Raises $400M as BlackRock Explores USDC”. CoinDesk, April 12, 2022.

- Shumba, C. “OneFootball Closes $300M Funding Round Led by Liberty City Ventures”. CoinDesk, April 28, 2022

- Tan, G., Kharif, O. “Crypto Startup Ava Labs Seeks Funds at $5 Billion Valuation”. Bloomberg, April 14, 2022

- Tan, E. “OpenSea Eyes ‘Pro Experience’ With Acquisition of NFT Aggregator Gem”. CoinDesk, April 25, 2022

- The Block Crypto, May 5, 2021